Andrew Lendnal - Gold Start: Teaching Your Child about Money

Here you can read online Andrew Lendnal - Gold Start: Teaching Your Child about Money full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2011, publisher: Exisle Publishing Pty Ltd, genre: Children. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

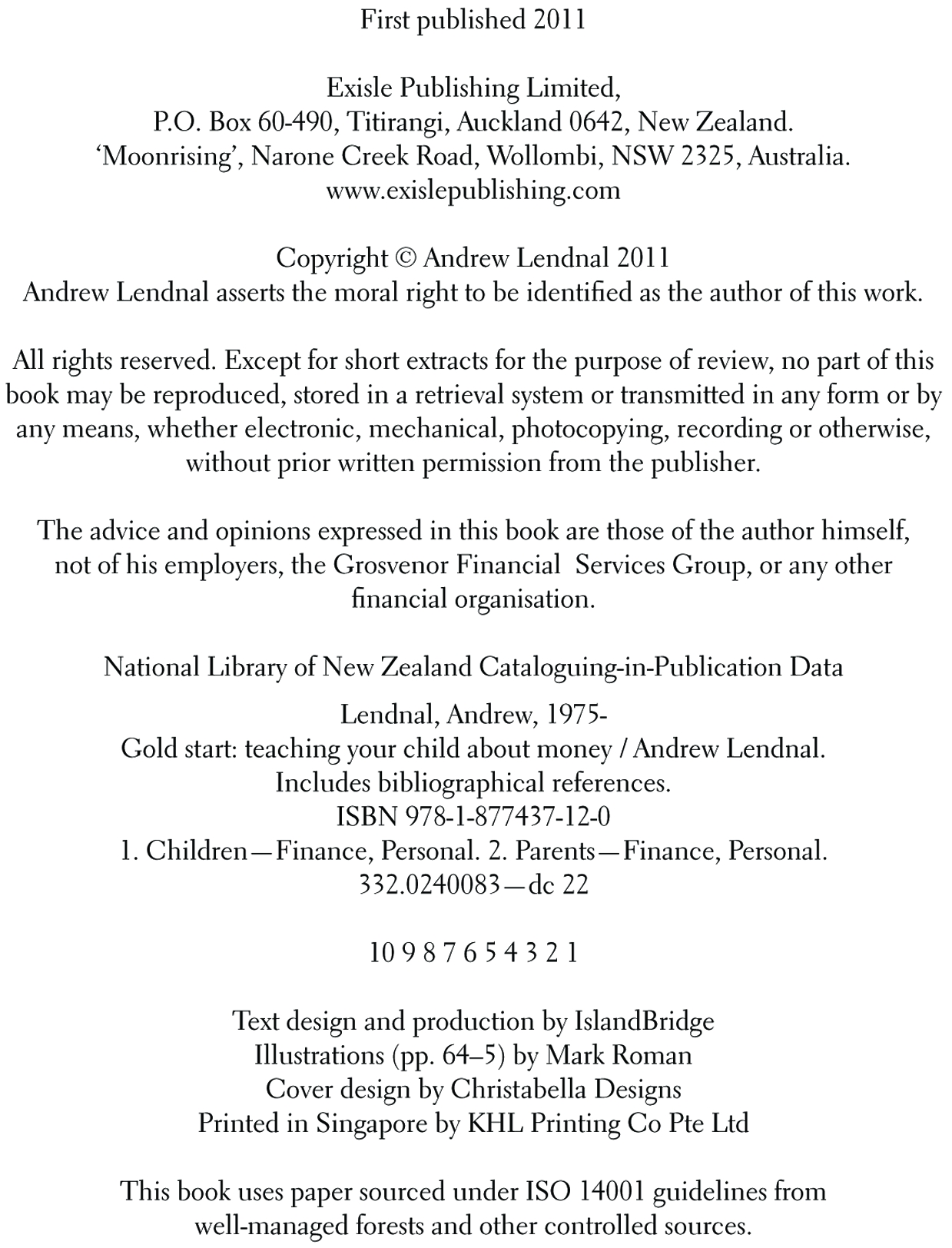

- Book:Gold Start: Teaching Your Child about Money

- Author:

- Publisher:Exisle Publishing Pty Ltd

- Genre:

- Year:2011

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

Gold Start: Teaching Your Child about Money: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Gold Start: Teaching Your Child about Money" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

GOLD START is the book that millions of parents have been waiting for: a book that provides parents, teachers and caregivers with the necessary tools to teach children the four basic principles of money management Earning, Spending, Saving and Sharing.

Do you have a plan to educate your children about financial matters?

Are you uncomfortable talking about money with your children?

Do you use money as a bribe to get your children to do things?

Do you argue with your partner about money in front of your children?

Do you give your children a consistent allowance?

Are you worried about how your children will get through university?

Financial author and educator Andrew Lendnal has been directly involved in helping children learn about money for several years, and believes that teaching money basics at a very early age is crucial. In fifteen practical lessons, he outlines the skills that toddlers, preschoolers, school-aged children and tweens require to be money savvy, followed by a special section focusing on teens and money. Full of handy practical tips, GOLD START also includes many family activities and games that will help children learn about money in a fun way, making this book both a handbook and a catalyst for family discussions about finances.

Do you have a plan to educate your children about financial matters?

Do you think about the values that you are communicating to your children through the way you handle money?

Are you uncomfortable talking about money with your children?

Do you sometimes use money as a bribe to get your children to do what you tell them?

If you feel youve been too busy to spend time with your children, do you try to make it up to them by buying them things?

Do you frequently argue with your spouse about money in front of your children?

Do you ever talk to your children about the importance of charity and helping others less fortunate than your family?

Do you give your children a consistent allowance?

Are you worried about Generation Debt: how your child will succeed in getting through university or college?

If any of these issues worry you, then this book is for you. GOLD START has been written by an expert in the field of educating children about money. It is jam-packed full of excellent tips and advice on how to make your childs life (and your own!) much easier in the future. The book is interactive too: full of questionnaires and tables to work through in order to find out the best financial plan for your family. The book also includes a chapter on Teens and money, written especially for older children to read themselves.

Andrew Lendnal: author's other books

Who wrote Gold Start: Teaching Your Child about Money? Find out the surname, the name of the author of the book and a list of all author's works by series.