CONTENTS

CHAPTER 1

CHAPTER 2

CHAPTER 3

CHAPTER 4

CHAPTER 5

CHAPTER 6

CHAPTER 7

CHAPTER 8

CHAPTER 9

CHAPTER 10

INTRODUCTION

Conversations about money and investing tend toward the terrifying for most folks. Seldom do people take the time to slog through the long, deep, gray tables tucked into the back of their newspapers. The television programming aimed at investment is filled with arcane phrases such as Dutch auction and foreign-sounding words: arbitrage, backwardation, contango. Sometimes it seems as if those in the know would prefer us not to understand. Theyd prefer we move along so they can revel in their own coded language about Wall Street, money and investing.

But their gambits arent that tough to unlock. You dont need a four-year degree or years spent toiling on the stock exchange to understand Wall Street. This book will help unravel the mysteries. By the end of this book, you will not only understand stocks and bonds, but also more complex investment instruments such as futures and options, as well as how to be smart about money and investing matters. Increasingly, individuals are responsible for organizing their own retirement planning. Investments make up the core of college-funding strategies. Even thinking about health care can benefit from a more thorough understanding of money and investing.

In this book, we will provide the keys to unlocking the mysteries of money and investing, so that when you are at a cocktail or dinner party you can deftly slip into a conversation about the markets, should one arise. In easy-to-understand fashion, this book will tell you about how the market worksthe world of stocks, bonds, mutual funds and other investmentsso that you can use this knowledge to make investing decisions that are right for you. We will provide history and show you how to read those long gray tables in the back of your newspaper. We will even decode many of the phrases that so-called experts toss around so easily and carelessly on television. And we will place the world of investing in the context of the broader economy and the monetary system of dollars, cents, credit cards and other means of money.

Think of yourself as traveling to a new place and this as your guidebook. Culture and history are explained. Maps to points of interest are enclosed. Recommended reading lists to delve deeper into specific topics have been selected by The Wall Street Journals experts.

So, without delay, lets journey into the land of money and investing.

CHAPTER 1

S TOCKS

M any people have heard of the New York Stock Exchange; maybe some have even seen footage of people scurrying around in strangely colored jackets. But just what are all those people doing at the NYSE, and what does it mean to you as an investor?

First, we should take a step back. Buying and selling stocks involve financial markets. And markets sound more complex than they are. In fact, many of us start learning about markets from a very early age.

As kids, many of us set up lemonade stands. We had a product we wanted to sell, and we went looking for buyers. We needed information to set prices. What were the kids on the next block charging? What kind of demand did we see? The corner of a block seemed to offer more opportunity than the middle of the block. None of us considered working from the alley. We also needed to know how much our sugar, plastic cups and water cost, in order to see if we were making any money at five cents a cup.

A stock market isnt that different. Its about buyers and sellers. Its about finding a place where the most buyers and sellers are located. Its about supply and demand. Basically, all the transactions in our life, from selling a used car to running a garage sale, contain elements of what happens among those brightly dressed folks running around the stock exchange floor (by the way, those jackets help traders quickly identify who a fellow trader works for). But in the world of stock markets, things happen faster and on a much larger scale than at a lemonade stand.

TWO TYPES OF MARKETS

In the United States, stocks trade in two main markets: the New York Stock Exchange and the Nasdaq Stock Market. A number of other markets exist, but they make markets mainly in stocks that are primarily traded at one of these two marketplaces. When companies go public, they can seek to list on any of these exchanges.

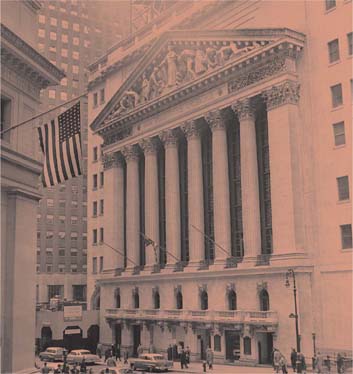

T HE N EW Y ORK S TOCK E XCHANGE

The New York Stock Exchange is the oldest stock market in the United States. It began in 1792 under a buttonwood tree in lower Manhattan, with folks trading shares back and forth among one another. Since then it has grown to become the largest stock market in the world.

Its now located on the corner of Wall Street and Broad Street in lower Manhattan, but its physical place is less and less important. In a world of high-speed information, stock market participants can work from Whitefish, Montana, as easily as from the floor of the exchange itself.

Trading at the New York Stock Exchange, often called the NYSE or the Big Board, uses a so-called specialist trading system. In this system, a single person is in charge of the trading in a particular stock. For instance, if you want to buy a share of IBM, your bid will ultimately go to the specialist assigned to trade IBM. That specialist acts as a kind of traffic cop, directing movement among buyers and sellers. He or she looks around to find someone who wants to sell a share of IBM at the price you want to buy. The matching up of buyers and sellers occurs throughout the trading day, and sometimes the specialist buys or sells for his own account if an order cant be matched.

When the NYSE is on television, sometimes you see a gaggle of folks standing in front of the specialist, hollering out buy and sell orders. Thats when the specialist looks most like a traffic coppointing, gesturing, yelling. It looks confusing, but its just a simple matching up of buyers and sellers so they can trade stocks.

Along with shouting and pointing, specialists also match buyers and sellers electronically. This kind of high-tech activity makes up a growing amount of the trading that happens at the New York Stock Exchange. While the trading volume and the number of stocks trading at the NYSE have grown dramatically in the past twenty years, the number of people working on the floor of the stock exchange has remained about the same, thanks largely to the growth of high-tech, all-electronic trading. All aspects of NYSE trading, including electronic trading, are refereed by the specialists.

THE HISTORY OF THE NYSE

The New York Stock Exchange, the worlds largest and best-known stock market, traces its history to 1792, when a group of brokers in our young nation agreed to trade stocks and other securities for a commission (securities being another name for financial assets such as stock and bonds). The Buttonwood Agreementso named since it was reached under a buttonwood tree in lower Manhattaninitiated trading in five securities, a small start for a market that now lists stocks with a value of about $20 trillion.

The New York Stock Exchange, the worlds largest and best-known stock market, traces its history to 1792, when a group of brokers in our young nation agreed to trade stocks and other securities for a commission (securities being another name for financial assets such as stock and bonds). The Buttonwood Agreementso named since it was reached under a buttonwood tree in lower Manhattaninitiated trading in five securities, a small start for a market that now lists stocks with a value of about $20 trillion.

The New York Stock Exchange, the worlds largest and best-known stock market, traces its history to 1792, when a group of brokers in our young nation agreed to trade stocks and other securities for a commission (securities being another name for financial assets such as stock and bonds). The Buttonwood Agreementso named since it was reached under a buttonwood tree in lower Manhattaninitiated trading in five securities, a small start for a market that now lists stocks with a value of about $20 trillion.

The New York Stock Exchange, the worlds largest and best-known stock market, traces its history to 1792, when a group of brokers in our young nation agreed to trade stocks and other securities for a commission (securities being another name for financial assets such as stock and bonds). The Buttonwood Agreementso named since it was reached under a buttonwood tree in lower Manhattaninitiated trading in five securities, a small start for a market that now lists stocks with a value of about $20 trillion.