Contents

Guide

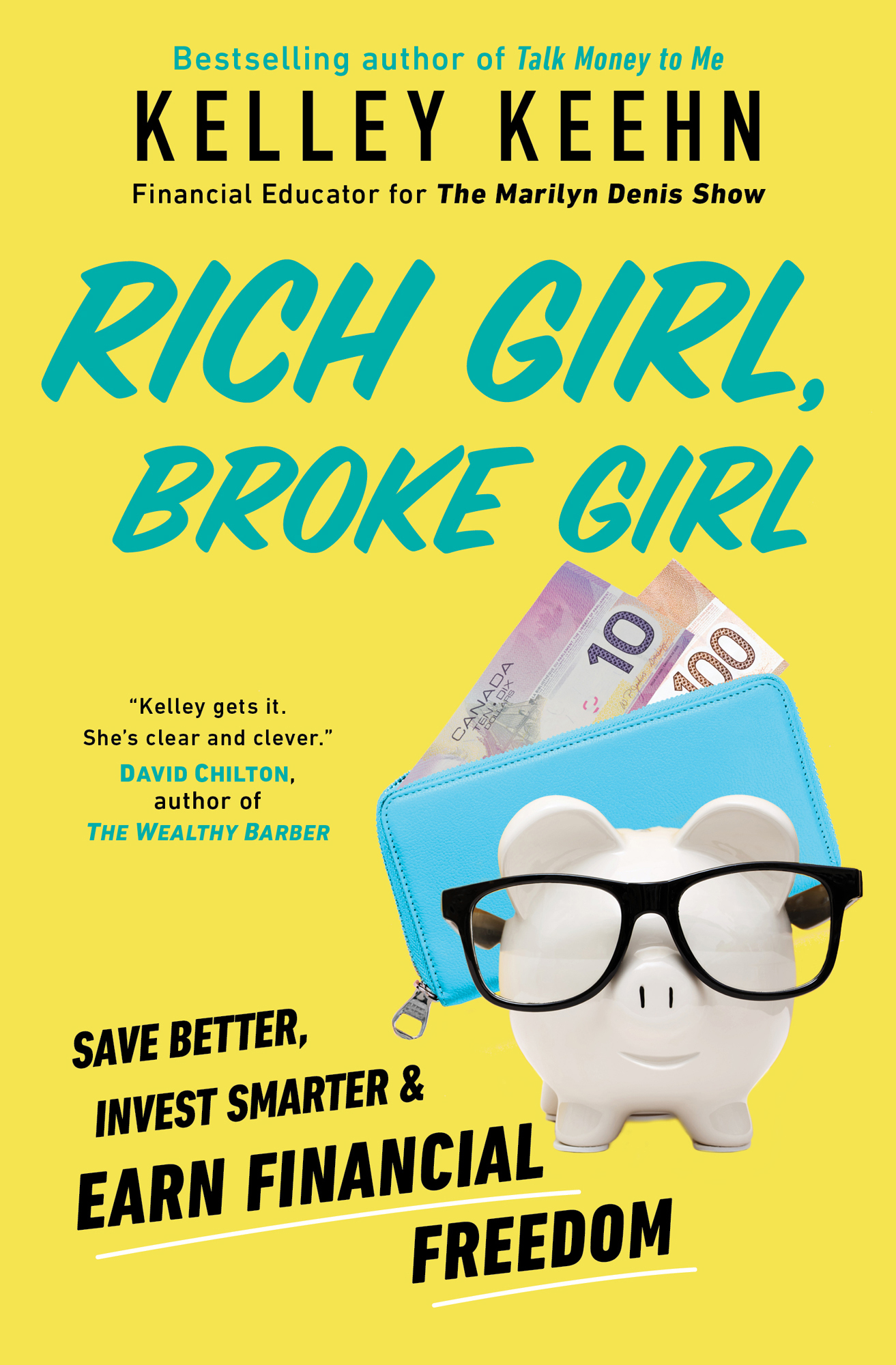

Bestselling author of Talk Money to Me

Kelley Keehn

Financial Educator for The Marilyn Denis Show

Kelley gets it. Shes clear and clever. David Chilton, author of The Wealthy Barber

Save Better, Invest Smarter & Earn Financial Freedom

ALSO BY KELLEY KEEHN

Talk Money to Me

Protecting You and Your Money

A Canadians Guide to Money-Smart Living

The Money Book for Everyone Else

She Inc.

The Prosperity Factor for Kids

The Womans Guide to Money

The Prosperity Factor for Women

Simon & Schuster Canada

A Division of Simon & Schuster, Inc.

166 King Street East, Suite 300

Toronto, Ontario M5A 1J3

www.SimonandSchuster.ca

Copyright 2021 by Kelley Keehn

This publication contains the opinions and ideas of its author. It is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, tax, investment, insurance, financial, accounting, or other professional advice or services. If the reader requires such advice or services, a competent professional should be consulted. Relevant laws vary from province to province. The strategies outlined in this book may not be suitable for every individual, and are not guaranteed or warranted to produce any particular results.

