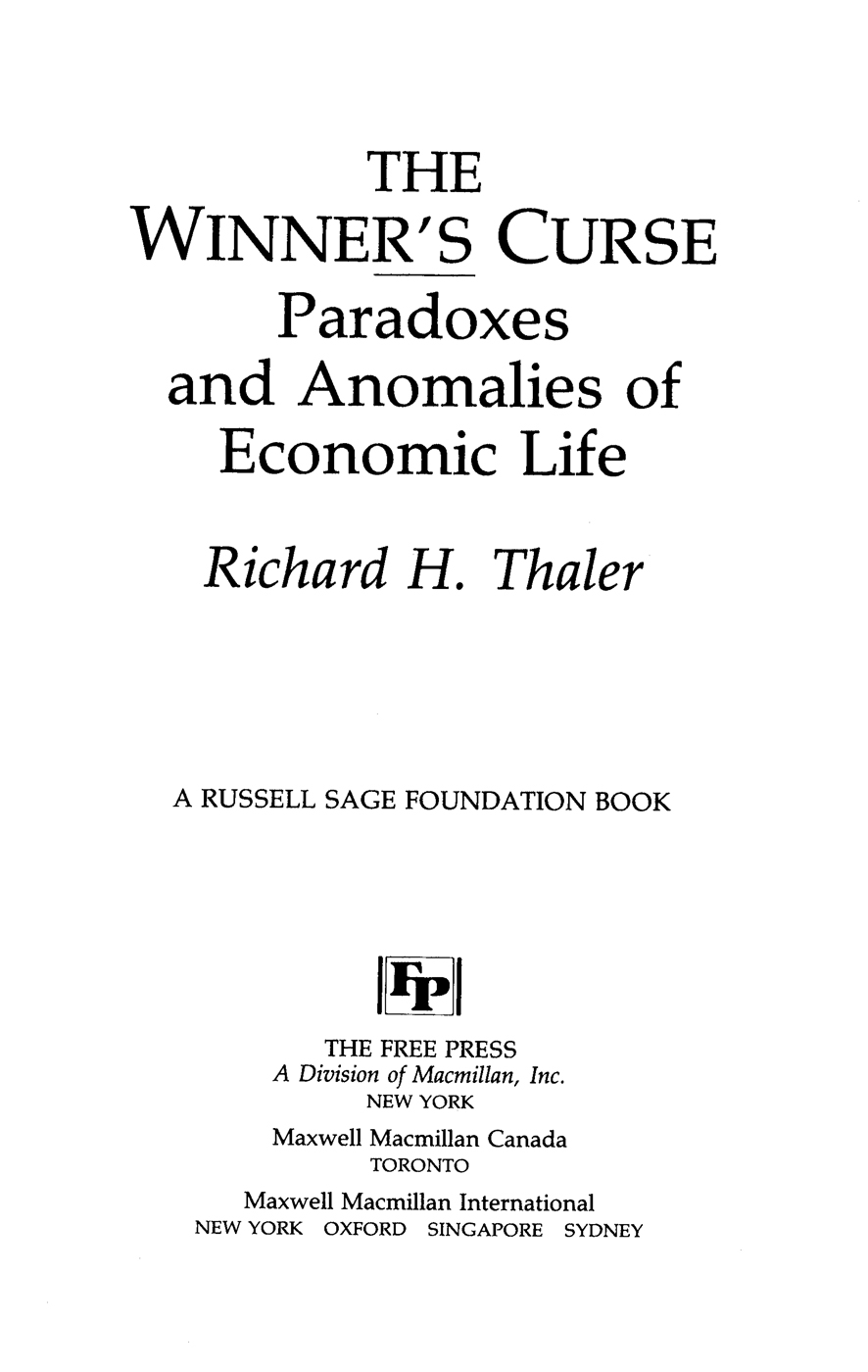

According to most economists, economic behavior is a rational process. It is assumed that we know what we want, strive to get it, and accept the verdict of the market for our effort. Indeed, all who deal with moneythe manager who plans competitive business strategies, the lawyer who negotiates contracts, the investor who evaluates risk against return, and the homemaker who balances a budgetare well aware of the economic forces which govern our affairs. But is economic behavior in real life as rationally explicable as economists claim? Will our carefully calculated pursuit of our preferences always be met efficiently by the market?

In this profound and provocative work, Richard Thaler challenges the received economic wisdom by revealing many of the paradoxes that abound even in the most painstakingly constructed transactions. He presents literate, challenging, and often funny examples of such anomalies as why the winners at auctions are often the real losersthey pay too much and suffer the winners cursewhy gamblers bet on long shots at the end of a losing day, why shoppers will save on one appliance only to pass up the identical savings on another, and why sports fans who wouldnt pay more than $200 for a Super Bowl ticket wouldnt sell one they own for less than $400. He also demonstrates that markets do not always operate with the traplike efficiency we impute to them. For instance, he cites the bewilderingly divergent pay scales for the same job in different industries, and reminds us that the stock market responds to such unlikely stimuli as the arrival of weekends, holidays, and seasonal changes.

