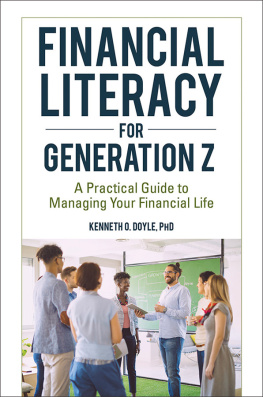

Your Cash Is Flowing

Why every entrepreneur needs to think like a CFO

2014 Kenneth M. Homza

All rights reserved.

This book may not be duplicated in any way without the express written consent of the author, except in the case of brief excerpts or quotations for the purpose of review. No part of this book may be reproduced or transmitted in any form or by any means (electronic, mechanical, photographic, recordings, or otherwise) with-out the prior permission of the author. The information contained herein is for the personal use of the reader and may not be incorporated in any commercial programs or other books, databases, or any kind of software without the written consent of the author. Making copies of this book or any portion of it for any purpose is a violation of the United States copyright laws.

ISBN: 978-0-9897069-1-9

Book design by Nehmen-Kodner: n-kcreative.com

Published and distributed by Homza Press

www.homza.com

To

Dad

Introduction:

Whos Your CFO?

Whether you know it or not, you do have a CFO. Someone, perhaps you, your accountant, bookkeeper, secretary, spouse, or office manager acts as your Chief Financial Officer. So the question isnt really whether or not you have a CFO (I would argue that every business does), but rather is your CFO any good at his job? Is he even qualified to be CFO?

The number of business owners I meet who tell me numbers do not matter is frightening. And almost certainly, the ones who say this are in financial trouble. Here are a few examples of what Ive heard:

I dont have a bank asking me for financial reports, so theyre not important. This company had already been through corporate bankruptcy, and the owner was currently facing personal bankruptcy.

My secretary enters all of the bills in QuickBooks and we just write the checks. Nothing wrong with that, if the person entering the bills knows what they are doing. QuickBooks is a fine program, but if the person entering the bills puts them into the wrong account or confuses assets with expenses (and I have seen this done countless times), then how in the world would anyone know what income is earned at the end of the month?

We dont worry about interest or depreciation every month, we let our tax accountant do that at the end of the year. I have seen businesses book a profit every month only to see interest and depreciation booked by the accountant in December wiping it all out and resulting in a loss for the year. Dont let any tax accountant convince you that a depreciation loss is good because it lowers your tax liability unless you also understand that you wont have enough money to invest in new capital equipment when your current stuff wears out.

We dont look at it that way. Yes, Ive actually been told by business owners that they have a better way than proven, age-old financial practices. Show me a business owner who says this and chances are they are losing money (and dont even know it).

I dont like to look at that stuff. Really? Well, Mr. Business Owner, that stuff is your money (or it was before your employees wrote themselves checks that you didnt know about). Perhaps you should have paid a bit more attention, even though its not your favorite thing to do.

Do any of these sound familiar? Is that really where you want to be? There is a better way. Whos Your CFO?

The rest of this book is devoted to CFO thinking in businesses from $2 million to $20 million (and beyond). Far from being a textbook, it draws on the thinking of a leading fractional CFO based upon his experiences in more than 30 companies with millions of dollars in annual revenue and hundreds of employees.

The Case For The Fractional Chief Financial Officer

I believe the case for the fractional Chief Financial Officer (CFO) is strong. Then again, I should; I have been doing this since 2003. Put simply, the fractional CFO provides services to multiple companies at the same time. I avoid the term part-time because I think about every one of my clients on a daily basis even though I may be in their office for only a limited number of hours each week (or not at all).

By focusing only on the uppermost part of the value pyramid, I reserve my time for only areas where I truly add value, such as strategic direction, reporting, and key business drivers. I delegate (usually to existing staff) the more basic financial and accounting processes while at the same time I serve as a mentor to the staff to help them raise their game.

Companies with revenues in the $2 to $20 million range (sometimes higher or lower) can benefit greatly from the CFO skill set but usually dont need and cant afford a full-time resource. Moreover, there just isnt enough work to support a full-time CFO. When these companies do have full-time CFOs, these individuals are usually spending a great deal of time on basic accounting and bookkeeping matters at far too great a cost to the company. In essence, they are really not Chief Financial Officers but controllers or accounting managers with an inflated title.

For these companies, the fractional CFO is the ideal solution. It brings a critical skill set to the table, and the value added can be significant.

Chapter 1

Accounting 201

Yes, that does say accounting 201, not 101. The following topics arent about the debits and credits but rather the whys and hows of financial statement preparation.

Financial Statements Dont Mean Very Much

Truthful Financial Results Are A Mirror

Too Many Lines

Update

Dont Be Too Much Like The Big Guys

I Love A Good Audit

Financial Statements Dont Mean Very Much

Recently I had a business owner tell me that financial statements didnt mean anything to him. Well, after looking at his statements, I could certainly make sense of his point of view. They were so improperly prepared that they didnt mean much to me either (except it was obvious that he hadnt been monitoring the condition of his business). Had they been properly prepared, he would have had a much better handle on how much money he was losing on a monthly basis, and we might not have been talking under a crisis scenario.

Financial statements should be able to tell the story of the performance of your business. At a glance, you should know whether you are making a reasonable profit or not and how that profit is translating into cash in the bank. Too often, business owners try to run their business by looking at the cash number. When the cash number starts to decline but the improperly prepared financial statements suggest that the business is profitable, theyre usually perplexed.

Rather than digging in to try to unravel the situation, business owners are sometimes uncomfortable with their understanding of financial statements and choose to ignore the nagging feeling that something is wrong. They choose to believe the evidence of a positive number at the bottom of the income statement, usually because that is what they want to believe. The result is that they continue business as usual, waiting until they are in crisis to reach out for help. Rarely does a bad situation get better by ignoring it.

The better approach is to reach out for help in understanding your financial statements. And if the person explaining your financial statements to you cannot do it simply, concisely, and in a way that you understand, then find someone else. Dont accept the fact that you, the business owner, cant understand it. Its really not difficult, and even if it is, its simply too important to ignore.

Next page