ANNEX A1

PORTFOLIO, PROGRAM, AND PROJECT GOVERNANCE FRAMEWORK IMPLEMENTATION

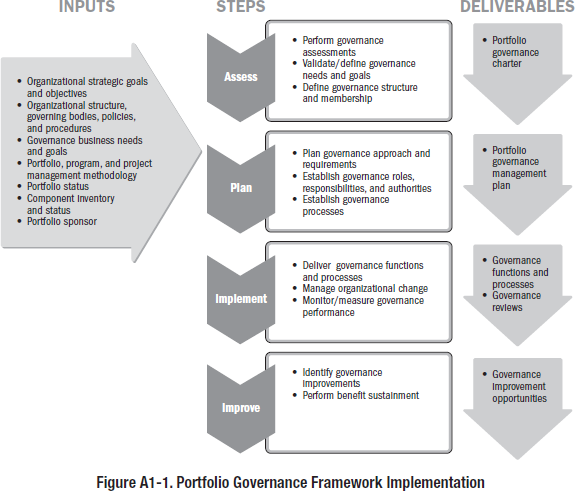

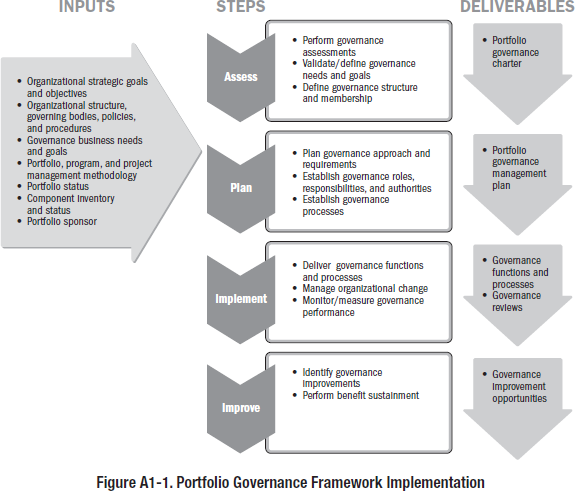

The purpose of this annex is to provide guidance on portfolio, program, and project governance framework implementation details in order to assess, plan, implement, and improve governance.

A1.1 Portfolio Governance Framework Implementation Steps

The implementation steps for a portfolio governance framework are provided in Sections ).

A1.1.1 Assess

As a first step, it is important to understand the current state of the portfolio's governance and processes. An important note is that portfolios are ongoing and longer range than programs and projects; therefore, periodic assessments may be needed. Performing an assessment in various areas of the organization along with the governance business needs helps to identify the target state and gaps and determine the portfolio governance scope, organizational structure, hierarchy, and roles in order to develop a portfolio governance charter.

The portfolio sponsor and portfolio manager should initiate the assessment for portfolio governance when there are no existing governance framework, functions, and processes or the current governance processes may need to be reengineered or improved to progress to the next level of effectiveness. To initiate the assess step, the key inputs are:

- Organizational strategic goals and objectives;

- Organizational structure, governing bodies, policies, and procedures;

- Governance business needs and goals;

- Portfolio, program, and project management methodology;

- Portfolio status;

- Component inventory and status; and

- Portfolio sponsor.

The extent of the assessment depends on the functions or processes that need to be implemented or improved and/or resources or culture and behavior change that needs to support governance. Organizations commonly use surveys, interviews, or meetings and focus groups to gather the information necessary to analyze the current governance environment and perform various analyses. The analyses are necessary to determine the gap between current state and desired future state. The assessment determines who, what, and how of governance and what is required to fill the gaps in order to successfully implement governance. The analysis should uncover who is making the investment decisions, what the authorities and decision areas or boundaries are, and how these decisions are being made and communicated. The assessment activities should encompass the following areas:

- Perform stakeholder analysis. Determine the current accountabilities and decision authorities. Then identify and engage key stakeholders to define governance needs, benefits, and justification for portfolio governance. Engage stakeholders to understand the culture, politics, and concerns to determine how these may impact strategic alignment and investment optimization. Identify influencers such as other portfolio or organizational complexity, politics, culture, and external stakeholders.

- Perform governance assessments. Determine what may impact the success of governance planning and implementation. Understand the organization's strategy and assess the strategic alignment process. Determine if the current process ensures optimization and portfolio alignment with organizational strategic objectives and investment optimization. Determine how alignment will occur within the portfolio components to support organizational strategic goals. The findings should support the implementation of or enhancement to the portfolio governance framework, functions, and processes. The following areas should be assessed:

- Understand organizational governance policies and structures. Assess if the current organizational structures and policies facilitate the appropriate portfolio governance mechanisms for the selection of projects that ensure achievement of the organization's goals and delivery of business value.

- Understand organizational mission, goals, and objectives. Understand the organization's strategic goals and objectives and how portfolio strategic alignment occurs. Assess the portfolio alignment process and determine if the current process ensures the appropriate project selection that is aligned with strategic goals and program and project delivery of business benefits.

- Determine decision making and authorities. Understand how investment decisions are made and who is making these decisions. Assess the current areas and the scope of decision making, specific authorities, roles and responsibilities, as well as related communications. Determine any issues with decision making and potential causes of the issues.

- Determine portfolio oversight capability and controls. Understand and assess the existing processes and controls that enable portfolio governance oversight, such as investment reviews, portfolio component phase gates, and resource allocation.

- Evaluate portfolio, program, and project management resources and competency. Assess the skills and capabilities as well as the competencies of sponsors and key stakeholders who need to support portfolio governance.

- Determine communications and level of transparency. Assess and determine the effectiveness of what is being communicated and to whom with regard to portfolio governance and, in particular, the investment decisions.

- Evaluate culture for governance adoption. Determine the readiness for change based on the history of change adoption, lessons learned, and both previous and current issues.

- Determine strategic key performance indicators (KPIs). Assess what KPIs are being used to support current portfolio governance oversight, such as portfolio phase-gate reviews.

- Evaluate integration of governance for portfolios, programs, and projects. Assess how resources are allocated and how the processes align across the portfolio management domain.

- Perform gap analysis. Perform a gap analysis of the current state to the future state to provide insight on the assessment areas that have existing gaps. This will facilitate the ability to perform a risk analysis against the gap and prioritize the work to be performed in order to achieve the future state.

- Perform SWOT/risk analyses. Analyze the strengths, weaknesses, opportunities, and threats to strategic alignment and benefits realization. Determine the impacts of identified risks to the attainment of portfolio goals and business benefits. Determine how the rollout of governance-related functions and processes would improve strategic alignment and benefits realization.

- Validate/define governance needs and goals. Based on the governance assessments and analyses, validate/define portfolio governance needs and goals. Governance needs and goals are unique to an organization and to the individual portfolio. Sponsors and key stakeholders may provide direction for governance needs, goals, organizational structure, membership, and authorities. Examples of governance needs and goals are decision-making transparency, accountability, risk management, etc. The portfolio governance plan should describe the governance goals and various decision and prioritization criteria and authorities in areas such as portfolio changes, phase-gate reviews, component initiation and transition, and resolution of escalated issues and risks.

- Define governance organizational structure and membership. Based on stakeholder analysis, various assessments, SWOT/risk analyses, and the approved portfolio objectives, define the portfolio's required governance organizational structure and membership. The organizational structure should be based on the needs of the organization and the portfolio's requirements. The organizational structure and members may be different for the portfolio governance versus the subportfolio and component governance. Document in detail the organizational structure, members, and roles, and how the organizational structure and membership changes during the selection and prioritization of the portfolio's components.