Investing in a Volatile Stock Market

Protect and Grow Your Portfolio in Turbulent Times

Lita Epstein, MBA

Avon, Massachusetts

Contents

The Right Investment Strategy

Volatility: The New Normal

Seeking Safety in Cash, Cash Equivalents, or Bonds

Counting on Gold and Other Commodities

Trading Forex for Growth or Safety

Riding the Ups and Downs with Momentum Trading

Looking for Buys with Value Investing

Getting Out of the Market Daily with Day Trading

Next Steps for Building Your Portfolio: Allocate It!

Introduction

Each day as the market opens, market watchers wonder whether it will move up or down and how dramatic that movement will be. Will it be nearly flat or will we see the Dow move 800 or 900 points or more? The only thing almost everyone expects to see, no matter what their viewpoint, is volatility.

Market volatility appears to be a permanent fixture of stock markets around the world. As an investor the key to your success depends upon your understanding of the causes of that volatility. I talk more about whats driving volatility in Chapter 1; for now, lets accept that its a feature of the market. Once you determine what direction you think the stock market or other securities markets will move, you can then make wise choices about whether to buy or sell the holdings in your portfolio. People do make money in both up and down markets. The key to success depends on your ability to pick the direction the market will go.

That may sound simple, but its at the heart of investing in a volatile market. And, as well see in the following chapters, there are specific strategies that will help you make money in such a market.

Chapter 1

The Right Investment Strategy

Start with the premise that to be successful in any market you need to have a clear idea of which way its going to move. But are we talking about changes in the short run or the long run? The answer lies in what kind of trader you are.

If youre a day trader, you need to think of the direction the market will go during the next twenty-four hours, but if youre a value investor youre not that worried about that days market moves. A value investor looks for cheap stocks that he or she believes have been beaten down and will likely recover, but that may not be for several years or more. So for value investors, its the longer-term horizon for their portfolio that matters. For all investors the first thing you must decide is the time horizon for your investment.

While I dont believe anyone can perfectly time the market, theres no question that you can follow the ups and downs and decide when its right to sell a security or to add to your holdings. That decision will be different for everyone depending upon his or her style of investing. The key is to follow the old adage, Buy low and sell high.

Dont Buy High and Sell Low

Unfortunately, many people buy high and sell low. Too often novice investors jump into the market when they think its safe. They see that the market has been going up for awhile and the bulls are running. By that time these novice investors dont know that the market may soon be due for a correction. They buy into the market near a high and then panic when the correction occurs often selling at a loss. The savvy investor will hold on through a correction if they didnt sell before the correction happened. The key thing to always remember is that you dont have a loss in the stock market until you sell. If you hold and wait for the next recovery, youll never realize that loss. But it does mean you must have the patience and the guts to wait out the recovery.

Sadly, not all stocks will recover. Sometimes you will need to take a loss, especially if some devastating news comes out about a stock or other security you hold, such as the news that impacted Enron stockholders when Enron collapsed in 2001 or when Lehman Brothers collapsed in 2008. When a stock you hold takes a nosedive in price, you must determine whether its a temporary setback driven by the market conditions or if it reflects negative news that could be a permanent loss in the value of the stock.

- If you think your stock fell because of general market news but its still a good investment, dont rush to sell at a loss.

- If you believe the company has significant problems and you dont want to stick around, take the loss and find a better place for your money.

In this book I introduce you to the various investing styles, from buy-and-hold value investing to momentum trading to rapid day trading. I explore the strategies for keeping your portfolio 100 percent safe with cash to looking for alternatives to stocks, such as gold and foreign currency as possible safety strategies. I also discuss strategies you can use for your portfolio depending upon the styles of investing you feel most comfortable implementing.

