Copyright 2020 by Jason A. Williams

All rights reserved. No part of this book may be reproduced or used in any manner without written permission of the copyright owner except for the use of quotes in a review.

Nothing in this book should be construed as investment advice. Any opinions expressed by Jason A. Williams in this book are not, and should not be read as, a recommendation to make any investment.

Chapter 1:

Money Printer Go Brrr

I grew up listening to Wu-Tang Clan when I was a kid. I must have listened to C.R.E.A.M. a thousand times. Over and over and over again. That hook still gets me today. Cash rules everything around me, CREAM, get the money.

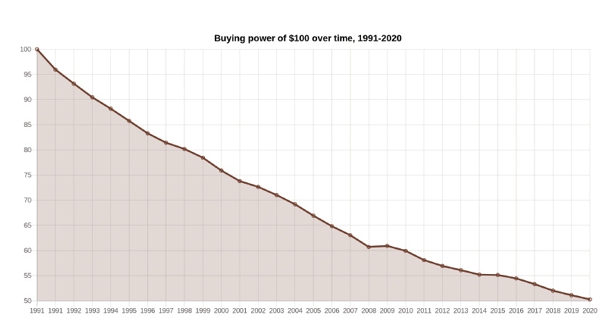

Dollar, dollar bill yall. It was my mantra as I built myself up from nothing. But Method Man would be pretty pissed if he knew how much that dollar bill was worth today. Look what happened to the buying power of a dollar since they released C.R.E.A.M. in 1991.

Image: Official Data Foundation

Its worth 50 cents today. 50, 50 cents, yall.

Why does this happen? Why has the dollar lost half its value in 30 years? The answer is simple: theyre fucking with the money. To be more accurate, theyre printing money. Trillions and trillions of dollars of it.

This is the crux of the whole book. The money in your bank account is slowly wasting away because of money printing. I could quote an economist about inflation here, but Dave El Presidente Portnoy sums it up best: You cant just be like, oh, heres a katrillion, katrillion, katrillion. You flood the market with katrillions, the katrillions mean nothing. It makes the currency worthless.

This is the root problem of our money. And it happens so gradually over time you barely even notice. Until now.

In 2020, the money printers went into overdrive to tackle the Covid-19 crisis. Trillions of fresh dollars pumped into the system to stop it collapsing. More money in a few months than almost 200 years of American history. Totally unprecedented.

This book is an attempt to figure out what happens next, and I come to only one conclusion. As crazy as it sounds, I think well look back on the year 2020 as the moment that triggered the end of the dollar era, and the start of a new global reserve currency. The bitcoin era.

March 2020

I was on a beach in Peru, surfing and enjoying my birthday when the reports started coming in. A new virus out of China had the city of Wuhan locked down. Within weeks it spread to Italy, then Seattle, then New York a full-blown pandemic. The whole world went into a panic. Lockdowns, shelter-in-place orders, travel bans. Total chaos.

I can still remember the eerie streets of Times Square. Billboards flashing Coca-Cola signs to no-one. Stock market tickers bleeding red. The S&P 500 down 33%. In the coming months, 55 million people across America lost their jobs. Small businesses were crushed. Restaurants, barbershops, salons, car dealers, retailers. Decimated. At one point, almost half the nation was unemployed.

Riots broke out across the country, fueled by decades of racism and inequality. Tear gas flooded the streets of Washington DC and rioters clashed with police. Looters smashed up storefronts. People died on the sidewalk.

On Wall Street, traders were reeling from the fastest crash in history. $16 trillion wiped out in a matter of weeks. The Dow suffered its biggest single-day points loss in history. The price of oil briefly turned negative and newspaper headlines screamed about a second Great Depression. This was it. This was the financial crash to end all crashes. Except the powers-that-be couldnt let that happen.

You probably saw the headlines. The Fed Will Pump Another $2.3 Trillion Into the Economy. Congress Agrees $2 Trillion Stimulus Package.

The US has Thrown More Than $6 Trillion at the Coronavirus Crisis.

This is more money than we even knew existed. When did we start throwing around the trillion figure? And where the hell was all this money coming from?

They printed it.

In a small room in Washington DC, twelve central bankers at the Federal Reserve mostly old, white men made a decision. How could they stop the economy from crashing into a depression? Print more money.

Im not exaggerating. Federal Reserve chairman Jerome Powell was later asked, Is it fair to say you simply flooded the system with money?

Yes, we did, he replied.

Where does it come from, do you just print it?

In the video interview you can see him shuffle awkwardly. He knew he was about to shatter everything we thought we knew about the dollar: We print it digitally. We, as a central bank, have the ability to create money .

Just let that sink in a minute. The Federal Reserve the bank of banks created money out of thin air. And then they passed it out to other banks and corporations like candy. The Fed pressed a button and added trillions of dollars to their balance sheet. They promised infinite cash if it was needed. The money rained down. And it worked. Stock markets began to recover. By August, stocks were back to record highs. Wall Street was saved again.

Image: CNBC

But something didnt feel right. On April 9th, a CNBC headline cheered the stock markets best week since 1938. But underneath the headline, in the very same screenshot, was another: More than 16 million Americans have lost their jobs in 3 weeks.

How could this be right? The lines for food banks in New York were eight blocks long. Most were struggling to pay their rent. Small companies were going bust. Mom and pop businesses that had survived decades were suddenly gone. Young people had their future ripped out of their hands.

But at least the stock market was going up.

This is what happens when you create money out of thin air and hand it out to those at the top. The rich get richer. The poor get screwed. This is how our money system works.

And heres the worst part. Every time they flood the market with freshly-printed dollars, they devalue the cash in your pocket. If you print katrillions, the katrillions mean nothing! Theyve been doing it for decades. You can literally see it happening over time.

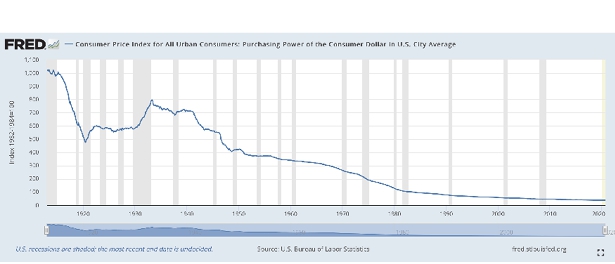

Heres a graph of the dollars purchasing power over the last century:

Image: US Bureau of Labor Statistics / St. Louis Federal Reserve

By the way, this is the Feds own chart. They know what theyre doing. They are devaluing your savings every year. Like going out and setting fire to your cash. This has been going on quietly for a long time, but never on this scale. In just three months of 2020, the Fed expanded its balance sheet by $3 trillion. Put it this way, thats more new dollars in a few weeks than the first 240 years of American history. Insane. The world started waking up to what was happening. In a small corner of the internet, a new meme began circulating: Money printer go brrr.

It depicts a manic-looking banker printing endless dollars to keep the stock market from falling. The meme appeared in Bloomberg, Forbes, the Wall Street Journal. And suddenly people started asking questions. What happens if we keep printing endless money? Does the dollar lose value? Why do we pay taxes if we can just print the cash?