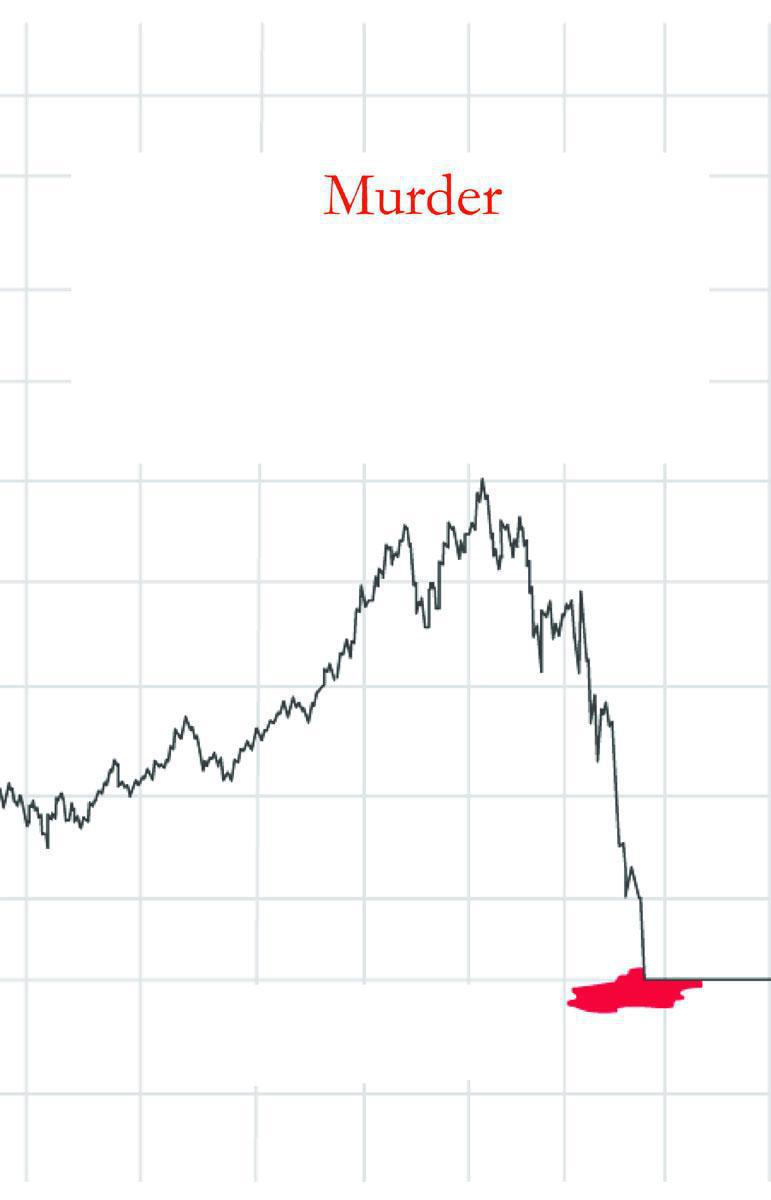

The Murder of

LEHMAN

BROTHERS

An Insiders Look at the Global Meltdown JOSEPH TIBMAN

Brick Tower Press Brick Tower Press

1230 Park Avenue

New York, NY 10128

Tel: 212-427-7139 Fax: 212-860-8852 bricktower @ aol.com www.BrickTowerPress.com

The Brick Tower Press colophon is a registered trademark of J. T. Colby & Company, Inc.

All rights reserved under the International and Pan-American Copyright Conventions. Printed in the United States by J. T. Colby & Company, Inc., New York. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, or otherwise, without the prior written permission of the copyright holder.

Library of Congress Cataloging-in-Publication Data

By Joseph Tibman

The Murder of Lehman Brothers

ISBN-13: 9781883283711 LCC#: 2009927654

First Edition, September 2009 Includes index.

Kindle Edition

Copyright 2009 by Joe Tibman Typesetting by The Great American Art Company 10 9 8 7 6 5 4 3 2 1

Contents

Prologue, v

Chapter 6 Lehman Isnt Bear

The First Half of 2008, 119

For my wife and children

Prologue

While I was not present for what I describe below, the story is true and, at Lehman, was legend, especially among us lifers who broke bread in the executive dining room. On this one page, I have allowed myself reasonable poetic license. Still, as I have known and observed both of the men I describe, I believe I have nailed the tenor of this event.

P

iled high with the usual paperwork, Allan Kaplan, an old-school senior executive, whom many came to regard as the conscience of Lehman Brothers, sat as his desk. Dick Fuld, one of the fixed

income traders, appeared in his office door.

Kaplan, as always, continued methodically working through the piles stacked and arranged in perfect right angles before him. He glanced expressionlessly in Fulds direction, returned his gaze to the work on his desk. Kaplan acknowledged the figure in his office doorway, just loud enough for Fuld to hear, and then ignored him as he continued his progress through the great volume of paper that required his attention, his sanction.

