Sujeet Indap - The Caesars Palace Coup

Here you can read online Sujeet Indap - The Caesars Palace Coup full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, publisher: Diversion Books, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

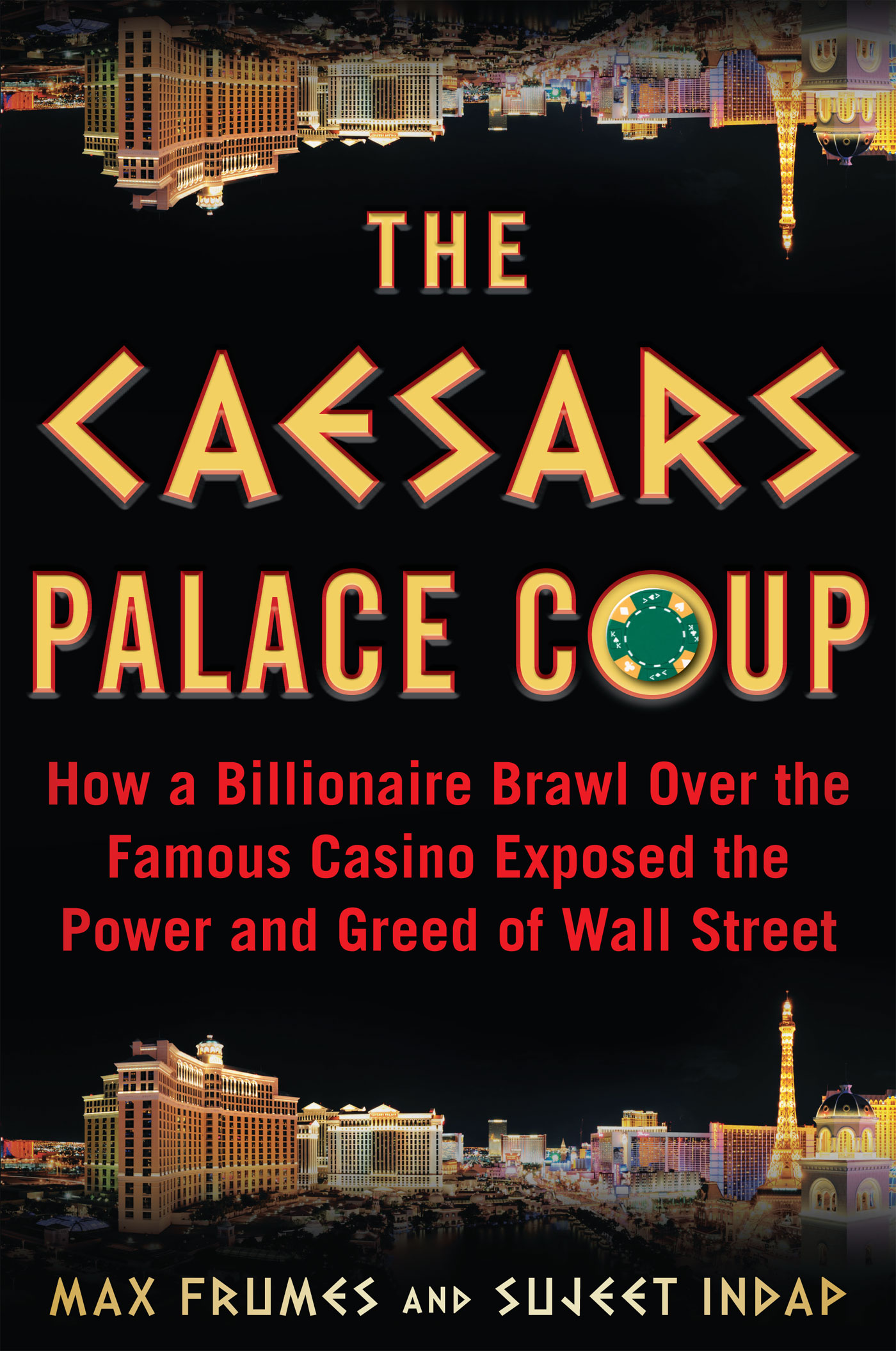

- Book:The Caesars Palace Coup

- Author:

- Publisher:Diversion Books

- Genre:

- Year:2020

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

The Caesars Palace Coup: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Caesars Palace Coup" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

The Caesars Palace Coup — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Caesars Palace Coup" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

To Abigail and Jocelyn, and to little Beatrice

Copyright 2021 by Sujeet Indap and Max Frumes

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever.

