Thanks to my heavenly Father, who never gives me a responsibility without giving me the ability to respond.

Thanks to all the women who shared their financial experiences, fears, and aspirations with me. Your participation has added value to other women in ways you will never know.

Thanks to my Harvest House team for their patience with all my life circumstances that threatened the completion of the manuscript. Your care, concern, and commitment to the Word put you in a special class of publishers.

Thanks to my research assistant, Cynthia Tucker, for her diligence in researching many aspects of the book. Also, the informal critiques from numerous personal and social media friends were a real godsend. Im grateful to you all.

Thanks to my incredible husband, Darnell Pegues, for his efforts to help me stay focused on writing while also providing for times of rest and refreshment from the process.

Thanks to my friends who maintained our relationship despite the fact that I never seemed to be available during this extended project. I appreciate all of you and promise to make it up to you.

Thanks to my intercessory prayer warriors for the doing the real work that brought this project to fruition. You know who you are and, most importantly, God knows and will reward you according to your kindness.

1. In obedience to God, I faithfully pay my tithes, give offerings, and help those in need.

2. I take full responsibility for where I stand financially.

3. I forgive and release all who have ever financially disadvantaged me in any way.

4. I do not allow my net worth to define my self-worth.

5. I refuse to enable irresponsible people to continue their negative financial behavior.

6. I walk in integrity in all my financial dealings.

7. I maintain a healthy balance between saving for the future and enjoying my blessings today.

8. I reject a scarcity mentality and choose to help others achieve their goals by sharing my knowledge, experiences, contacts, and other resources.

