Wake up to a Life of Abundance

Copyright 2013 by Max Ito

All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, or by any information storage or retrieval system without written permission from the author.

Inclusion of brief quotation in a review is permitted.

ISBN (978-0-9890905-3-7)

Disclaimer: This book is for informational purposes only. Please consult qualified attorneys, accountants, financial advisers and other professionals regarding business and investment decisions.

For more info:

Max Ito

201-359-5978

www.facebook.com/WakeUpToALifeOfAbundance

To Toshiyuki Ito, my father and Yasuyo Ito, my mother,

who have supported and believed in me.

Integrity is the most valuable attribute

I learned from them.

TABLE OF CONTENTS

Chapter

My First Offer

Taking the Plunge

O n January 25 th , 2012, I could not sleep, thinking about my first investment property. I was going to close on it the next day. Had I made the right decision? What if Id overlooked potential pitfalls? Was my purchase price low enough to make this investment work?

Could I back off this deal even though the closing date was tomorrow? I asked myself the same question again and again and never found the right answer. I do not remember when I fell asleep, but my mind was determined when I woke up in the morning. I am going to close on this deal and I will officially become an investment property owner today!

In the morning, I visited the property and conducted a final walk-through. Right after the walk-through, I went to the attorneys office for closing. After signing a number of documents, my attorney smiled and said, Congratulations. You are a home owner. My realtor gave me keys for the property and I purchased an investment house in New Jersey on January 26 th , 2012.

Throughout the process, I felt as if I were about to jump from a cliff. I did not know what came next and I did not know how to fly. After purchasing my first investment property, I spent tens of thousands of dollars on real estate education and learned creative investment strategies. With a deeper understanding of real estate investment, I realized that my first investment was not necessarily excellent in terms of return on investment, but still good enough to generate positive cash flow. It also certainly gave me confidence and hands-on knowledge which I have utilized for my next deals. In this book I will walk you through my experiences during the first deal. I will also share my thoughts about what I could have done differently.

I have enjoyed flying after my first purchase. While purchasing property is merely a single step on my journey, holding property is another long-term journey. Within a year, I have closed on five real estate deals. Three deals are single family homes. One is the acquisition of a multi-unit apartment with 170 units with partners. The other one is a real estate financial deal. I am determined to grow as a real estate professional and continue to fly on this investment journey.

Why Real Estate?

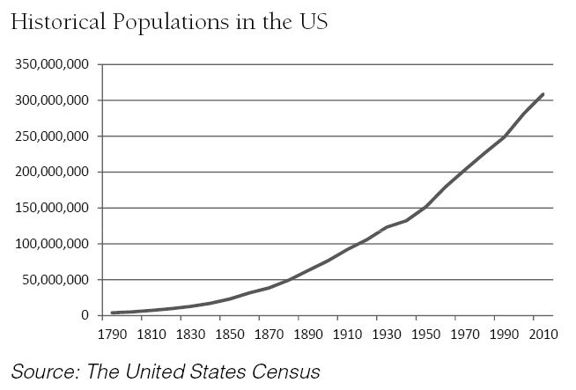

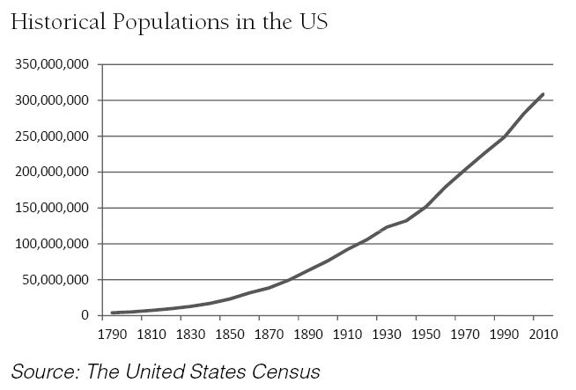

I was born and raised in Japan. The population in Japan is expected to decrease significantly in the future. On the other hand, population in the US has strongly increased over the past 10 years. Demand for housing is expected to remain strong in the future in the US.

Can anybody predict which Fortune 500 companies will survive in the next 30 years? 50 years ago, who could have predicted that major bookstores would face bankruptcy due to increased trends in online shopping? It is extremely difficult to predict future trend in business. Compared to business, it is much easier to predict future demands of real estate. Will people still need a place to live in 30 years? The answer is most likely Yes. Since the price of a single real estate transaction is, more often than not, higher than other transactions, some have the misconception that real estate is risky. Some may have friends who have gone bankrupt because of their failure in real estate investments.

You cannot conclude that real estate is risky based on the fact that others have failed. The real estate business is much safer than other businesses. Return on investment in the real estate investment with conventional methods is typically lower than return on investment in small business, since smaller risks are involved in real estate. You can also increase return on investment in real estate with creative financing and finding motivated sellers without necessarily increasing risks.