Thaler argues that recognizing these sometimes topsy-turvy facts of economic behavior will compel economists, as well as those of us who live by their lights in our jobs and organizations, to adopt a more balanced view of human nature, one reflected in Adam Smiths professed belief that, despite our selfishness, there is something in our nature that prompts us to enjoy, even promote, the happiness of others. Keeping this view in mind as we deal with colleagues, competitors, teammates, and friends, we are likely to find ourselves the richer for it, and just may avoid the winners curse. This insightful book will be read and discussed widely by scholars and professionals.

RICHARD H. THALER is the Henrietta Louis Johnson Professor of Economics at the Johnson Graduate School of Management at Cornell University.

FREE PRESS

A Division of Simon & Schuster, Inc.

NEW YORK

1992 Simon & Schuster, Inc. (New York)

jacket design Mike Stromberg

author photo by Christopher Little

Thank you for purchasing this Free Press eBook.

Sign up for our newsletter and receive special offers, access to bonus content, and info on the latest new releases and other great eBooks from Free Press Books and Simon & Schuster.

or visit us online to sign up at

eBookNews.SimonandSchuster.com

Free Press

A Division of Simon & Schuster, Inc.

1230 Avenue of the Americas

New York, N.Y. 10020.

www.SimonandSchuster.com

Copyright 1992 by Richard H. Thaler

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever. For information address Free Press Subsidiary Rights Department, 1230 Avenue of the Americas, New York, NY 10020.

First Free Press ebook edition June 2012

FFREE PRESS and colophon are trademarks of Simon & Schuster, Inc.

Simon & Schuster Speakers Bureau can bring authors to your live event. For more information or to book an event contact the Simon & Schuster Speakers Bureau at 1-866-248-3049 or visit our website at www.simonspeakers.com.

ISBN 0-02-932465-3

ISBN 978-1-45169-787-2 (eBook)

To

Jessi, Maggie, and Greg

My Favorite Anomalies

Contents

This book required more than the usual amount of help to write. Versions of each of the chapters in this book were previously published by the Journal of Economic Perspectives in a special feature on Anomalies. I owe thanks to the editors, Carl Shapiro and Joseph Stiglitz, for inviting me to write this series. (The idea for the Anomalies feature was hatched during a dinner conversation I had with Hal Varian, who then passed on the suggestion to the Journal.) Without those quarterly deadlines, there is no way I would have ever produced this book (see ). Carl and Timothy Taylor also read, commented on, edited, and greatly improved all the columns. Their suggestions were always constructive, and often followed.

For more than half of the columns I solicited one or more collaborators. Their names appear in the Table of Contents and on the first page of the corresponding chapters. Many of the coauthored chapters would have been impossible for me to write alone, and none of them would have been as good (or as much fun to do) if I had done them by myself. I want to emphasize that every coauthor was a full partner, and I would request that academics who wish to cite a coauthored chapter of this book please either cite the original column or be sure to include the coauthors name in the citation. (The original references to the published columns appear below.)

Writing four columns a year took a lot of time, and, as we know, time is money. I am grateful to Concord Capital Managment and the Russell Sage Foundation for providing the money, and to the Johnson Graduate School of Management at Cornell for yielding the time. Eric Wanner at Russell Sage went well beyond the normal duties of a Foundation President by serving as my book agent. And Tom Dyckman has been very helpful and flexible in arranging my Cornell duties, though please dont tell him that.

I have also had the help of several patient friends who have read far more than their share of my first (and sometimes second and third) drafts. Those who have carried a special burden are Maya Bar-Hillel, Colin Camerer, Werner De Bondt, Pat Degraba, Bob Frank, Danny Kahneman, Ken Kasa, Jay Russo, and Tom Russell. All were cooperative well before they read . Dennis Regan, Charlotte Rosen, and Deborah Treisman all read the galley proofs and helped spot numerous typos. Finally, Peter Dougherty, my editor at The Free Press, helped me turn 13 columns into a book. Thanks.

The material in this book was previously published in the Journal of Economic Perspectives and is reprinted here with the permission of the American Economics Association. The articles were revised for this book. The original references are Robyn M. Dawes and Richard H. Thaler (1988), Cooperation, Journal of Economic Perspectives, Vol. 2, No. 3,

A friend of yours is the Chairman of the Acme Oil Company. He occasionally calls with a problem and asks your advice. This time the problem is about bidding in an auction. It seems that another oil company has gone into bankruptcy and is forced to sell off some of the land it has acquired for future oil exploration. There is one plot in which Acme is interested. Until recently, it was expected that only three firms would bid for the plot, and Acme intended to bid $10 million. Now they have learned that seven more firms are bidding, bringing the total to ten. The question is, should Acme increase or decrease its bid? What advice do you give?

Did you advise bidding more or less? Most peoples intuition in this problem is to bid more. After all, there are additional bidders, and if you dont bid more you wont get this land. However, there is another important consideration that is often ignored. Suppose that each participant in the auction is willing to bid just a little bit less than the amount he or she thinks the land is worth (leaving some room for profits). Of course, no one knows exactly how much oil is in the ground: some bidders will guess too high, others too low. Suppose, for the sake of argument, that the bidders have accurate estimates on average. Then, who will be the person who wins the auction? The winner will be the person who was the most optimistic about the amount of oil in the ground, and that person may well have bid more than the land is worth. This is the dreaded winners curse. In an auction with many bidders, the winning bidder is often a loser. A key factor in avoiding the winners curse is bidding more conservatively when there are more bidders. While this may seem counter-intuitive, it is the rational thing to do.

Next page