Thank you for purchasing this Simon & Schuster eBook.

Sign up for our newsletter and receive special offers, access to bonus content, and info on the latest new releases and other great eBooks from Touchstone Books.

or visit us online to sign up at

eBookNews.SimonandSchuster.com

| Touchstone

A Division of Simon & Schuster, Inc.

1230 Avenue of the Americas

New York, NY 10020

www.simonandschuster.com. |

This work is a memoir. Events, actions, experiences and their consequences have been retold as the author presently recollects them. Some names and identifying characteristics have been changed, and some dialogue has been recreated from memory.

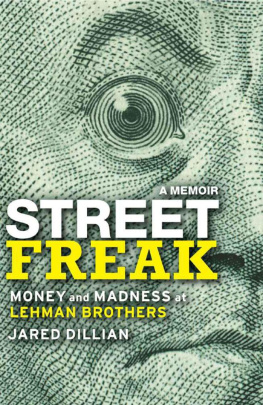

Copyright 2011 by Jared Dillian

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever. For information address Touchstone Subsidiary Rights Department, 1230 Avenue of the Americas, New York, NY 10020.

First Touchstone hardcover edition September 2011

TOUCHSTONE and colophon are registered trademarks of Simon & Schuster, Inc.

The Simon & Schuster Speakers Bureau can bring authors to your live event. For more information or to book an event, contact the Simon & Schuster Speakers Bureau at 1-866-248-3049 or visit our website at www.simonspeakers.com .

Designed by Renata Di Biase

Manufactured in the United States of America

10 9 8 7 6 5 4 3 2 1

Library of Congress Cataloging-in-Publication Data

Dillian, Jared.

Street freak : money and madness at Lehman Brothers / Jared Dillian.

p. cm.

1. Stock exchangesUnited States. 2. Financial crisesUnited States. 3. Global

Financial Crisis, 20082009. 4. Lehman Brothers. I. Title.

HG4910.D535 2011

332.620973dc22 2011011938

ISBN 978-1-4391-8126-3

ISBN 978-1-4391-8128-7 (ebook)

CONTENTS

PROLOGUE | PORTRAIT OF A TRADER

October 2, 2007

| SPARTACUS

October 2, 2007

| DRIVE

September 11, 2001

| VICE ASSHOLE

Fall 2001

| FOUND MONEY

Winter 2002

| JAY KNIGHT

Winter 2002Spring 2002

| PRIMATE OF THE YEAR

Summer 2002Fall 2002

| DARK

Fall 2002Winter 2003

| T+1

Winter 2003Summer 2004

| AGGRESSIVE

Summer 2004Fall 2004

| THANKYOUDRIVETHRU

Fall 2004Winter 2005

| PIKER

Spring 2005Fall 2005

| EVERYTHING IS NOT GOING TO BE OK

Winter 2006

| I REMEMBER

Winter 2006

| TOP TICK

Spring 2006Winter 2007

| GRACE

Spring 2007Winter 2008

| BAD TRADER

Winter 2007Summer 2008

| THOSE BASTARDS

Summer 2008Fall 2008

STREET

FREAK

PROLOGUE

Portrait of a Trader | October 2, 2007

Back in 1999, when the world was brimming with optimism, when there were purple Yahoo! taxicabs patrolling the streets of San Francisco, I was a clerk on the options trading floor of the Pacific Coast Options Exchange. It was there that I learned how the financial markets worked. I spent much of my time standing in the back of the Intel-Oracle pit with the other clerks and stock jockeys; that is, the area where traders in Intel and Oracle options congregated.

There was a trader in the pit named Jack Taylor. Jack was six four, 240 pounds, with no concept of personal space. He spent half his day in a personal fast market, almost as though he was on crack, trading everything in sight: BUY YOUR BOOK, JAN 30 CALLS, 20 LOT! SELL YOUR BOOK, DEC 25 PUTS! SAGEOLA! SAGEAROONI! He was all arms and legs, thrashing his crumpled-up risk reports, crashing into other traders in the pit, eating lobster and steak burritos, passing gas all over the rest of the crowd, and heading out back to have sex with one of the female exchange clerks behind the Dumpster.

I wanted to be like Jack.

I wanted to be like Jack because he seemed to be one of Gods simplest and most beautiful creations. Make money, good. Lose money, bad. Burrito, good. Hangover, bad. My life seemed terribly complicated, and if I could boil down my existence to this primordial level, then it would be an existentially freeing experience.

But I was wrong. Jacks wild personality was a smoke screen, a defense mechanism that he had created to convince other people (and perhaps himself, too) that his life really was that uncomplicated. He was not a simple guy but a rather complex one: a smart kid who had graduated from an Ivy League school, who had made deliberate and rational choices about what to do with his life, and who was now having second thoughts. His acting out was his way of coping, his way of distracting himself from the reality that the financial markets are a cruel way to make a living.

Jack now owns a sandwich shop in Chicago: Jacks Sandos.

All traders go through what Jack went through. They learn to cope with the idea that they are expendable. If you ever take a trip to an investment banks trading floor, look around. Try to find the rare and elusive silver fox. Try to count the number of traders over forty. You wont find many.

Partly this is because of mathematics. If the markets are mostly a zero-sum game, then the winners stick around and the losers find other things to do with their lives. The likelihood of somebody lasting ten years is only about one in five hundred.

The bigger reason that you dont see old farts on trading floors is because people self-select. After a number of years in the business, they say enough is enough, hand in their company ID, and they go raise alpacas outside of Spokane.

The important detail is that all traders are capitalists of one stripe or another. Some of them are even supercapitalists, staunch libertarians, politically well to the right of even the Republican Party. And capitalism requires a dedication to the pursuit of reality. A rock is a rock is a rock. A rock is not a tree, no matter what mental gymnastics you perform. Profits are profits. Losses are losses. And there is no evading losses. You see your P&L every day, and the negative number stares you in the face.

Back in the civilian world, people permit themselves to evade reality. If the market is down, they wont open the brokerage statement. They will stop investing. They will give up. They will hope that things come back.

Being a professional trader allows no such evasion. Hope is not a strategy. If you have a loss, you had better figure it out, or you are out on your ass.

That is a hell of a way to live.

But only if you can get to work in the morning. Seven years of this.

Im late. Again. Did I lock the front door?

If youre a trader, it is important to exercise the illusion of control, because the reality is that youre not in control of anything. The smartest man on Wall Street, after months and months of research on a single trade, has no control over the outcome. In the short term, his position can move against him and force him to liquidate the worlds best idea, only to make him watch as it appreciates 200 percent over the next six months.

I definitely turned the coffeemaker off. But Im not sure I locked the front door

Next page