For more information, email

Diversion Books

A division of Diversion Publishing Corp.

www.diversionbooks.com

First Diverson Books edition, March 2021

Hardcover ISBN: 9781635766776

eBook ISBN: 9781635766769

Printed in The United States of America

1 3 5 7 9 10 8 6 4 2

Library of Congress cataloging-in-publication data is available on file.

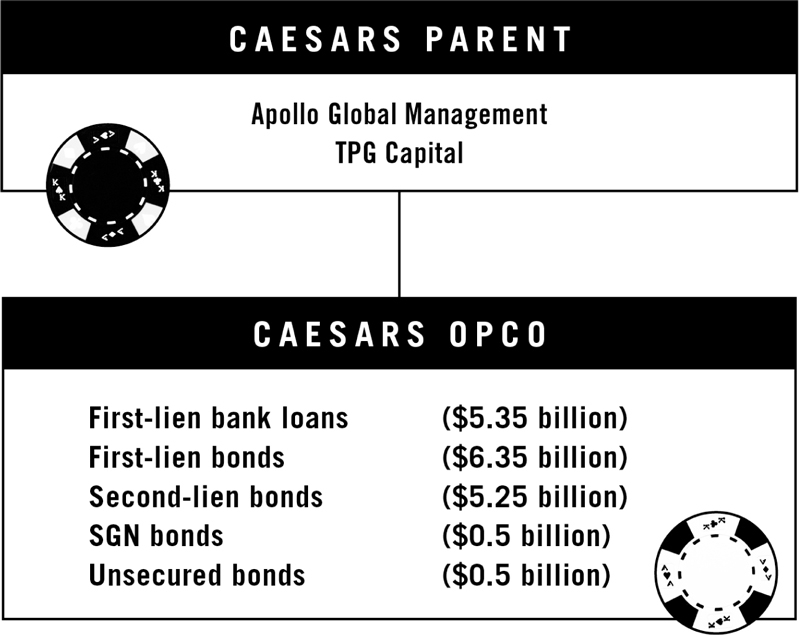

Caesars Parent

Caesars:

- Gary Loveman (CEO)

- Eric Hession (finance)

- Paul, Weiss, Rifkind, Wharton, & Garrison (legal counsel)

- Blackstone Advisory/PJT Partners (financial advisor)

private equity owners

Apollo Global Management:

- Marc Rowan

- David Sambur

TPG Capital:

- David Bonderman

first-lien bank loan holders

GSO Capital:

- Ryan Mollett

Stroock & Stroock, & Lavan (legal counsel):

- Kris Hansen

first-lien bondholders

Elliott Management:

- Dave Miller

- Samantha Algaze

Kramer, Levin, Naftalis & Frankel (legal counsel):

- Ken Eckstein

second-lien bondholders

Appaloosa Capital Management:

- Jim Bolin

Oaktree Capital Management:

- Ken Liang

- Kaj Vazales

jones day (legal counsel)

- Bruce Bennett

Houlihan Lokey (financial advisor)

- Tuck Hardie

- David Hilty

other parties

- Millstein & Co (financial advisor to Caesars OpCo)

- Kirkland & Ellis (legal counsel to Caesars OpCo)

- Richard Davis (Examiner)

- Judge Benjamin Goldgar (US Bankruptcy Court Judge, Northern District of Illinois)

G uys, weve got a $60 million gap to fill.

The room murmured for a moment, then someone shouted, Jim, its actually $130 million.

