Edmund L. Andrews

W. W. Norton & Company New York London

Copyright 2009 by Edmund L. Andrews

For information about permission to reproduce selections from this book, write to Permissions, W. W. Norton & Company, Inc.,

500 Fifth Avenue, New York, NY 10110

Andrews, Edmund L.

Busted: life inside the great mortgage meltdown / Edmund L. Andrews.

p. cm.

ISBN: 978-0-393-07128-3

1. MortgagesUnited States. 2. Subprime mortgage loansUnited States. 3. HousingUnited StatesFinance. 4. HousingPricesUnited States. I. Title.

HG2040.5.U5A753 2009

332.7'20973dc22

W. W. Norton & Company, Inc.

500 Fifth Avenue, New York, N.Y. 10110

www.wwnorton.com

W. W. Norton & Company Ltd.

Castle House, 75/76 Wells Street, London W1T 3QT

To Patty, for richer or poorer.

And to The House, which left me wiser if poorer.

Introduction

I f there is anybody who should have avoided the mortgage catastrophe, it is me. As an economics reporter for The New York Times, I have been the papers chief eyes and ears on the Federal Reserve for the past six years. I watched Alan Greenspan and his successor, Ben S. Bernanke, at close range. I wrote several early-warning stories in 2004 about the spike in go-go mortgages. Before that, I had a hand in covering the Asian financial crisis of 1997, the Russia meltdown in 1998, and the dot-com collapse in 2000. I had learned a lot about the curveballs that the economy can throw at us.

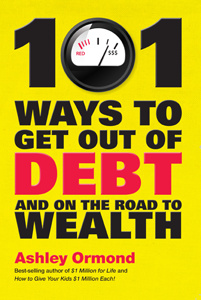

But in 2004, I joined millions of otherwise sane Americans in what we now know was a catastrophic binge on overpriced real estate and reckless mortgages. As I write in February 2009, I am four months past due on my mortgage and bracing for foreclosure proceedings to begin.

Nobody duped me, hypnotized me, or lulled me with drugs. Like so many othersborrowers, lenders, and the Wall Street deal makers behind themI thought I could beat the odds. Everybody had a reason for getting in trouble. The brokers and deal makers were scoring huge commissions. The condo flippers were aiming for quick profits. The ordinary home buyers wanted to own their first houses, or bigger houses, or vacation houses. Some were greedy, some were desperate, and some were deceived. Maybe some were like me: in love.

Whatever our individual stories, the consequences of this nationwide bender are apparent. Wall Streets most iconic firms have been decimated, and the commercial banking system is effectively bankrupt. Bear Stearns and Lehman Brothers are gone. Merrill Lynch is the ravaged subsidiary of Bank of America, which itself is on life support from the federal government. Citigroup is a zombie bank. American International Group, once the nations largest insurance company, is now an extremely expensive ward of the state.

Beyond the institutional wreckage, Americans are poorer than they were a few years ago. By the end of 2008, one out of eleven home mortgages was either delinquent or in foreclosure, according to the Mortgage Bankers Association. One out of every six homes was underwater, meaning that the mortgage amount was higher than the market value of the house. The number of families that had lost their homes to foreclosure had more than doubled since the housing bubble peaked, from just over 900,000 in 2006 to a new record of 2.2 million in 2008. As I write, analysts are predicting that at least 3 million homes will enter foreclosure in 2009 unless the government rescues them.

Between collapsing home prices and collapsing stock prices, the United States has lost about $12 trillion in wealth over the past two years. It is tempting to dismiss that figure as paper losses, but it amounts to a gigantic hole in the nations balance sheet that will take years to repair. Meanwhile, the United States has almost single-handedly tipped the rest of the global economy into its worst downturn in decades.

This book describes in gory detail how I got it wrong and the personal nightmare that followed, but its broader purpose is to explore how so many other people also went wrong. I know why I borrowed nearly a half-million dollars. The mystery is why so many people were so eager to lend it to menot once, but three times.

What were we thinking? How hard was it to understand the risks we were taking? Didnt we learn anything from the speculative bubble and bust of dot-com stocks in 2000?

I decided to explore that question by learning about the people who helped deliver the money to my doorthe mortgage brokers and real estate appraisers, the lenders and the Wall Street securitizers, the credit rating agencies who blessed the deals, and the institutional investors who paid top dollar for a piece of the action.

I became an expert on the exotic new tools of home finance: a rainbow of no-doc and low-doc loans; interest-only loans; piggyback loans; and option ARMS, known in various quarters as pick-a-payment loans and exploding ARMS. As I began to drown in debt, I learned that I could borrow even more money and boost my credit rating in the process. Through it all, banks and finance companies happily competed to keep my shell game going.

Misery doesnt love company, but I do take some pride that I outlasted two of my three mortgage lenders. One of them, a highflier in the subprime business, was shut down by federal regulators in early 2007. Its loans were so bad that it became a catalyst for the panic that kicked off the broader financial crisis in August 2007. Another of my lenders became one of the most immediate victims of that crisis, collapsing overnight in the first week of August and becoming the second biggest bankruptcy of 2007.

The Great American Mortgage Bust wasnt a freak event, like a midsummer snowstorm. It was the result of a trend toward higher debt and greater speculation that had been building for at least twenty-five years. We were taught to borrow more, buy more, save less, and take bigger risks. We learned new financial tricks, grew more confident, and constantly pushed the limits of what seemed acceptable. Creative financing, an early-1980s phrase that implied shady or stupid deals, was repackaged as financial innovation. Debt became high-tech, sophisticated, even cool. When the borrowing binge reached its inevitable climax, the fallout engulfed a huge share of the country.

I am not a victim, because I knew full well I was taking a huge gamble. My hunch is that a large share of the people who are now in trouble knew in their gut they were taking unreasonable risks too. Adults who buy homes have to take responsibility for their decisions.

That said, this crisis would not have been possible without breathtaking cynicism on the part of the brainiest people and biggest institutions in American finance. For all the baffling complexities at workcollateralized debt obligations, conduits, and computer-run risk modelsthis is a fairly simple story about how a lot of really smart people embraced and proselytized for a lot of inexcusable hogwash.

This crisis wasnt an accident. We didnt get unlucky, said David Einhorn, director of Greenlight Capital, a New York City hedge fund, in a speech in October 2007. This crisis came because there have been a lot of bad practices and bad ideas. Why should anyone be surprised? We got what we deserved. Amen. This was a democratic debacle that made fools out of people up and down the financial food chain. Yet it was worse than that. This was a debacle that stemmed from deep-seated rot and corroded ethics in our financial system.