9. I continually seek to increase my knowledge of financial concepts and strategies.

10. I look to God as my Supreme Financial Adviser and the Supplier of all of my needs.

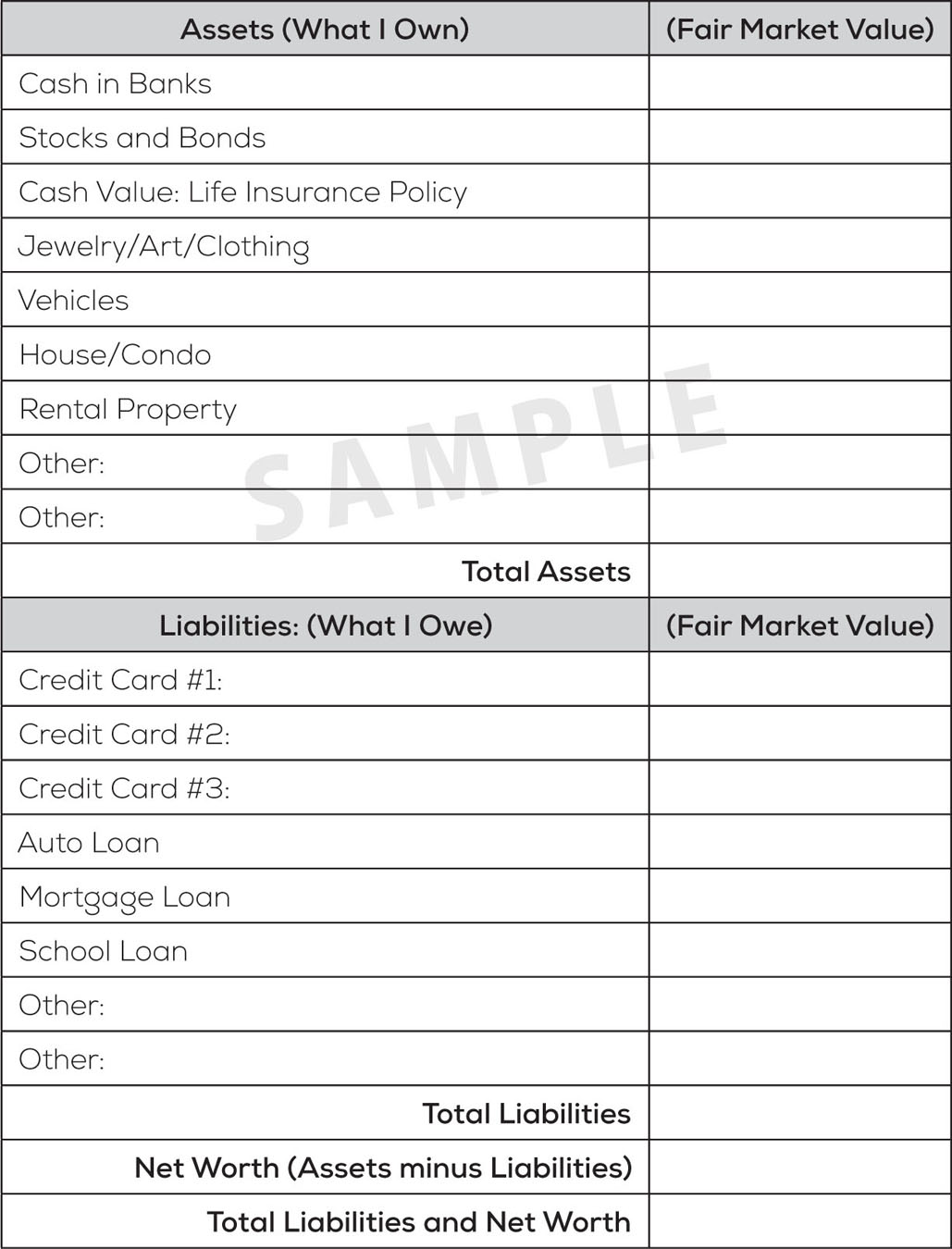

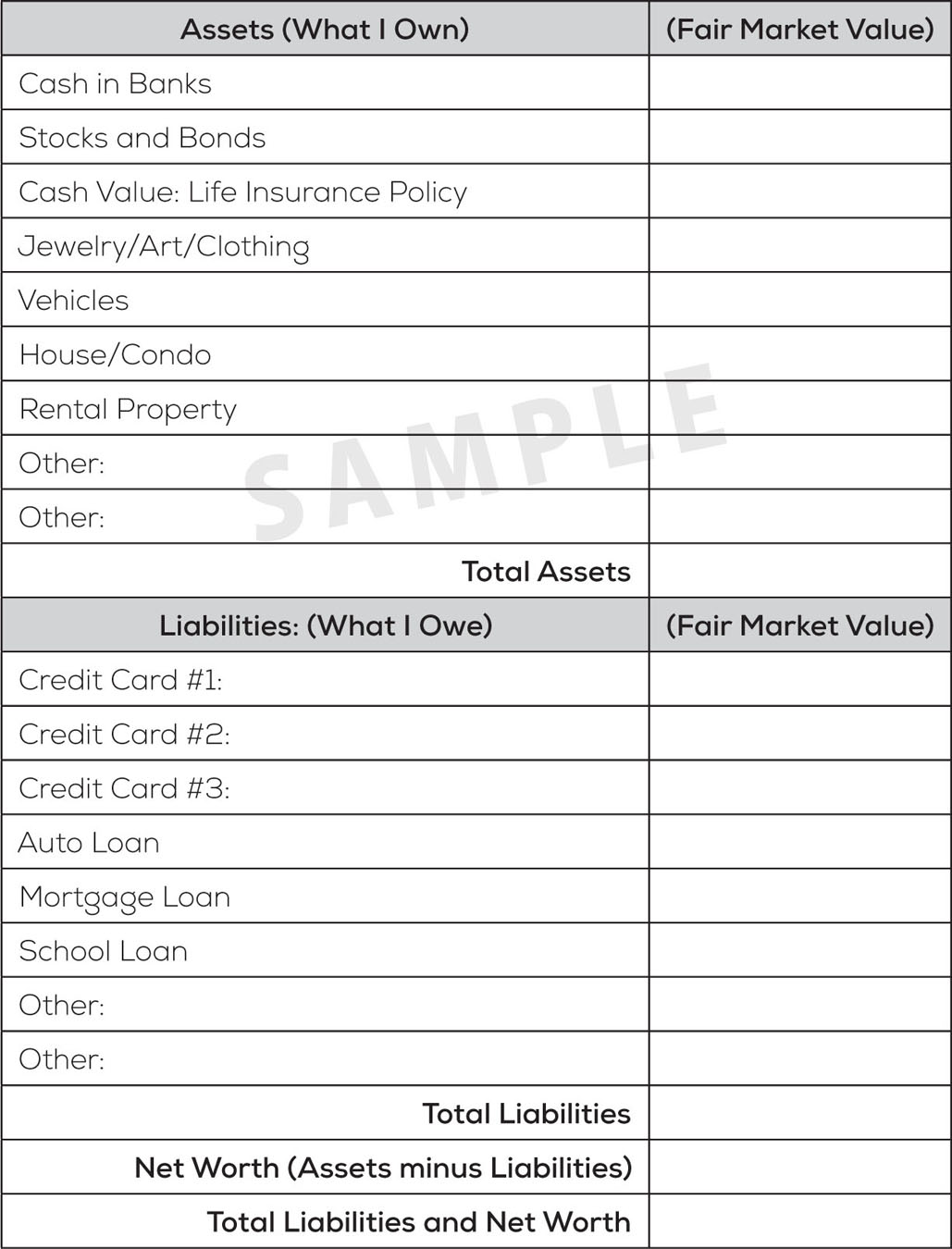

