Peter Hadekel - Picking Winners

Here you can read online Peter Hadekel - Picking Winners full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. publisher: Barlow Publishing, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Picking Winners

- Author:

- Publisher:Barlow Publishing

- Genre:

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Picking Winners: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Picking Winners" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Picking Winners — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Picking Winners" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Copyright Peter Hadekel, 2020

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, without prior written consent of the publisher.

Library and Archives Canada Cataloguing in Publication data available upon request.

978-1-988025-52-0 (hardcover)

Publisher: Sarah Scott

Book producer: Tracy Bordian/At Large Editorial Services

Cover design: Paul Hodgson

Interior design and layout: Liz Harasymczuk

Copy editing: Eleanor Gasparik

Proofreading: Wendy Thomas

Indexing: Wendy Thomas

For more information, visit www.barlowbooks.com

DISCLAIMER

All views expressed in this book are Scott Frasers own and do not represent the opinions of his current or former employers or of any other entity. At the time of this writing, Scott Fraser owned some or all of the publicly traded companies discussed in this book.

This book must not be construed as a public offering to sell securities or advice in any jurisdiction. Nothing in this book should be understood as investment advice.

The fundamentals of the companies discussed have changed since this writing. Past returns are not indicative of future results. All amounts discussed are contemporaneous and dont account for subsequent splits, reverse splits or other corporate actions.

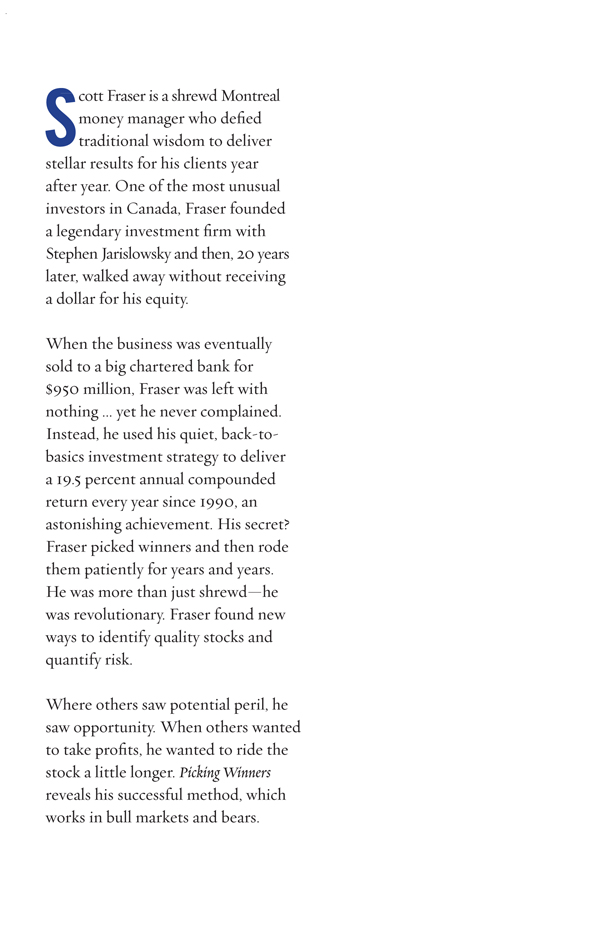

In mid-February 2020, Scott Fraser and his wife, Rachel, arrived at Longboat Key on the west coast of Florida to begin a six-week vacation. For Fraser, a ninety-one-year-old investment adviser from Montreal, it was an opportunity to relax in the sun and reflect on another outstanding year in the stock market. His portfolios had once again climbed by close to 20 per cent in the year just past, and his annual average return since 1990 remained over 19 per cent.

There were no clouds on the horizon. The eleven-year bull market in stocks was intact and thriving. The Dow Jones Industrial Average was making record highs, inflation and unemployment were low, banks were well capitalized, and there were few apparent financial risks. This had become the longest bull market in history, and there was no reason to think it wouldnt continue.

