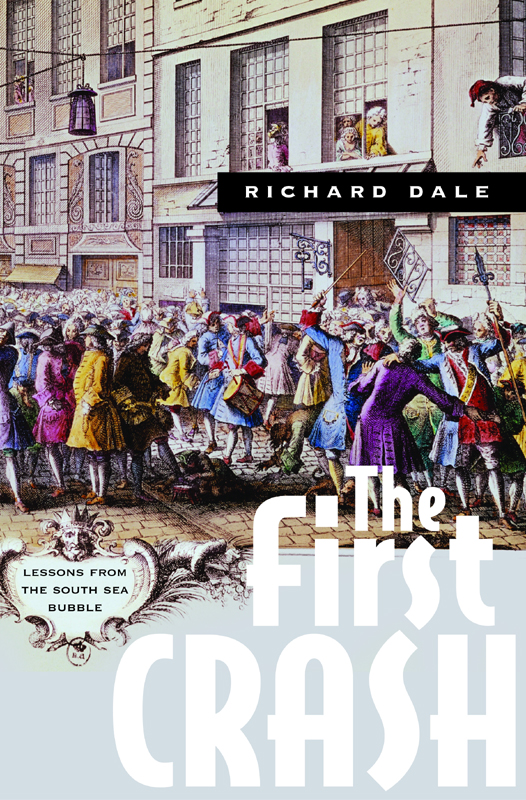

The First Crash

The First Crash

LESSONS FROM THE SOUTH SEA BUBBLE

Richard Dale

PRINCETON UNIVERSITY PRESS

PRINCETON AND OXFORD

Copyright 2004 by Princeton University Press

Published by Princeton University Press, 41 William Street, Princeton, New Jersey 08540

In the United Kingdom: Princeton University Press, 3 Market Place, Woodstock, Oxfordshire OX20 1SY

All Rights Reserved

Library of Congress Cataloging-in-Publication Data

Dale, Richard

The first crash: lessons from the South sea bubble / Richard Dale.

p. cm.

Includes bibliographical references and index. ISBN 0-691-11971-6 (cl: alk. paper)

1. South Sea Bubble, Great Britain, 1720. 2. Financial crisesGreat BritainHistory18th century. 3. Capital marketGreat BritainHistory18th century. 4. StocksPricesGreat BritainHistory18th century. 5. South Sea CompanyHistory. I. Title.

HG6008.D35 2004 |

332.63228dc22 | 2004044319 |

British Library Cataloging-in-Publication Data is available

This book has been composed in Sabon

Printed on acid-free paper

www.pup.princeton.edu

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

To the memory of Peter Carter (1929 to 1983), an inspirational teacher of history

Contents

Acknowledgements

I would like to thank Professor Charles Goodhart and Professor Forrest Capie for their encouragement after reading drafts of early chapters of this study, as well as several anonymous referees who provided helpful comments and suggestions. I am also grateful to Richard Baggaley of Princeton University Press for showing such enthusiasm for the project from start to finish. I have received valuable assistance from staff at the British Library, Goldsmiths Library, the London Guildhall Library, the Bank of England Reference Library and the House of Lords Record Office. It is thanks to the Courtauld Institute that I was able to track down a portrait of Archibald Hutcheson MP who emerges as the unsung hero of the South Sea Bubble. Finally I must acknowledge a special debt to my wife Niki who acted as a tireless research assistant and without whose support this work would not have been completed.

The First Crash

Introduction

THE YEAR 1720 is a seminal date in financial history for it was in that year that stock markets in London, Paris and Amsterdam, as well as in lesser centres such as Hamburg and Lisbon, experienced a contagious collapse which brought ruin to investors and threatened the stability of governments. This was the first international financial crash and it has become the trigger for an intense debate about the rationality of investors and the very nature of financial markets. Are such markets inherently unstable? Are investors subject to periodic bouts of euphoria and despaira kind of collective manic depressionthat cannot be explained by underlying economic fundamentals? Are the Wall Street crash of 1929, the global crash of 1987, the bursting of the Japanese financial bubble in the 1990s and the subsequent international dot.com boombust direct lineal descendents of the 1720 crash? Or can all these episodes be explained, as some economists insist, in terms of investor rationality in the face of uncertainty and external shocks?