What I Own and What I Owe as of

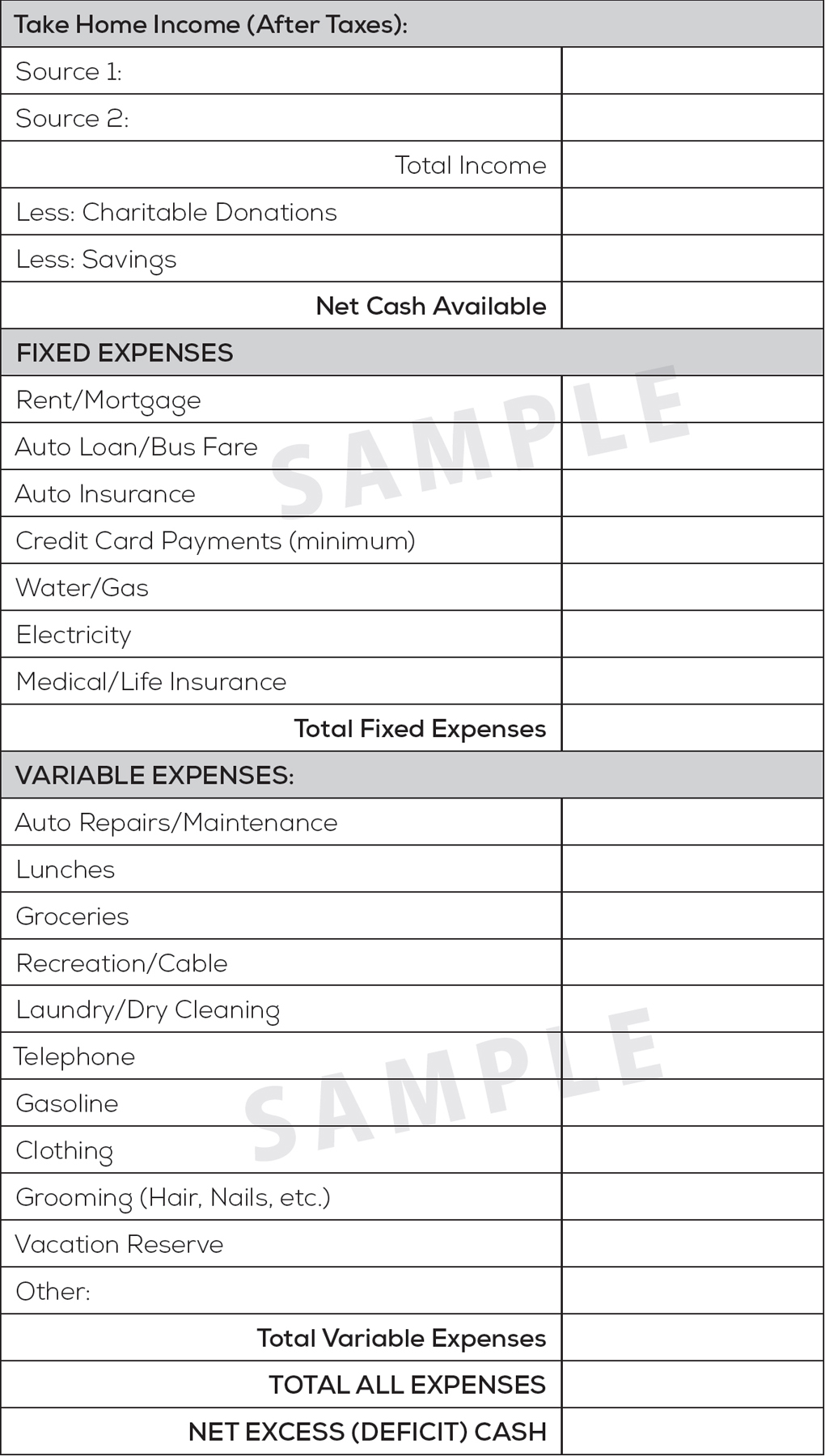

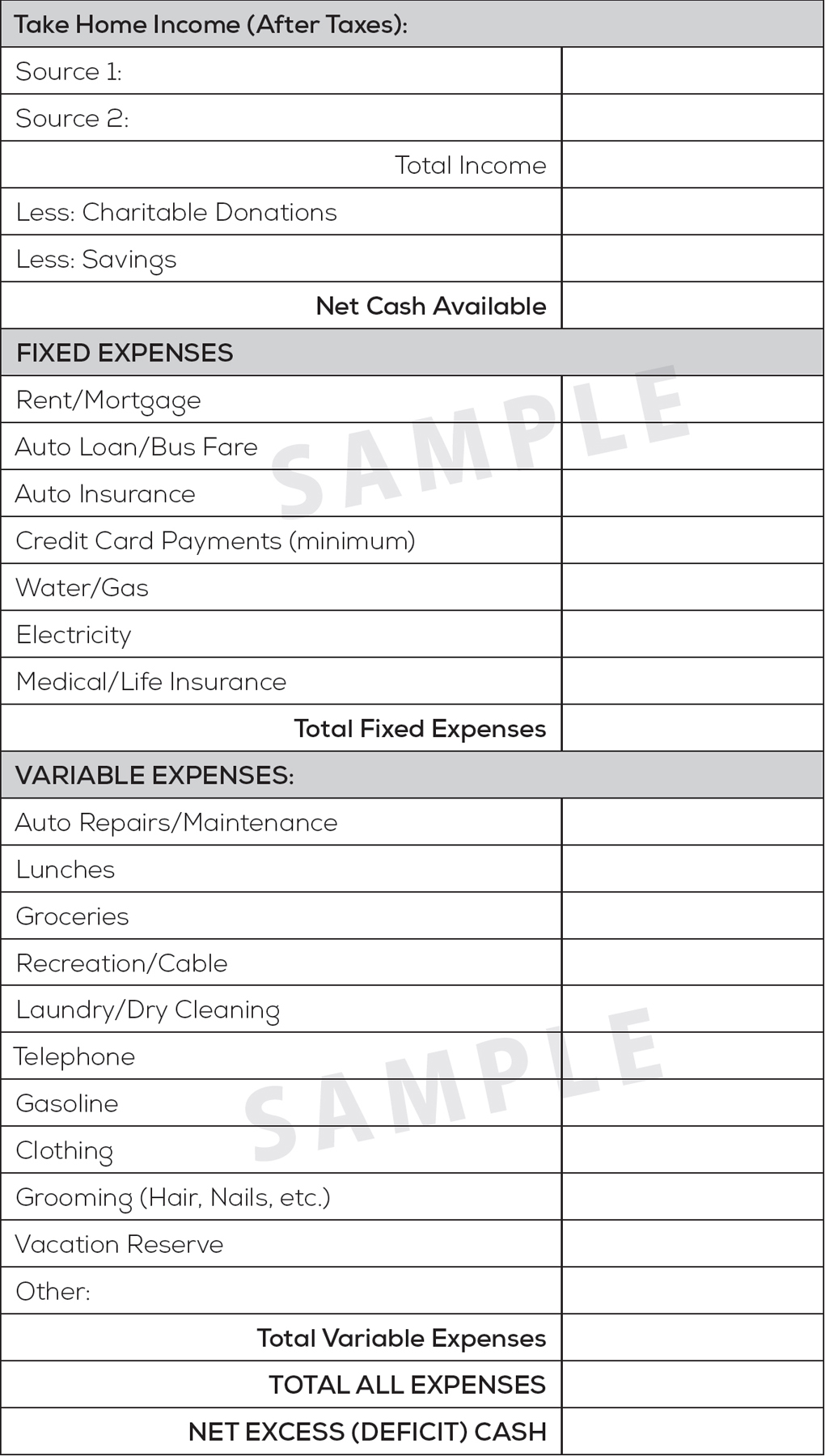

What I Get and Where It Goes

Top personal finance sites (timely articles, how-tos): www.bankrate.com , CNNmoney.com , MoneyCentral.msn.com

Free copy of your credit report (annually) from the three reporting agenciesEquifax, Experian, and TransUnion (does not include your FICO score; see below): http://www.annualcreditreport.com/

Copy of your FICO credit score (not free): www.MyFico.com .