Some analysts warned of a potential correction, but Fraser generally didnt pay much attention to stock-market prognosticators. What they had to say didnt apply to his time-tested strategy of buying quality stocks for the long term and holding them through ups and downs.

Sure, there were news reports about a virus in China that had struck the city of Wuhan, a large commercial centre with a population of eleven million. The virus first surfaced in December 2019, when it had alarmed some Chinese medical officials, but the government kept a tight lid on the story for several weeks, even sanctioning those who tried to speak publicly about it.

When the outside world first heard about the new coronavirus, and the COVID-19 disease associated with it, reports stressed that 80 per cent of cases were either mild or asymptomatic. Deaths were largely confined to Hubei province in China. It was another in a string of viruses that had emerged from Asia in recent times, and none of those prior virus scares had proved to be global threats. So in those early days, while it was on the radar screens of investors, the new coronavirus hardly looked like a major threat to public health or financial stability.

Slowly, the truth began to emerge. One result of Chinas inaction was that the disease spread rapidly among the local population and among many visitors to the city from places like the United States, Italy, Japan, South Korea, and Iran. The Chinese government finally acknowledged the scale of the problem when thousands fell sick: it had little choice but to order a lockdown of Wuhan and a travel ban to and from the city.

By this time, investors had begun to see COVID-19 as an opportunity. The Dow Jones Industrial Average, which had reached its all-time high of 29,568 on February 12, began to slide. In the early weeks of the market correction, the virus served as a way to knock down prices of expensive stocks, providing a cheaper entry point for some buyers. Then the market decline gained momentum, exacerbated by collapsing oil prices. A dispute between Russia and Saudi Arabia over how much oil should be pumped into the marketplace had come at the worst possible time.

Soon stock prices were in free fall: by March 23, the Dow index had fallen all the way to 18,591, an astonishing decline of 37 per cent from the top, with new complications to consider. There was not only fear and panic about what was now a global pandemic but also widespread concern about a massive disruption to the global economy as countries tried to contain the virus. Workers were ordered to stay home; businesses were shuttered; air travel plummeted; borders were closed.

Governments pumped huge amounts of emergency funding into their economies to try to cushion these blows, but it was apparent that the economic impact of the disease would be severe. Bankruptcies, loan defaults, and massive unemployment loomed on the horizon. A global recession appeared inevitable, and who knew how long it would last? A vaccine to fight the virus was unlikely for another twelve to eighteen months, and no anti-viral treatments for COVID-19 had yet been approved by authorities.

In the circumstances, investor psychology was volatile in the extreme. Panic about the pandemic and confusion over how governments would respond led many to react in fear. In the absence of certainty, many investors sold stocks and fled to cash, but Scott Fraser wasnt one of them. When I first saw the crack in the market, I said to myself that I have seen this before. I will just pull in my horns and sit tight, he remembers. At the end of December, we had a lovely portfolio. Nothing had changed in February as far as the fundamentals were concerned.

Fraser had spent a lifetime ignoring the noise that markets can make during volatile periodsthe short-term swings of fear and greed that could cloud rational decision-making. History had proven him right. In the last prolonged bout of market panicthe financial crisis of 200809Frasers portfolio absorbed a short-term hit of approximately 25 per cent on paper but bounced right back in the following years as markets climbed to new heights. He had been able to profit fully from that recovery precisely because he had remained fully invested and had not succumbed to fears about market gyrations.

In 2008, I could see that some banks were probably going to fail, he recalls. And I could see that this was going to lead countries to fail, like Iceland and Ireland. But I also could see that there was going to be an end to it if I just stayed patient.

It takes a lot of courage to stay invested when prices are plummeting; Fraser recognizes the nature of the problem that investors face in such circumstances. If they prefer to get out of the market for a period of time, at what point do they choose to exit, or to get back in? With the hindsight afforded by academic research, we know that most investors get these decisions wrong.

Font size:

Interval:

Bookmark:

Similar books «Picking Winners»

Look at similar books to Picking Winners. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Picking Winners and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.