Thats a bad start. We just went backwards, Jim Millstein sighed. This was about to get harder.

Millsteins frustration could be forgiven. This meeting should have been wholly unnecessary. For a generation, Millstein had been one of the top advisors in the world of corporate bankruptcies, first as a lawyer and later as an investment banker. Just a few years earlier, he had served in the Obama administration as the inaugural Chief Restructuring Officer of the United States. But now, on September 23, 2016, Millstein was five years removed from his stint as a Washington insider. He had set up his own firm, Millstein & Co., to capitalize on his sterling reputation and experience. However, he had not fully appreciated just how nasty the restructuring world had become in his absence. After having the power of the US Treasury Department behind him for the better part of two years, he now found himself being mistreated by ex-Ivy League jocks almost half his age.

That morning, he was surrounded by a group of scowling hedge fund managers and their advisors in the offices of the Kirkland & Ellis law firm high atop New York City. Kirkland had a famously impressive set-up for such high-stakes meetings. Entire floors in the Citigroup Center in midtown Manhattan consisted of conference room after conference room, where white marble hallways lined by floor-to-ceiling wood panels gave way to larger open spaces and sprawling views of the city.

Millstein was trying to, once and for all, solve the restructuring of Caesars Entertainment, whose twists and turns had riveted Wall Street. The knock-down, drag-out affair was finally at its endgame. The fighting that had begun more than eight years ago after an ill-timed $28 billion leveraged buyout of the storied gaming company was mercifully being put to rest, along with Millsteins nightmare. The brightest financial minds in the world just had to find an extra $130 million to bridge the gap between what was being offered and what was asked. These investors merely had to pledge back pennies on the dollar to clinch this deal.

If everyone chips in, the bank debt and senior bonds are good to do the same, Dave Miller said, speaking on behalf of himself and Ryan Mollett. Miller and Mollettwhile only in their mid-thirties had already established themselves as superstar distressed debt investors. Miller was with the feared hedge fund founded by Paul Singer, Elliott Management. Ryan Mollett worked at GSO, an affiliate of the juggernaut investment firm Blackstone. Collectively, the pair represented dozens of Caesars creditors holding $12 billion of Caesars debt. The two had been bitter adversaries early in the case but had long since made peace.

Gavin, I need $6 million from your group, Millstein demanded from Gavin Baeria, an executive at hedge fund Angelo Gordon, as politely as one can for such a sum.

Baeria, finding the spectacle comical, could only laugh. The $6 million would be fine but the sheer absurdity deserved at least a chuckle. This triviality could have been handled in a straightforward email.

I cant talk for the group but I cant imagine were not going to be OK with this, Baeria said.

Millstein turned to the last group represented in the room. Ken, that leaves

We are not chipping in! shouted Ken Liang. This was the moment Millstein had been dreading. There was an old expression in complex restructuringsjust get everybody into a roomabout hashing out a lasting compromise. That approach suddenly did not look so promising.

Millstein had cut his teeth as a lawyer in the mid-1980s just as corporate raiders and private equity firms were emerging on Wall Street. They were called barbarians, both for their slash-and-burn tactics and their insatiable thirst for profits and glory. Thirty years later, private equity had become a mainstream, if not celebrated, part of the financial establishment. No longer were private equity firms condemned as savages; rather they were earnest entrepreneurs, builders of businesses, and saviors of pensioners.

The distressed debt hedge fund now filled the pirate caricature on Wall Street. The invention of the junk bond had fueled the takeover mania of the 1980s. High yield bondsor junkallowed small or risky companies, along with buccaneering raiders, to tap the capital markets from which they had otherwise been closed off. As those deals went bust in the early 1990s, the debt became distressed, and the vulture investor was born. Vulture funds could scoop up the debt of troubled companies for nickels and dimes and take control of over-indebted but otherwise viable companies.

Next pageFont size:

Interval:

Bookmark:

Similar books «The Caesars Palace Coup»

Look at similar books to The Caesars Palace Coup. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Caesars Palace Coup and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.