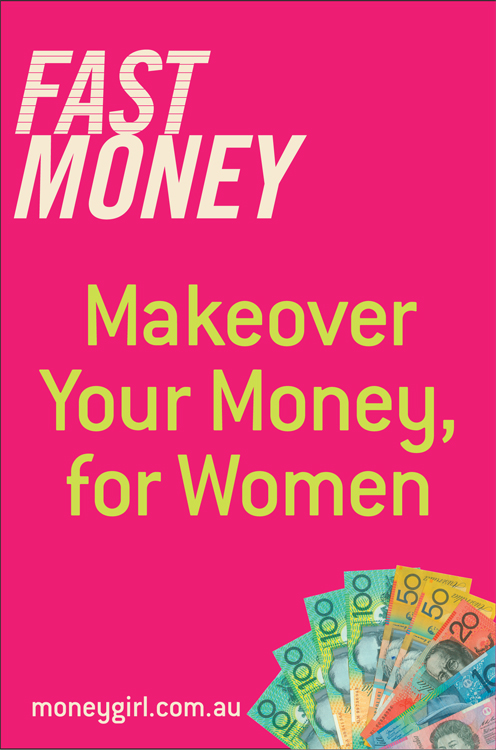

First published in 2013 John Wiley & Sons Australia Ltd

42 McDougall Street, Milton Qld 4064

Office also in Melbourne

The moral rights of the authors have been asserted

Fast Money: Makeover Your Money, for Women Nina Dubecki and Vanessa Rowsthorn 2013

Excerpts taken from Money Makeover , first published 2010 by Wrightbooks, an imprint of John Wiley & Sons Australia, Ltd

National Library of Australia Cataloguing-in-Publication data:

Author: Dubecki, Nina.

Title: Makeover your money, for women [electronic resource] / Nina Dubecki.

ISBN: 9781118613078 (ebook)

9781118613085 (ebook: Kindle)

Series: Fast money.

Subjects: Budgets, personal.

Finance, personal.

Saving and investment.

Other Authors/Contributors: Rowsthorn, Vanessa.

Dewey Number: 332.02401

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair dealing for the purposes of study, research, criticism or review), no part of this book may be reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means without prior written permission. All enquiries should be made to the publisher at the address above.

Disclaimer: The material in this publication is of the nature of general comment only, and does not represent professional advice. It is not intended to provide specific guidance for particular circumstances and it should not be relied on as the basis for any decision to take action or not take action on any matter which it covers. Readers should obtain professional advice where appropriate, before making any such decision. To the maximum extent permitted by law, the authors and publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based on the information in this publication.

Introduction

So heres where your money makeover starts.

Before you do anything else, youll need to get your current financial situation sorted out you cant become a successful investor until you have a true picture of where you stand financially and a good understanding of where you want to go.

Well cover everything youll need to know in order to put yourself in the best position possible to start investing. And while things like setting goals and putting together a savings plan can sound all too much like hard work, you should never underestimate how important they are in swinging financial fortune in your favour.

In the next four chapters you will:

$ work out what money means to you

$ learn about good and bad debt (and how to get rid of the bad)

$ pick up some budgeting tips

$ uncover a couple of nifty techniques to help you save more than you ever thought possible

$ learn the fundamentals of becoming an investor.

Go forth and conquer!

Chapter 1: Setting your goals

There once was a girl called Sheree

Who dreamt of sailing the sea

She wrote a great plan

Worked hard as one can

And now sails her yacht off Fiji.

Ah, money. We have such a complex relationship with it. On the one hand weve grown up being taught that money makes the world go round; and yet on the other hand, were taught that money isnt everything . Confused, anyone?

Before you can jump on the path to financial success, you need to look at the way you think about money and get rid of any preconceived ideas and bad money habits that might be holding you back. Like it or not, money affects every aspect of your life from where you live to how you live, so its vital that youre the one calling the shots in your relationship, not the other way around.

You also need to stop for a moment and decide on your financial goals. Life whizzes by so fast that if you dont pause to give serious thought as to what you want to achieve financially (and why), future decisions may get made on the run without taking into account whats really important to you.

T hen, as with any good makeover, you need to commit yourself to taking action. As they say, theres no time like the present so giddy-up! In this chapter well cover:

$ your relationship with money: taking a look at yourself in the mirror

$ money myths: 10 thoughts to banish forever

$ setting goals: working out what you want to achieve

$ taking ownership: committing to making it happen.

Your relationship with money: taking a look at yourself in the mirror

As trusty old Dr Phil will tell you, you cant move forward until you have addressed the past. The same goes for your relationship with money. Over the years youve probably collected baggage that you might not even know you have.

Often the way people behave with money is not built on reason, but on emotion. For example, splashing out on an expensive dress can be more about getting swept up in the adrenaline of a shoppers high (or perhaps caught in the grips of a very persuasive salesperson) than anything else. How you think about money can also be related to what youve been taught (or not been taught) growing up. Your familys attitude towards money can have a huge influence on the way you behave. If you grew up hearing that the only chance youll ever have of becoming wealthy is by making it as a high-flying lawyer or a doctor, why would you think otherwise?

Ninas story (age 39)

It was completely by accident that I became interested in investing. In fact, until my mid-20s Id thought my only chance of becoming wealthy would be to marry someone rich or to win Tattslotto. These were notions my parents had unconsciously instilled in me, but not through any fault of their own its just that no-one had ever taught them about money, either.

About 12 years ago, I was in the city one Saturday afternoon when it started to rain, so I ran into a bookshop to escape. Walking down the aisles a book called The Wealthy Barber caught my eye and I picked it up and started to flick through. Id never read a book about money before, but this one sounded interesting and seemed accessible so I paid for it and left. Reading it later that night was a revelation. For the first time in my life, I realised that I wouldnt ever have to worry about money again if I took a few simple steps. I understood that my financial future was firmly in my hands.

Luckily, I didnt have any credit card debt that was one thing my parents had taught me about money: to always pay my credit card balance off in full every month. So the first thing I did was to open a managed fund with $2000, after which I committed to monthly direct debits of $200 straight out of my bank account. In the space of three years, the balance had grown to around $20 000. Id also saved enough for a deposit on a little apartment in the inner city. It was the start of my life as an investor.

Its time to air your dirty laundry

Do you have any long-held notions about money that arent doing you any favours? Have a good think about your attitude towards money. For example, do you think youre just not one of the lucky ones and that youll never be well off? Or are you waiting for that big pay rise or Tattslotto windfall to head your way before you start investing? Consider the way you behave with money and look at your habits closely try to be as honest as you can. By understanding your attitude towards money and committing to changing those beliefs and behaviours youre taking your first step towards financial success.

Examples of bad habits

Just like biting your nails, there are plenty of bad money habits that hold women back when it comes to taking control of their finances. Do any of these sound a little too familiar?