Contents

xi

xv

CHAPTER 1

CHAPTER 2 25

...

CHAPTER 3 55

CHAPTER 4 75

CHAPTER 5 119

CHAPTER 6 157

CHAPTER 7 187

...

CHAPTER 8 221

CHAPTER 9 269

CHAPTER 10 309

Foreword

Nassim Nicholas Taleb'

I

One would tend to think that gambling is a sterile activity that is meant to occupy those who have not much else to do and others when they have not much else to do. You would also think that there is a distinction between "economic risk taking" and "gambling," one of them invested with respectability, the other treated as a vice and a product of a parasitic activity.

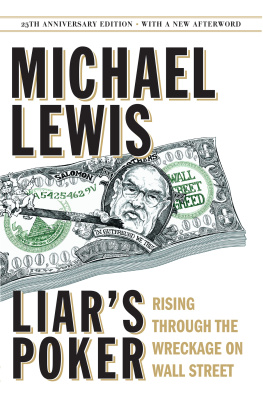

This book shows that the distinction between what is called purely gambling and "productive economic activity" is one of those socially constructed ones that remain sticky in our minds. While many may disagree with the point (our economics culture is vitiated by these mental boundaries between activities), it remains that gambling injects currency into economic life in the form of the expectation of future cash transfers and that, and not just narrowly defined "productive" activities, may make the world advance. We may not accept it because economics is a narrative discipline and this appears to be the wrong narrative. It is not that gambling imitates economic life, but that economic life is largely modeled after gambling. That was the idea of the original thinker John Law, made infamous with his bankruptcy; Aaron Brown, another original thinker, revives it and takes it further.

II

Until the day when I opened the manuscript for this book, I was not interested in gambling, any form of gambling. I had taken the aggressive view that, contrary to what we were taught in all these probability volumes, and in the misguided books on the history of probability and "risk," gambling could not offer us lessons about real randomness, nor that it could be a laboratory where you could get actual training for the messy, aPlatonic real life. Just as we tend to underestimate the role of chance in life in general, we tend to overestimate it in these games, by the mechanism of the availability heuristic that makes things the more salient when they easily come to mind.

Indeed, I found it infuriating to listen to people who, upon being informed that I specialize in problems of Chance, immediately jump to references to dice. Two illustrators for a paperback edition of one of my books spontaneously and independently added dice on the cover (the cover illustrator) and below every chapter (by the typesetter), putting me in a state of rage. The editor warned them to "avoid the ludic fallacy" as if it were a well-known intellectual violationamusingly, they both reacted with "ah, sorry, we didn't know." What I call ludic fallacy (after the Latin ludus, play) is the misuse of games as the wrong epistemological ground.

How does randomness end up disappearing in these games? Just consider that you know the probability, and that the payoff does not change throughout. The casino never surprises you by announcing that it will be paying you 100 times more, or a tenth of your take. Furthermore, the dice average out so quickly that I can say with certainty that the casino will beat me in the very near long run at, say, roulette, as the noise will cancel out, though not the skills (here, the casino's advantage). The more you extend the period (or reduce the size of the bets), the more randomness, by virtue of averaging, drops out of these gambling constructs.

The ludic fallacy is present in the following chance setups: random walk, dice throwing, coin tosses, the infamous digital "heads or tails" expressed into 0 or 1, the "Brownian motion" corresponding to the movement of pollen particles in water, and similar examples. These generate a quality of randomness that cannot be even qualified as randomness-protorandomness, or Mandelbrot's "mild randomness" is a more appropriate designation. At the core, all these theories ignore a layer of uncertainty. Worse, they do not know it!

The revelation was that poker differs greatly from the random walk-hence, one could learn from it; furthermore, it may be the sole venue for us to learn about randomness. How? Simply, it has other hidden higher layers of uncertainty-many of them. It has suckers, people who invite you to take advantage of them. It also has people for whom you are the sucker (of course, without your being aware of it). You are not flipping a coin and moving left or right. You are not betting against a large machine like a roulette wheel. You are not engaging in a blind draw. You are playing against other humans. You cannot easily control their maximum bet. Your betting policy matters far more than the probability of getting a given card. You can bluff your way, confuse other players, win in spite of a bad hand, or lose in spite of an unlikely good one. Not least, bets can escalate.

In short, there is autistic probability and social probability, one that is made complicated (and interesting) thanks to the messes and convolutions of human relations. Poker and this book bring us to the latter.

So poker resembles real life, owing to uncertainty about the cards, uncertainty about others' betting policy, and uncertainty about the perception by others of your own betting policy. But it is even more similar to real life, as we saw, in quite unsuspected ways.

III

In spite of having known Aaron B. for several years, mostly as an empirical-minded intellectual of probability, I did not really know what he was about until I read this book. I knew that he has the unusual and valuable background of someone who engaged in the intellectual activity of risk management, but had experience in trading and gambling, therefore got to know uncertainty with more depth and an open mind-which is what uncertainty requires. In other words, a finance professor practitioners could talk to without getting angry.