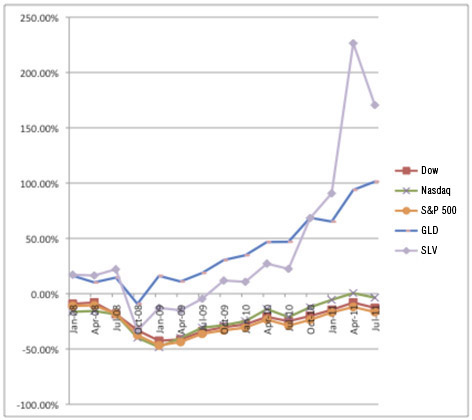

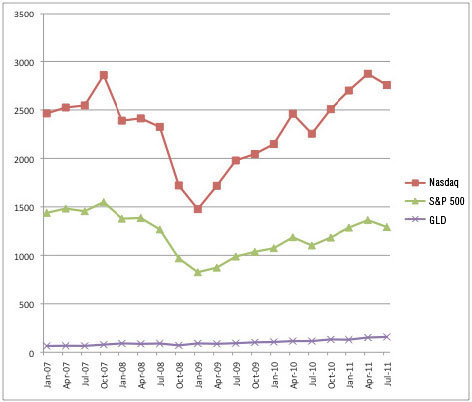

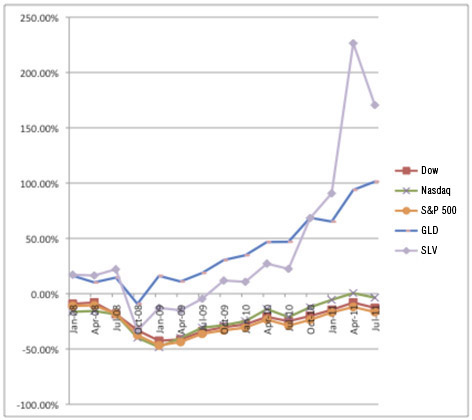

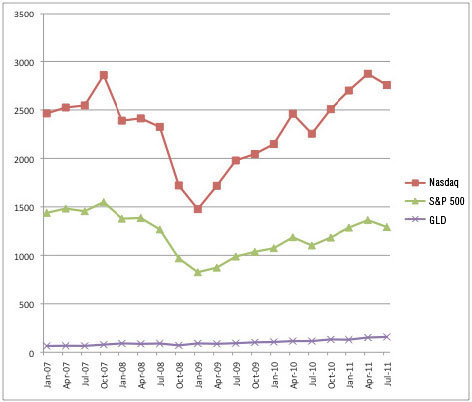

Nasdaq vs. S&P 500 vs. Gold Prices as of 1st of Quarter, January 2007 to July 2011

This chart shows how volatile stocks have been on a quarterly basis versus the Gold ETF, GLD, between the periods of January 2007 through July 2011. Gold has stayed on a slow but steady climb while lines for both Nasdaq and the S&P 500 look like roller coasters.

Know Thyself

Before you even think about an investing style, you need to consider your investing temperament and risk-taking ability. If youre the type of person who easily panics when the market goes down or someone who just cant sleep at night if your portfolio loses money, you need to seek safety. You can do that with cash or cash equivalents. You may also want to consider bonds to add a bit of growth to your portfolio. Even cash investment comes with risk the risk that inflation will eat up your money. Well take a closer look at seeking safety in cash in .

Be Aware of Your Risk Tolerance

Only you can know when a particular investment or trading strategy is too risky. If you cant watch the ups and downs of the marketplace without getting sick to your stomach, youre best off not getting into this volatile market.

Many people with an appetite for a bit more risk have found safety in gold. No doubt theyve done well. Between the market bottom in February 2009 and September 2011, the gold ETF GLD climbed from $92.63 per share to $158.06 per share. Thats a 70.6 percent increase in thirty-one months. Silver did even better, rising 124 percent in that same period. Sounds great doesnt it? In well look at the pros and cons of gold investing, as well as other commodities.

Other investors seek to try their hand at foreign exchange trading (Forex). Currencies that attract people seeking safety include the Canadian dollar, the Swiss franc, and the Japanese yen. Well talk about the world of Forex trading in .

Now you might think that you want to stay away from stocks in this volatile market place, but youre wrong. Those investing in stocks even in a wildly swinging market have seen incredible gains. Between February 2009 and September 2011, the Nasdaq climbed more than 75 percent, while the S&P 500 rose 54 percent. Not bad, right?