Advice about a variety of credit card issues from top experts: https://www.creditcards.com

Life insurance calculator (determine how much coverage you need): http://money.msn.com/life-insurance/life-insurance-quotes.aspx, http://www.insure.com/articles/interactivetools/lifeneedsestimator/calculate.jsp

Life insurance quotes: www.selectquote.com , www.zanderinsurance.co m

Quicken WillMaker Plus (software for preparing wills): http://www.nolo.com/products/quicken-willmaker-plus-wqp.html

Living trust templates (for wills, trusts, power of attorney, advance directives, etc.): https://store.nolo.com/products/online-living-trust-nntrus.html , www.suzeormanwillandtrust.com

Copy of your personal Social Security statement: http://www.ssa.gov/myaccount

Funding your childs education: www.SavingForCollege.com

Investing 101: A Tutorial for Beginner Investors: https://www.investopedia.com/university/beginner/

Trustworthy, established discount brokerage houses for purchasing stocks and bonds: Vanguard.com , Fidelity.com , Schwab.com

Guide to finding fee-based financial advisors: Napfa.org , GarrettPlanningNetwork.com

Financial calculators (various financial calculators for auto loans, mortgages, student loans, investments, income taxes, and other): http://www.financialcalculator.org

Guideline and tips for buying and selling cars: https://www.edmunds.com/

Options and alternatives for repaying federal student loans: http://studentaid.ed.gov/repay-loans

How to Review Your New Car Sales Contract: https://www.edmunds.com/car-buying/how-to-review-your-new-car-sales-contract.html

Deborah Smith Pegues is a CPA/MBA, TV host, certified John Maxwell Leadership Coach, certified behavior consultant, Bible teacher, and global speaker. She has written 16 transformational books, including the bestselling 30 Days to Taming Your Tongue (over one million sold) and Emergency Prayers . She and her husband, Darnell, have been married since 1979 and reside in Southern California.

To contact the author:

E-mail: Deborah@ConfrontingIssues.com

Website: www.ConfrontingIssues.com

(323) 293-5861

Money Mentoring Moment

Your core beliefs about finances will dictate how you earn, spend, save, and share your resources.

Your standing today is a reflection of those beliefs.

W hen I was growing up, people would often knock on our door, sometimes late into the night, asking my father for a small ($25 to $200) emergency loan. On the surface, he was an unlikely lender. He was not a man of great means, nor did he work at a high-paying job. In fact, as a sawmill foreman, he made just over the minimum wage.

His secret was that he knew how to budget and save his money. He managed well and faithfully provided for a household of nine. He found creative ways to make extra money when bad weather caused the sawmill to be shut down from time to time. He also recognized an opportunity to profit from people whom he described as those whose yearnings exceeded their earnings. He kept a stash of cash ready for their emergency requests. He didnt lend to everyone who asked, but from those he did, he always required a promissory note with an unusually high interest amount. Note that I said amount versus a rate. You see, he would just state, rather than compute, an amount he felt he should charge. He also required some form of collateral, such as jewelry or the title to a vehicle. The people who failed to repay the loan never got another opportunity to borrow again. He would ultimately sell their collateral, so he did not lose either way. When he died at age 78, he had a large portfolio of outstanding loans. As the executor of his estate, I forgave most of them. I figured the borrowers deserved a break for the exorbitant interest. Notwithstanding, several of them told me that he was a financial refuge for them and many others with poor credit and no other borrowing options.

My mother helped others in a different way. She was very charitablealmost to a fault. She rarely saw a need she didnt try to meet. For instance, the father of a family who lived near us earned a good incomemuch more than my dadbut the man was financially irresponsible. Therefore, his family always lacked lifes necessities. My mother would regularly give our clothes to his kidswithout consulting us. One of his daughters and I were in the same class, and we wore the same size. It was not unusual to meet her at school wearing one of my best dresses. Mom said that she just couldnt stand seeing kids look pitiful like that. Although she didnt have access to much money, she found favor with a couple of retail stores who extended her a charge account. She occasionally allowed friends and relatives to use her credit. She got burned a few times when they failed to pay their charges. I wish I could say that she finally learned her lesson, but she didnt. Even at her death at age 82, several people still owed her money.

Next page