Larry Swedroe - Think, Act, and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals

Here you can read online Larry Swedroe - Think, Act, and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2012, publisher: McGraw-Hill, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Think, Act, and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals

- Author:

- Publisher:McGraw-Hill

- Genre:

- Year:2012

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

Think, Act, and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Think, Act, and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

If youve been wondering why youve had such a hard time investing well, Think, Act, and Invest Like Warren Buffett will diagnose your ills and treat them in this delightful short book. -- William Bernstein, Author, A Splendid Exchange and The Investors Manifesto

Follow the investment strategy advocated by Larry Swedroe, and free yourself to spend your time on lifes treasures--like your family and friends! -- William Reichenstein, Professor, Baylor University

As someone who teaches a college investments course, I would not have thought it possible to do what Swedroe has done in such a short concise book. -- Edward R. Wolfe, Professor of Finance, Western Kentucky University

Its amazing. Larry Swedroe managed to pen a magnificent book not only chock full of actionable advice but one thats fun to read. Get a copy and treat yourself to a better financial future. -- Harold Evensky, President, Evensky & Katz

Larry Swedroe is the undisputed expert in helping investors manage portfolios the smart way. His new book, Think, Act, and Invest Like Warren Buffett, combines all facets of wealth management in an inspiring and powerful manner. -- Bill Schultheis, Author, The New Coffeehouse Investor

This book, which covers the whys and hows of successful investing, was written for those investors who just cant (or wont) read a 300-page investing book. Swedroes set of 30 rules is an education in itself. Its a small book with a big message. -- Mel Lindauer, Forbes.com columnist and co-author, The Bogleheads Guide to Investing and The Bogleheads Guide to Retirement Planning

You could not spend a more profitable hour than reading Larry Swedroes wise and lucid hundred page investment guide. -- Burton G. Malkiel, Author of A Random Walk Down Wall Street

Larry Swedroe is the Mark Twain of the investment aphorism. This concise book builds to a conclusion that features thirty of his pithy truths. My favorites include: Never work with a commission-based advisor. If it sounds too good to be true, it is. The more complex the investment, the faster you should run away. -- Ed Tower, Professor of Economics at Duke University

Larrys book is about how to be successful in investing and in life. But, who would believe this involves understanding Big Rocks? I now understand their importance and so should you! -- John A. Haslem, Professor Emeritus of Finance, University of Maryland, and author of Mutual Funds

Larry Swedroes latest book shows you how to succeed at investing with simple yet powerful guidance thats backed by the financial sciences. Add it to your must-read list. -- Steve Vernon, author of Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck

This book is a quick and thorough read of the passive approach to investing in as few pages as possible. As someone who teaches a college investments course that deals extensively with this topic, I would not have thought it possible to do what he has done in such a short concise book. Kudos to Larry for continuing in his quest to educate investors and save them as Larry says one investor at a time from a financial services industry whose primary goal is largely to enrich themselves. -- Edward R. Wolfe, Professor of Finance, Western Kentucky University

Because common sense isnt so common, thank goodness Larry Swedroe provides his readers with this magnificent book. With well-founded actionable advice, his readers can insure that they enrich their lives not Wall Streets bank accounts. -- Harold Evensky, President, Evensky & Katz

Larry doesnt tell you how to do what Warren Buffett does as much as avoid what Warren Buffett avoids, which turns out to be exceptionally important and doable for any investor. He tells you to avoid a few things I would tell you to embrace, like some hedged strategies, but that is because Wall Street typically overcharges you for these, so even here Larry is on the side of the angels. Every investor can benefit immensely from this book. -- Cliff Asness, Founding and Managing Principal, AQR Capital Management

Many investment books adopt an adversarial tone--urging us to achieve success by somehow outwitting the market. Larry Swedroe explains why following such a strategy often diminishes our financial as well as our spiritual wealth--and shows us how a holistic approach to money, markets, and human behavior provides the most rewarding path to follow. -- Weston Wellington, Vice President, Dimensio

A valuable addition to the growing library of books for investors wanting to successfully launch their own portfolio. Sticking to the core principles of this book will go a long way in preparing investors for their eventual retirement years. -- SeekingAlpha.com

About the Book:

If you wanted to create the next earth-shattering consumer product, Steve Jobs would be an ideal role model to follow. If you planned to become a great golfer, you might look to Arnold Palmer or Jack Nicklaus.

So, if your goals are to outperform other investors and achieve your lifes financial goals, what should you do?

Think, act, and invest like the best investor out there: Warren Buffett. While you cant invest exactly like he does, Think, Act, and Invest Like Warren Buffett provides a solid, sensible investing approach based on Buffetts advice regarding investment strategies.

When it comes to investing, Director of Research for the BAM Alliance and CBS News blogger Larry Swedroe has pretty much seen it all--and hes come to the conclusion that simple is better, that adopting basic investing principles always increases an investors chance of success, and that Buffett is an excellent model for such investing.

In Think, Act, and Invest Like Warren Buffett, Swedroe provides the foundational knowledge you need to:

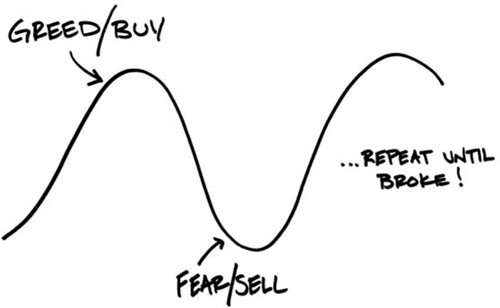

- Develop a financial plan to help you make rational decisions on a consistent basis

- Determine the level of risk thats right for you, and allocate your assets accordingly

- Build a low-cost, tax-efficient, globally diversified portfolio

- Manage your portfolio by rebalancing periodically to maintain proper risk levels

The beauty of the Buffett approach is its profound simplicity: follow the basics, keep your cool, and have a sense of humor and humility.

The market volatility of recent years has ushered in armies of economists, forecasters, and other so-called experts whose job it is to explain how everything works. Somehow, they have managed to muddy the waters even more.

The truth is, investing is easier than you think--even in todays economy. Complex problems can have simple solutions, Swedroe writes. Think, Act, and Invest Like Warren Buffett helps you go back to the basics--so you can leap in front of the investing pack.

Larry Swedroe: author's other books

Who wrote Think, Act, and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals? Find out the surname, the name of the author of the book and a list of all author's works by series.