Fuld was unable to shuffle his feet in the threshold of Kaplans office for very long, and like a shark that must keep moving to live, strode to the senior executives desk, announcing that he required a signature so that he

1. A security that pays a fixed return, such as a bond, commercial paper, or preferred stock.

v vi JOSEPH TIBMAN

could complete a profitable, time-sensitive trade. Kaplan lifted his head, placed his half-smoked Cohiba in an ashtray and blankly looked at the impertinent, headstrong Fuld. Moving only his lips, he informed Fuld in crisp words that seemed to disappear into the pile of the carpet, that he, Kaplan, from his mile-high aerie, would consider approval of Fulds trade once his desk was clear of the many piles.

Fuld, his veins filled with adrenaline rather than blood, could not sit on this trade. Every second that passed increased the risk that he would lose it. For Fuld, it was all about the moment. In this one, as in so many others, he saw the purpose of his very existence and that of his firm as one: to make money. It was written in stone that no one wanted to rub Kaplan the wrong way. To do so could precipitate unpredictable wrath. But Kaplan was increasingly an anachronism. Time would not stand still to accommodate the outdated approval process that tied Fulds hands.

To consummate the trade, Fuld required Kaplans immediate sanction. Making the situation doubly frustrating was a clear expectation, undoubtedly shared by Kaplan, that the trade would be quickly approved once the titans eyes fell on the paperwork. Slam-dunk. But Fuld was tangled in the red tape of this powerbroker, known for his traditional, understated manner, as well as limited tolerance for hotheads who came to him halfcocked, ill-prepared, or disrespectful of the process.

Still there was a monetary bottom line and it flashed neon in Fulds eyes: the trade will not wait. Kaplan, still ignoring him, had become an intolerable brick wall. And so, acting on pure impulse and instinct, the very innards of the best traders, Fuld cleared Kaplans desk with a single sweep of his arm, scattering the exalted ones neat piles around his desk. Sucking in his breath, Fuld told the implicitly fearsome Allan Kaplan that now he could approve the trade; his desk was clear.

If Kaplan flinched, it was not visible to the human eye. But he did fix his stare on Fuld, eyes widening, this, the only discernible reaction. Fulds cheeks filled with blood as he awaited his fate. Inwardly, Kaplan smiled puckishly. Yes, he was amused and impressed. This Fuld had potential. Kaplan silently reviewed the documents requiring his approval of the insubordinate traders transaction, and with dispatch, delivered his signature.

THE MURDER OF LEHMAN BROTHERS vii

Fuld rotated on heels of wing tips, utterly in the dark as to what the poker-faced Kaplan had in store for him. Would he even have a job the next day? But Fuld was in the moment, like the best of traders, the risk takers, and held the authorization to trade in his hand.

Many years later, in May of 2003, Dick Fuld stood before a packed chapel of mourners, including numerous employees of the firm that Fuld, now CEO, transformed into a major force on Wall Street. He lauded and joked affectionately about Kaplan, making great mention of his deceased colleagues integrity and ethics, and about the suit pants Kaplan belted so highFuld affectionately chuckledthat they reached Kaplans chin. Until a week before, Allan Kaplan had been fully engaged at Lehman, despite a festering illness, serving the firm he had made his second home for thirty-six years. In summing up Kaplans tenure , Richard Fuld, the hard-assed titan, one of the most powerful men on Wall Street, always bursting with testosterone, choked tearfully on his closing words: Allan was my friend.

Fuld would later honor Kaplan by naming the auditorium on the lower level of Lehmans majestic Time Square tower after him. He wanted to do something. And it was a fine gesture. But the man called the conscience of Lehman had expired.

Introduction

I

t was a Friday like no other. September 12, 2008. Just one day earlier, I was somewhat concerned about the hammered Lehman Brothers (LB) share price and the persistent rumors about my firm, but I had been here before.

Well not exactly here. But I was sure Lehman would survive as an independent firm. I knew it. And this was the consensus, not universally throughout the firm, but among most people with whom I spoke. We were not panicking. Were my colleagues and I deluding ourselves? Had we overdosed on the Lehman-distributed talking points for client damage control? Or were we simply in mass denial? I cannot even pretend to know. I slept well that Thursday night and woke up on Friday refreshed. But this was a Friday, the memory of which is hard-wired in my brain. Soon after I arrived at my office in the Lehman headquarters at 745 Seventh Avenue on the north end of Time Square, it was clear my world, and that of all those around me, was spinning off its axis. The word was out. The Federal Reserve Bank (Fed)and U.S. Treasury were in the building. So were Bank of America and Barclays Capital. Or were they? Were they meeting elsewhere? Shit. What did it matter where they were? This was it. Two of our competitors, far weaker in investment banking,