Published by Redleaf Press

10 Yorkton Court

St. Paul, MN 55117

www.redleafpress.org

2015 by Tom Copeland

All rights reserved. Unless otherwise noted on a specific page, no portion of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or capturing on any information storage and retrieval system, without permission in writing from the publisher, except by a reviewer, who may quote brief passages in a critical article or review to be printed in a magazine or newspaper, or electronically transmitted on radio, television, or the Internet.

Ninth edition 2015

Cover design by Jim Handrigan

Interior typeset in Times New Roman

Library of Congress Cataloging-in-Publication Data

Copeland, Tom, 1950-

Family child care record-keeping guide / Tom Copeland, JD. Ninth Edition.

pages cm (Redleaf business series)

Includes index.

Summary: This resource covers everything you need to keep accurate business records and save money on your taxes. If you pay close attention to the recommendations in this book, you will be able to claim the maximum allowable deductions and pay the lowest possible federal taxes Provided by publisher.

ISBN 978-1-60554-398-7 (e-book)

1. Family day careUnited StatesAccounting. 2. Family day careTaxationUnited StatesAccounting. I. Title.

HF5686.F28C67 2014

657.832dc23

2014012395

Disclaimer

Redleaf Press and the author are not engaged in rendering legal, accounting, or financial advice or any other professional services, and we are not responsible for the outcome of how the information in this book is interpreted or applied. If you require legal or expert tax assistance, obtain the services of a qualified professional.

This publication is designed to provide accurate information about federal tax record keeping for family child care providers. Despite our attempts to explain the tax laws thoroughly and in a simple manner, errors and omissions may occur in this text. Tax laws are in a constant state of change.

Contents

I t has been over four years since I wrote the eighth edition of this book. Since that time, Congress and the Internal Revenue Service (IRS) have made many changes to tax rules that affect family child care providers. There have been changes in depreciation rules, adjustments to food and mileage rates, and clarifications on how to calculate the Time-Space percentage. I have been involved in many IRS audits and have represented providers in several Tax Court cases over the past four years that have also clarified numerous rules.

Further necessitating this ninth edition, the IRS issued two significant new rules in 2013. One allows providers to deduct in one year items costing $500 or less, if they prepare a proper statement for their records at the beginning of each year (see .

Throughout this book I will make references to the IRS Child Care Provider Audit Technique Guide that was revised in 2009 (http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Child-Care-Provider-Audit-Technique-Guide). This publication helps IRS auditors better understand the issues that arise when auditing family child care providers. As with every edition of the Family Child Care Record-Keeping Guide, this book is specifically for those who care for children in their homes and get paid for it. Many child care providers pay more in federal taxes than necessary because they dont keep careful track of their expense deductionseither because they think its too much work or because they dont know what expenses are deductible. This book addresses both problems by explaining record keeping in a simple manner and by identifying more than one thousand tax deductions.

The information in this book applies to child care providers in every state, regardless of local regulations. If you pay close attention to the recommendations in this book, you will be able to claim the maximum allowable deductions and pay the lowest possible federal taxes. Please be aware that this book covers only federal tax rules; you should consult your state tax laws for additional regulations that may affect your business.

Keeping Up with the Changing Tax Laws

This edition of the Family Child Care Record-Keeping Guide is based on tax law as of January 31, 2014. Changing laws may eventually make some of the statements in this edition outdated. Visit my blog (www.tomcopelandblog.com) for announcements of all new tax changes that affect family child care providers and to see an extensive collection of materials on family child care record-keeping and tax issues My blog also contains a tax preparer directory and a schedule of the webinars and training workshops I conduct across the country.

For updates about IRS audits of family child care providers, my blog contains many articles, Tax Court cases, Revenue Rulings, and other IRS documents that can help you if you are audited (look for IRS Audits/Documents. All IRS resources cited in this book can be found on my blog.

Each January, Redleaf Press publishes an annual update of the Family Child Care Tax Workbook and Organizer. This book will help you prepare and file your own tax return. It contains the most current and comprehensive tax information, instructions for using specific forms, a special chapter on record-keeping tips, and a family child care tax organizer to make it easier to transfer your records and receipts to the tax forms.

Redleaf Press also publishes the Family Child Care Tax Companion annually. This book is for providers who use tax professionals to prepare their tax return. It contains a series of worksheets for you to fill out and give to your tax professional. It will help you and your tax professional avoid mistakes on your tax return. Visit the Redleaf Press Web site at www.redleafpress.org for more information about the Tax Companion and the Tax Workbook and Organizer.

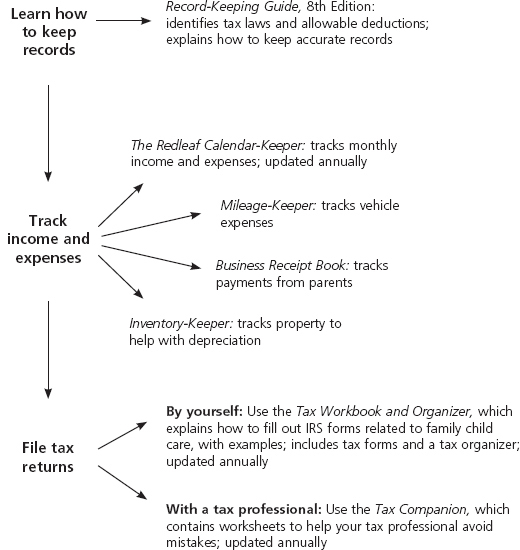

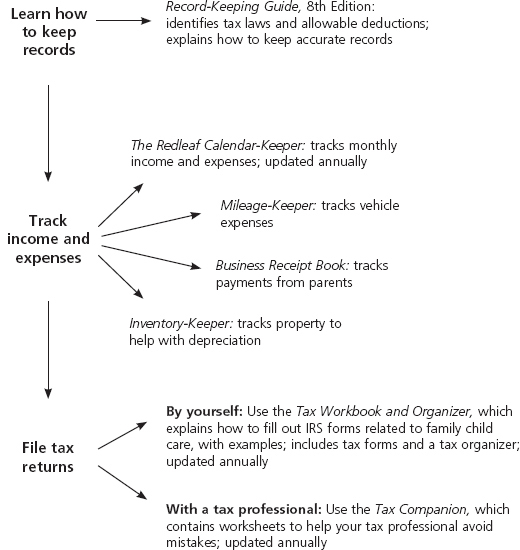

Record-Keeping Resources from Redleaf Press

The Family Child Care Record-Keeping Guide is most effective when it is used in combination with the other Redleaf Press publications that have been designed specifically for the business needs of family child care providers. Although all of these items may be purchased and used separately, together they offer the benefits of a complete, customizable record-keeping and tax preparation system. These business resources include the following publications:

The Family Child Care Tax Workbook and Organizer explains how to fill out your tax return each year. Use this book if you are doing your own taxes.

The Family Child Care Tax Companion is designed to help make your tax professionals job easier and to prevent errors on your return. Use this book if you hire a tax professional.

The Redleaf Calendar-Keeper contains monthly income and expense charts that enable you to conveniently organize your records. It also contains special charts to track your meals and snacks.

The Family Child Care Mileage-Keeper is a mileage log to help you track your vehicle expenses.

The Family Child Care Business Receipt Book contains a set of carbonless receipts to help you track individual parent payments.

The Family Child Care Inventory-Keeper is a depreciation log to help you track your business and household property.

The diagram that follows illustrates how you can use the publications in this series to keep your records and prepare your taxes. Visit www.redleafpress.org for additional information about books available from Redleaf Press.

Next page