No warranty is made with respect to the accuracy or completeness of the information contained herein, and both the author and the publisher specifically disclaim any responsibility for any liability, loss or risk, personal or otherwise, which is incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this book.

The consumer proposal cost chart has been reprinted with the permission of Hoyes, Michalos & Associates Inc. Licensed Insolvency Trustees. The City Car graphics have been reprinted with permission of Envato and were created by vintagio. The Finance & Economy Infographic for PowerPoint graphics have been reprinted with permission of Envato.

The investment calculations were determined by using Calculator.nets financial investment calculator. The credit card payment calculations were determined by using Bankrate.coms credit card payoff calculator. The line of credit payment calculations were determined by using TD.coms personal loan and line of credit payment calculator.

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever. For information address Simon & Schuster Canada Subsidiary Rights Department, 166 King Street East, Suite 300, Toronto, Ontario, M5A 1J3.

This Simon & Schuster Canada edition December 2021

SIMON & SCHUSTER CANADA and colophon are trademarks of Simon & Schuster, Inc.

For information about special discounts for bulk purchases, please contact Simon & Schuster Special Sales at 1-800-268-3216 or .

Interior book design by Joy OMeara

Cover images: Melpomenem / Getty (Piggy Bank), Kenneth-Cheung / Getty ($10 Bill), Wdragon / Getty ($100 Bill), All For You Friend / Shutterstock (Wallet)

Library and Archives Canada Cataloguing in Publication

Title: Rich girl, broke girl : save better, invest smarter, and earn financial freedom / Kelley Keehn.

Names: Keehn, Kelley, 1975 author.

Identifiers: Canadiana (print) 20210215976 | Canadiana (ebook) 20210216034 | ISBN 9781982160517 (softcover) | ISBN 9781982160524 (ebook)

Subjects: LCSH: WomenFinance, Personal.

Classification: LCC HG179 .K4284 2021 | DDC 332.0240082dc23

ISBN 978-1-9821-6051-7

ISBN 978-1-9821-6052-4 (ebook)

To Kathy and Wyatt

Authors Note

While all of the stories and anecdotes described herein are based on true experiences, the names, situations, and some details have been altered to protect individual privacy. Neither the author nor the publisher is engaged in rendering legal, accounting, financial, or other professional services by publishing this book. As a precaution, each individual situation should be addressed with an appropriate professional to ensure adequate evaluation and planning are applied. The author and publisher specifically disclaim any liability, loss, or risk that may be incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this work. The material in this book is intended as a general source of information only and should not be construed as offering specific tax, legal, financial, or investment advice. Every effort has been made to ensure that the material is correct at the time of publication.

Interest rates, market conditions, tax rulings, and other investment factors are subject to rapid change. Individuals should consult with their personal tax advisor, Chartered Professional Accountant, Certified Financial Planner, Chartered Financial Analyst, or legal professional before taking any action based upon the information contained in this book.

Introduction

W ere you ever told that, as a woman, you could financially achieve anything, dream as big as any man, accomplish anything you set your mind to? And when you tried and didnt succeed right out of the gate, what happened then? If youre anything like me (and countless other women), you were warned not to mess up again. You might have even been blamed for trying. Maybe you were told that money isnt your strong suit and that you should probably leave finances to someone else in your life. Perhaps people laughed and told you to marry rich, to count on others not only to bring in the purse but to control the strings for you, too.

Been there, heard that before. Many women have. And thats not to say that women havent come far. Just think of your grandmother or great-grandmother. Could she vote? Could she own property? Did she have her own bank account?

We have come a long way, and thats true in a financial sense, too. Today, women are more powerful and wealthy than ever before. Women hold 40 percent of global wealth. That number is expected to increase to nearly $22 trillion over the next forty years.

Ladies: that triumphant news is worth a tip of the hat. But we still have so far to go. Believe it or not, younger generations are taking less charge of their finances than previous oneseven when the ladies are the primary breadwinners in their households! Fifty-six percent of women defer to a spouse on investments. Eighty-five percent of women who defer financial decisions to their husbands believe their spouses know more about money matters than they do. Often, this is grossly untrue!

Fear holds us back, and ignorance, too. Heres the hard truth: youre not truly free in life until you achieve financial equality and financial literacy. Even if you rely on a spouse for support, it doesnt mean you cant or shouldnt understand finances and your money situation. Oh, and like I said before, young ladies, Im looking at you. Why? Because 61 percent of millennial women are deferring to a spouse on financial matters.

Old misconceptions and traditions die hard. Ive heard the excuses from women of every generation:

Im not good with money.

I dont get math.

I dont have time.

Whats the point?