To Cocoa, Cabana, Amber, Natasha and Rosie.

The best five dogs a man can have .

Published in the United Kingdom in 2012 by

Portico Books

10 Southcombe Street

London

W14 0RA

An imprint of Anova Books Company Ltd

Volume copyright Collins & Brown 2009, Portico 2012

Text copyright Lex van Dam 2009, 2012

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of the copyright owner.

First ebook publication 2012

ebook ISBN 9781908449504

A CIP catalogue for this book is available from the British Library.

10 9 8 7 6 5 4 3 2 1

Also available in paperback

ISBN 9781908449146

This book can be ordered direct from the publisher at

www.anovabooks.com

To view all text boxes, tables and graphs at a larger size, give them a double click.

INTRODUCTION

You might have heard the old stock market saying, that when you give your money to an expert to manage, the expert ends up with your money and you end up being the expert. There is a lot of truth in that as far as I am concerned giving my money to someone else to manage has seldom worked for me. Thats why I manage my own money and thats why I think you should consider doing the same.

Over the past 19 years I have traded the stock market for myself as well as on behalf of a well-known international bank and a large hedge fund. My experiences have given me a deep understanding of what is really going on in the City of London. They formed the basis of a television series called Million Dollar Traders, which was shown on BBC2 in early 2009.

Million Dollar Traders followed a diverse group of eight people five of whom were complete beginners and the other three were very inexperienced trading stocks for a period of eight weeks, after only two weeks of training. Between them they traded with 500,000 (or $1,000,000 at the exchange rate at that time) of my own money, and were allowed to make their own decisions on what stocks to buy and sell.

Allowing eight people to manage my money with just two weeks training seems a risky proposition, but I believed it to be safer than giving money to experienced professionals. This is because I believe that my methods of trading are based on common sense and can be easily learned and applied. And common sense is something that most experts lack!

The Million Dollar Traders ended up losing about 2% of my capital, which does not sound great, but was much better than the professionals who, over the same period, lost more than 4%. I think it was pretty amazing that a group of inexperienced people with only minimal training were able to outperform the experts.

This book is not meant to teach you how to make a million dollars. It is intended to make you think about the markets, to explain a few basic and not-so-basic concepts, and to learn to trust yourself. After reading it you should have a good idea of what it takes to invest money in the stock market in a responsible manner.

More recently I have started my own trading academy at www.lexvandam.com, which helps people to trade, initially mainly through online modules. It is based on my concept of 5-Step-Trading and has had a great reception from the people who have completed the modules.

Let me finish by repeating what my old manager at Goldman Sachs always used to say at the end of our morning meeting, Lets go make some money!

Lex van Dam

www.lexvandam.com

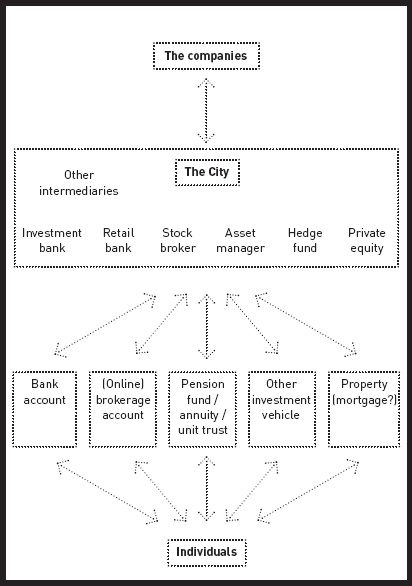

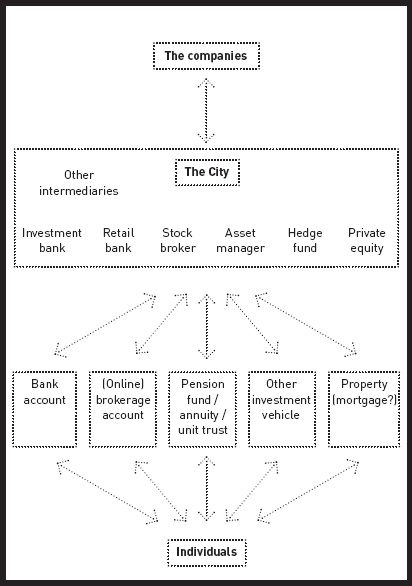

, you need to understand precisely how the financial system works, and where you fit in. If you want to be a player, first you have to know which game you are playing good luck!

The world of finance

Companies

If you own a company and you want to develop a new product, build a new factory, or open new stores you might need to raise some money. If the numbers add up and your idea seems profitable, you will generally be able to raise this money either by borrowing it, or by selling a stake in your company.

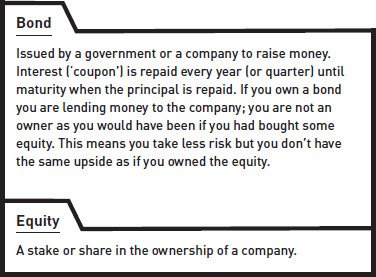

That stake is called equity and, if the company is large enough, it can be traded on the stock market. Owning equity in a company gives the buyer the right to part of the profits, either directly through payment of dividends, or indirectly through retaining profits in the business and thereby making the company more valuable.

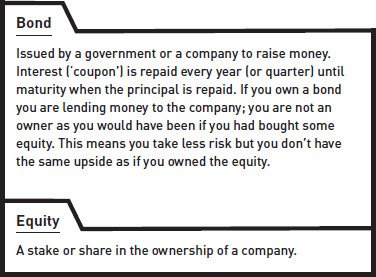

When you raise finance in the form of loans, this is called debt or a bond. The money that a company makes is first used to pay interest on these loans, and any residual money belongs to the shareholders, and can be used to pay them a quarterly or annual dividend.

COMMON MISCONCEPTION: Following a set of trading rules will make you money

There are plenty of so-called investment gurus out there who will try to convince you that all you need to make money is to follow their rules. I believe strongly that you cannot simply learn a set of trading rules and expect to make money. If you are lucky this may work for a while, but there will come a point when the trading environment changes and the old rules stop working, and without a new set of rules you are stumped. You need to develop a trading style that suits you, with your own rules that must be flexible.

This book does not contain a list of rules to be followed blindly, instead it offers general guidelines that can be adapted depending on your own circumstances and knowledge, as well as the prevailing market environment.

When making trading decisions many people simply look at historical stock movements and try to use these to predict future stock prices. Others just analyse individual companies rather than the wider context in which they trade. I take a holistic approach to trading and try to cover all the different bases before making my decisions I think you should too.

MY AIM IS TO MAKE YOU THINK AND CHALLENGE CONVENTIONAL WISDOM AND THIS BOOK PRESENTS A FRAMEWORK THAT YOU CAN USE TO MAKE BETTER INVESTMENT DECISIONS.

Buying a share gives you a right to part of all the future revenue streams of a company, and it is interesting to know that equity investors look at the same company in a different way to bond investors. Bond investors want to ensure their interest is paid on time and that their initial capital is paid back when the loan terminates. They are very focused on analysing the cash flows of a company. Equity investors are more about hope; they hope that the company will make money and that the share price will go up. Their investment is a lot riskier than simply lending money to the company but the potential rewards are a lot higher as well. Companies are not the only ones to issue bonds. The UK government raises funds by issuing bonds known as Gilts. So even if you feel far removed from the world of finance you, as a taxpayer, are a player whether you like it or not.

Companies

Companies