Organizational Structures

Organizational structures are the minimum basic settings in Asset Accounting (FI-AA) needed to meet various business functions. They also determine how assets accounts are managed. They depict how business processes are broken into manageable units that allow the classifications and assignments of FI-AA components to other organizational units at a given point in time in the SAP system (e.g., cost centers, plants, etc.). The classification of assets plays a significant role, because it allows you to organize assets accounting based on defined accounting criteria (e.g., according to asset classes, depreciation methods, etc.).

Asset Accounting (FI-AA) is a component in SAP R/3 that serves as a subsidiary ledger to the Financial Accounting (FI) general ledger containing information that relates to fixed asset transactions posted in the system.

Specifying the Setting for Country-Specific Disclosure Requirements

Asset accounting disclosure requirements vary from country to country based on the accounting standards prevalent in a particular country. For example, the amount allowed for Low Value Assets (LVA) differs from country to country.

SAP comes with settings for most countries. Hence, you dont need to do anything here, but its smart to check the existing settings to make sure that they meet your requirements.

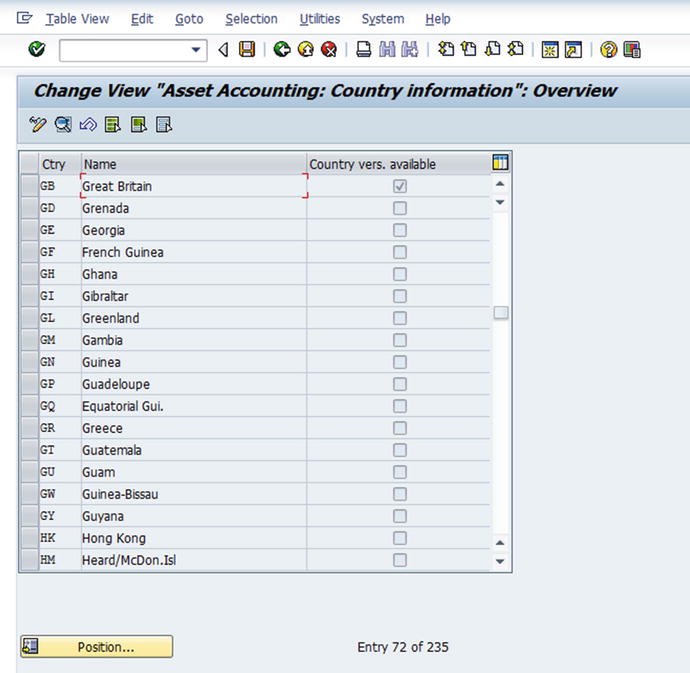

You check your country-specific settings from the Change View Asset Accounting: Country information: Overview screen (see Figure appears.

Figure 1-1.

List of country-specific settings supplied by SAP in the system for Asset Accounting

Defining Chart of Depreciation and Depreciation Areas

It is important to note that in SAP R/3 system all GL accounts are defined in the chart of accounts and Asset Accounting works with the chart of accounts assigned to the company code in FI. A chart of accounts dictates the structure of general ledger accounts and contains the list of G/L accounts used by a company code(s) for business processes and for posting daily financial transactions from which financial statements and balance sheet are drawn at any given time. A detailed discussion of the charts of accounts is outside the scope of this book. However, the chart of accounts is covered in the book entitled SAP ERP Financial Accounting and Controlling: Configuration and Use Management (Apress 2015), which can serve as a very good reference.

Chart of Depreciation

A chart of depreciation is a list of country-specific depreciation areas supplied by SAP to meet legal and business disclosure requirements for your company code. Depreciation areas are predefined settings for calculating different values in parallel for individual fixed assets to meet certain disclosure requirements.

SAP comes with a predefined sample chart of depreciation for most countries that you can use. The system also allows you to create your own chart of depreciation by copying existing chart of depreciation in the system and modifying them to meet your requirement. This will be discussed in detail in the Copying Reference Chart of Depreciation/Depreciation Areas section later in this chapter. The chart of deprecation is country specific. It means that chart of depreciation varies from country to country. Hence it is important to use the chart of depreciation that is applicable to your country. Like chart of accounts, each company code is only entitled to use one chart of deprecation. Just as it is possible for several company codes to use the same chart of accounts, more than one company code can use the same chart of depreciation simultaneously.

Depreciation Area

The depreciation area is defined in the chart of depreciation with two numeric digits. SAP ERP comes with predefined depreciation areas, which specifically meet each countrys accounting treatment and disclosure requirements. It is also possible for you to define your own depreciation area. Whether you want to use the chart of depreciation supplied by SAP or define your own chart of depreciation is a matter of choice. Once the depreciation key is defined and assigned to the asset master record, it is then possible to post values and depreciation to the assigned accounts.

The chart of depreciation contains different depreciation areas with depreciation keys such as 01- Book depreciation, 15-Tax Balance sheet, 20-Cost-accounting depreciation, 41-Investment support deducted from asset, etc. Depreciation key 01 is usually the leading depreciation area in SAP ERP. SAP ERP has the flexibility that allows you to display different depreciation areas with the same value and depreciation terms in different currencies. The system also allows different assets valuation to be carried out to meet different needs. For example, to produce financial statements to meet local requirements, for internal management reporting, financial statements according to IAS, US GAAP, etc.

Copying Reference Chart of Depreciation/Depreciation Areas

This is where you actually commence the customizing of your chart of depreciation. The chart of depreciation is nothing other than a list of depreciation areas that hold the appropriate parameters that enable you to conform to certain countries legal requirements on asset valuation. You can only define chart of depreciation by copying the country-specific reference charts of depreciation provided by SAP. When you copy the required predefined chart of deprecation for your company code country, the system copies all the depreciation areas in the reference chart of deprecation. Go through the depreciation area carefully and delete the unwanted depreciation areas.

The chart of depreciation you will define in this section will be assigned to your company code later in the Assigning the Chart of Depreciation to a Company Code section.

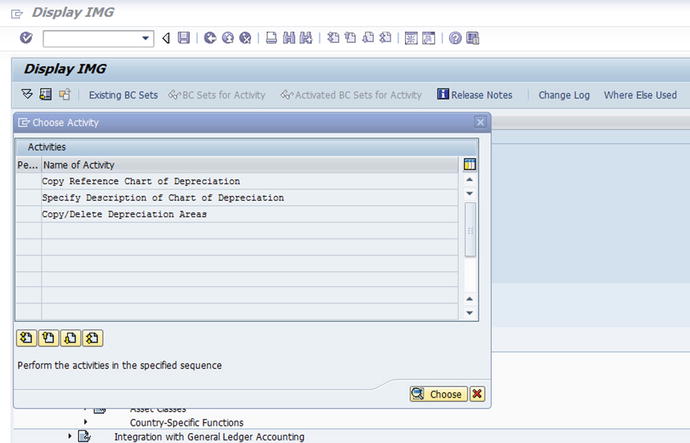

To get to the screen where you define a chart of depreciation, use this menu path: IMG: Financial Accounting (New) Asset Accounting Organizational Structures Copy Reference Chart of Depreciation/Deprecation Areas. The Choose Activity screen containing a list of options you can choose from is displayed in Figure .

Figure 1-2.

The initial screen where you commence defining the chart of depreciation

The screen gives you the sequence of activities you can perform. Select Copy Reference Chart of Depreciation from the list of activities options displayed on the screen (by clicking on it) and then click the

![Jane E. Kelly - Bookkeeping and Accounting All-in-One For Dummies [UK edition]](/uploads/posts/book/80164/thumbs/jane-e-kelly-bookkeeping-and-accounting.jpg)