Contents

First published in 2013 John Wiley & Sons Australia Ltd

42 McDougall Street, Milton Qld 4064

Office also in Melbourne

The moral rights of the author have been asserted

Fast Money: Conquer Your Mortgage Ashley Ormond 2013

Excerpts taken from 101 Ways to Get Out of Debt and on the Road to Wealth, first published 2009 by Wrightbooks, an imprint of John Wiley & Sons Australia, Ltd

National Library of Australia Cataloguing-in-Publication entry:

Author: Ormond, Ashley.

Title: Conquer your mortgage [electronic resource] / Ashley Ormond.

ISBN: 9781118612996 (ebook)

9781118612989 (ebook: Kindle)

Series: Fast money.

Subjects: Mortgage loansAustralia

Finance, PersonalAustralia.

Dewey number: 332.7220994

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair dealing for the purposes of study, research, criticism or review), no part of this book may be reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means without prior written permission. All enquiries should be made to the publisher at the address above.

Disclaimer: The material in this publication is of the nature of general comment only, and does not represent professional advice. It is not intended to provide specific guidance for particular circumstances and it should not be relied on as the basis for any decision to take action or not take action on any matter which it covers. Readers should obtain professional advice where appropriate, before making any such decision. To the maximum extent permitted by law, the author and publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based on the information in this publication.

About the author

Ashley Ormond was one of Australias first PC-equipped mobile lenders, starting out in the early 1980s with a financial calculator, a dual-floppy drive Compaq portable PC and a portable Epson thermal printer in his car. This was before the age of mobile phones, the internet, Windows, Excel, or even hard drives. It was back in the days when:

- lenders actually analysed each borrowers ability to repay

- borrowers actually had to have a job or other source of income

- borrowers actually had to have proof of a savings record, proof of income, proof of assets

- lenders had to actually think about how each debt would be repaid, instead of just shovelling money out the door

- lenders actually retained the credit risk and retained the ownership of loans, instead of just selling them to unsuspecting bond-holders on the other side of the world.

His banking and finance career included several senior executive roles at major Australian and international banking and finance groups, including running branch networks, lending operations, product development, pricing and financial control. His formal qualifications include a Bachelor and Masters in Law, a Bachelor of Arts in Economic History and a Graduate Diploma in Applied Finance and Investment. He has also lectured for the Securities Institute of Australia. Since retiring at 40, he has been a director of several companies, including listed, private and not-for-profit companies and a charitable foundation.

Ashley is the principal of Investing 101 Pty Ltd, a specialist investment research firm that holds an Australian Financial Services Licence. He is a sought-after speaker and commentator on financial markets and has written two best-selling books on finance: How to Give Your Kids $1 Million Each! and $1 Million for Life.

Ashley lives in Sydney with his wife and two children. He may be contacted at . Visit his website for access to newsletters, updates and other useful articles: < www.investing101.com.au >.

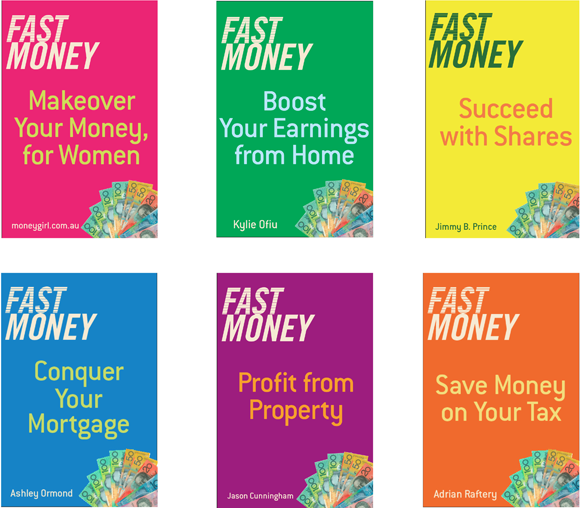

More Fast Money e-books

For more insights from our experts in personal finance, download the other titles in our Fast Money e-book series or go to wiley.com and search for Fast Money .

If you enjoyed this sample, read the full-length book

101 Ways to Get out of Debt and On the Road to Wealth

by Ashley Ormond

Buy the print or e-book here: www.wiley.com/buy/9781742169361

101 Ways to Get Out Of Debt and On the Road to Wealth is the ultimate handbook for anybody who wants to get out of debt and stay out of debt. This book will provide you with an insiders knowledge of how to beat the lenders at their own game. Inside you will find 101 practical and proven methods that anybody can use to master their debt. Best-selling author Ashley Ormond shows you how to conquer all types of debt, including mortgages, credit cards, car loans, personal loans, investment loans and small business loans.

Buy the print or e-book here: www.wiley.com/buy/9781742169361

Introduction

A home mortgage is the largest debt you will be likely to take on in your life, and it is usually the debt that lasts the longest. A home mortgage is a necessary evil because it is usually the only way to buy a first home. From there the aim should be to get rid of it as quickly as possible, so you can get on with building real wealth.

Every dollar you spend on mortgage payments is two dollars you could be investing instead to build wealth for the future, thanks to the numerous tax breaks you get for investing.

Although a mortgage might start out at several hundred thousand dollars over 25 or 30 years, there are dozens of ways that can help you pay it off much sooner.

Chapter 1

Do the numbers

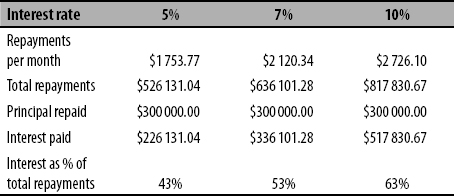

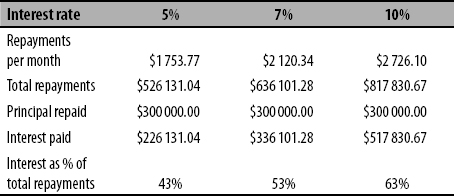

Most of your repayments go towards paying interest to the lender, and in most cases less than half of your total repayments actually go towards paying back the amount borrowed (the loan principal). For example, if you borrow $300 000 over 25 years at 7 per cent, you end up paying back a total of $636 101 (not counting fees and other charges), which is more than double the amount you borrowed in the first place.

shows the situation for loans at interest rates of 5 per cent, 7 per cent and 10 per cent when $300 000 is borrowed over 25 years.

: mortgage repayments for different interest rates when $300 000 is borrowed over 25 years

The next important factor is that the loan balance reduces very slowly at the start of the loan, because in the early years the majority of each repayment goes towards paying interest to the lender and only a very small part actually reduces your principal balance. The higher the interest rate, the greater proportion of each payment goes in interest and the slower the balance reduces over time. This can be seen in .

: mortgage balance reduction at different interest rates