Another reason why I love real estate is leverage. Which bank will loan you money when you purchase stocks? Only real estate transactions allow you to get high leverage. If you make wise use of your debts, debts will be your good friend and strongly support your business growth. I also love the real estate business since it certainly has a positive impact on our society. One of my seasoned investor mentors once told me that he purchased more than 10 properties in undesirable areas. He rehabbed those properties and made them look very good. Afterwards, tenant quality significantly improved and the renovation had a great impact on the neighborhood. The value of the homes in the neighborhood skyrocketed after its neighbors were revitalized.

Investors enjoy various tax benefits through real estate investment. Depreciation is a huge benefit of real estate investment. We will discuss tax shields later in the book.

Lastly, I love real estate deals because they bring passive income. It is still true that investors need to work on the acquisition of the properties. Once they acquire the properties, relatively little workload is required and they receive rental income every month. Before realizing the importance of passive income, I had only invested in my skill sets. I had just focused on improving my future performance at work so that I could get a better job in the future. I can currently clearly see that those who focus only on their skill sets believe that their workload is the only way to earn money. If you deeply realize the difference between asset and liability in Robert Kiyosakis book Rich Dad Poor Dad , you will be convinced that it is important to focus on increasing assets which generate positive cash flow. You can call yourself an asset, since your work generates cash flow. You need to realize that there are other assets available such as real estate.

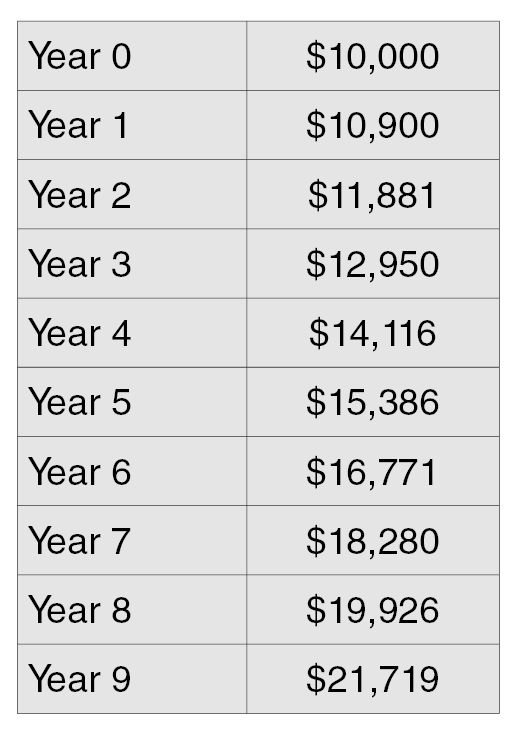

Rule of 72

Do you know how long it takes to double your money if you put it in savings account at a bank? If your interest rate is 0.3%, it will take 240 years to double your money. You need to think about better ways to utilize your money.

Rule 72, this is the simplified way to calculate how long it takes to double your money.

Lets explain this rule by using an example.

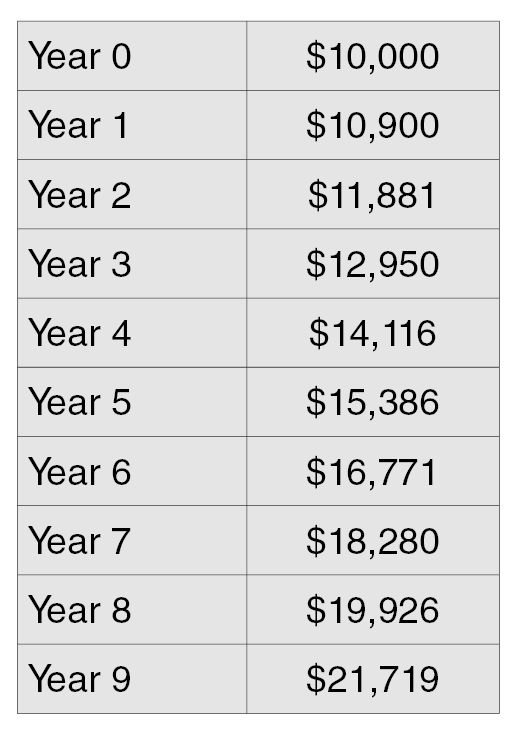

Investment: $10,000

Annual return: 9%

72 divided by 9 = 8. It takes approximately 8 years to double the investment. One of the assumptions of this rule is all the returns are re-invested in this opportunity.

Why is doubling the initial investment important? Because investors can withdraw the same amount of initial investment and still enjoy the same growth in the future.

For example in the previous scenario, in the end of year eight, investors can withdraw $10,000. The remaining balance is roughly $10,000. Investors can enjoy 9% growth afterwards. Since investors recoup the initial investment, return on investment after year 9 is infinite.

Next page