The South Sea Bubble has a pivotal role in this debate because it represents the extremity of investor conduct. If ever there was an example of manic herd behaviour this was surely it. By the same token, if the South Sea Bubble can be interpreted as a rational investor response to changing economic prospects and the uncertainties associated with eighteenth century financial innovation, then the rational stock market model remains intact. It is the central purpose of the present study to throw further light on this fundamental issue by focussing first on the opinions of contemporary observers and investors during and preceding the fateful Bubble year, and second on the valuations implicit in share prices and subscriptions. In the course of this exercise it will be necessary to rescue from obscurity a remarkable individual whose contemporary analysis of events leading up to the 1720 crash compares favourably with anything that has been written about it since.

Of course, there are many modern accounts of the South Sea Company and the boombust year of 1720. There is a very good general work by Carswell which use formal economic analysis to explain the rise and fall of South Sea stock. On the other hand, little has been written about investors perspective during the Bubble, or the various attempts by contemporary commentators to value South Sea shares. The present study attempts to fill this gap by drawing on early eighteenth century writings to describe and explain investor behaviour at the time of the Bubble. And it is from such contemporary sources that the true unsung hero of the South Sea crash emerges. The gentleman concerned was Archibald Hutcheson, Member of Parliament for Hastings, a professional lawyer and self-taught economist, who may fairly be described as the father of investment analysis. Hutchesons meticulous valuations of the South Sea Company demonstrated an alarming divergence between fundamental values and market prices in the run-up to the Bubble, but his warnings about the inevitability of a crash were ignored until it was much too late.

Historians of the Bubble have also ignored important clues to investors motivation provided by the traded prices of South Sea subscription receipts. The new data provides conclusive evidence that in 1720 investors did not conform to the rational model favoured by many financial economists. The analysis shows that investors lost their bearings to the point where prices of directly substitutable financial instruments, representing equivalent claims on the South Sea Companys dividends and assets, became wildly out of line with each other. As described below, it was as if the investing public were engaged in a familiar eighteenth century lottery game, viewing each successive draw (share issue) as offering the prospect of ever larger lottery prizes (capital gains). Finally, this study treats the Bubble, not as a self-standing episode in English financial history, but as one, admittedly extreme, example of the way in which investment markets may behave anywhere, at any time. In brief, the argument here is that the events of 1720 offer insights into the nature of financial markets that, being independent of place and time, deserve to be considered by todays investors everywhere. The first historian of the Bubble, Adam Anderson, who was formerly a clerk at the South Sea Company, expressed similar thoughts nearly two hundred and fifty years ago:

The unaccountable frenzy in stocks and projects of this year 1720 may by some be thought to have taken up too much room in this work: but we are persuaded that others of superior judgement, will approve of the perpetuating the remembrance thereof, as a warning to after ages.

The question of whether financial markets are subject to periodic bouts of irrationality, as Adam Anderson implies, is a crucial issue for investors, businesses and policy makers. If the irrationality argument is accepted, investors need to be aware that prevailing market prices may not represent fair value, contrary to what efficient markets theory would suggest. Businesses may be misled into harmful investment decisions based on inflated market prices for their stock. And macro-economic policy makers may need to intervene, if only by leaning against the wind, since bubbles, when they unwind, can lead to economic dislocation, lost output and amplified business fluctuations. The rationality/irrationality issue is therefore centre-stage at the present time and one of the main purposes of this study is to contribute to a better understanding of the subject by exploring the murky waters of early eighteenth century finance.

Next page