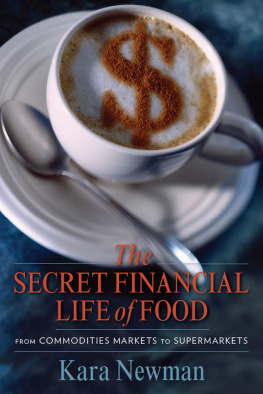

The Secret Financial Life of Food

Arts and Traditions of the Table: Perspectives on Culinary History

THE SECRET FINANCIAL LIFE OF FOOD

From Commodities Markets to Supermarkets

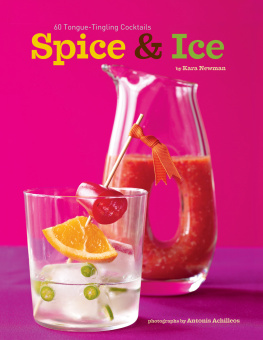

Kara Newman

COLUMBIA UNIVERSITY PRESS

NEW YORK

Columbia University Press

Publishers Since 1893

New York Chichester, West Sussex

cup.columbia.edu

Copyright 2013 Columbia University Press

All rights reserved

E-ISBN 978-0-231-52734-7

Library of Congress Cataloging-in-Publication Data

Newman, Kara.

The secret financial life of food : from commodities markets to supermarkets / Kara Newman.

p. cm. (Arts and traditions of the table: perspectives on culinary history)

Includes bibliographical references and index.

ISBN 978-0-231-15670-7 (cloth : alk. paper)

ISBN 978-0-231-52734-7 (e-book)

1. Commodity exchangesHistory. 2. AgricultureEconomic aspectsHistory. 3. FoodHistory. I. Title.

HG6046.N49 2013

332.6441dc23

2012010138

A Columbia University Press E-book.

CUP would be pleased to hear about your reading experience with this e-book at .

COVER ART: Lew Robertson, Getty Images

COVER DESIGN: Milenda Nan Ok Lee

References to Internet Web sites (URLs) were accurate at the time of writing. Neither the author nor Columbia University Press is responsible for URLs that may have expired or changed since the manuscript was prepared.

To Eliott Newman and Naomi Newman

Contents

Bringing this book to life meant dealing with a number of hurdles, from lost historical archives to recalcitrant traders and close-lipped corporate gatekeepers. But a number of people were critical in helping to uncover resources, providing helpful and intelligent information, as well as support through the rougher patches. The following individuals are worth their weight in gold (or any other commodity they see fit to trade): Author and culinary historian extraordinaire Betty Fussell was instrumental in helping flesh out the early outline for this book and encouraging me to pursue it; her books The Story of Corn and Raising Steaks proved to be valuable resources. Culinary history powerhouse Andrew F. Smith provided endless encouragement, and I am honored to know him as teacher, historian, and friend. The Culinary Historians of New York, particularly Cathy Kaufman and Linda Pelaccio, who allowed me to present parts of the pork belly chapter to the membership, showed me that an audience for this book exists.

Since it is nearly impossible to persuade traders and corporations to reveal their trading activities, past or present, I relied on historical newspaper accounts to piece together some historical arcs. For that, I am indebted to New York Universitys Bobst Library, the New York Public Librarys archives, and librarian Melody Allison of the Funk Family Agriculture, Consumer, and Environmental Sciences Library at the University of Illinois, Urbana-Champaign.

It was a particular disappointment to learn just how much of the former New York Mercantile Exchanges historical archives were lost when the tragedy of September 11, 2001, decimated the exchanges home in the World Trade Center. However, a number of industry insiders, current and former, provided information that helped connect together stories, including Curt Zuckert at the CME Group, Lee Underwood and Tim Barry at the IntercontinentalExchange, and Will Acworth at the Futures Industry Association. I am particularly grateful that Leo Melamed, chairman emeritus of the Chicago Mercantile Exchange, and Joseph ONeill, former president of the New York Cotton Exchange, granted interviews.

A number of finance and economics experts generously shared their time and expertise for this project: Alan Bush of Archer Financial Services, Chad Hart of Iowa State University, Bill G. Lapp of Advanced Economic Solutions, Ron Plain of the University of Missouri, and Jim Robb of the Livestock Marketing Information Center.

Gratitude also is due to Jennifer Sondag and Chris Grams of the CME Group for their gracious assistance in obtaining images to include in the book, as well as to Ryan Carlson, who maintains the fascinating Trading Pit Blog (www.tradingpitblog.com). Thank you also to culinary historian Lynne Olver for granting permission to reprint her useful and highly entertaining Hershey Bar Index.

The team at Columbia University Press deserves special mention, particularly editor extraordinaire Jennifer Crewe, as well as Jay Harward, Meredith Howard, Irene Pavitt, and Kathryn Schell.

Finally, I am lucky to have the following people in my corner: Sandra and Alan Silverman; Joelle, Laurie, and Rowana Miller; Jennifer and Madelyn Sendor; Naomi and Eliott Newman; and, especially, Robert Silverman.

Few people can claim to have had a food epiphany while reading Barrons, but thats what happened to me. In a roundtable discussion of market experts, after many dry pages about where the S&P 500 Index and gold bullion might end the year, commodities trader Jim Rogers offered this wisdom: Buy breakfast.

He was referring to futures contracts sold on frozen orange juice and pork bellies, which he expected to appreciate in value during the coming year. But to me, it was more than an investment idea. I thought of the BLTs and cartons of Tropicana orange juice Id consumed over the years. Although I had a vague notion of the agriculture and manufacturing associated with bringing food to the table, never before had I contemplated the secret financial life of my meals.

At the time, I was working as a financial editor for a consulting firm, overseeing a team that churned out daily stock and bond market reports for corporate clients. I was given a new and serendipitous task: write a daily commodities report.

Suddenly, I was hungry on the commodities beat, and I wanted to learn more. I enrolled in a course on derivatives offered by the Futures Industry Institute and taught by a commodities trader. The class was geared toward prepping eager young traders for a certification exam. I flipped past the pages on interest rate futures and diagrams of hedging strategies to the list of products traded as commodities.

For the uninitiated, the commodities market generally is divided into five sectors: metals, energy, livestock, softs, and grains. The first two I found fairly straightforward: metals includes precious metals and base metals, such as copper and aluminum, while energy refers to products like crude oil and natural gas.

But after that, the course book read like a menu: The livestock category includes cattle (live cattle and feeder cattle) and hogs (live and the fabled pork bellies, a commodity now ubiquitous on trendy restaurant menus but which ceased trading in 2011). The grains sector spans the range of corn, oats, soybeans, and wheat. And the softs group refers to cocoa, coffee, orange juice, sugar, and, puzzlingly, also cotton and lumber.

And thats just a partial list. It goes on, especially if you include contracts that are traded outside the United States and those that once traded here but are no longer: barley; butter and cheese; chickens; eggs, which surprisingly were a highly speculative market during the 1970s; fruit; milk; peppercornsred, green, or black (largely traded in India, as are most other spices); potatoes; and rice. Apparently, if one can consume it, one can trade it.

How long had this been going on? A partial answer comes from

Next page