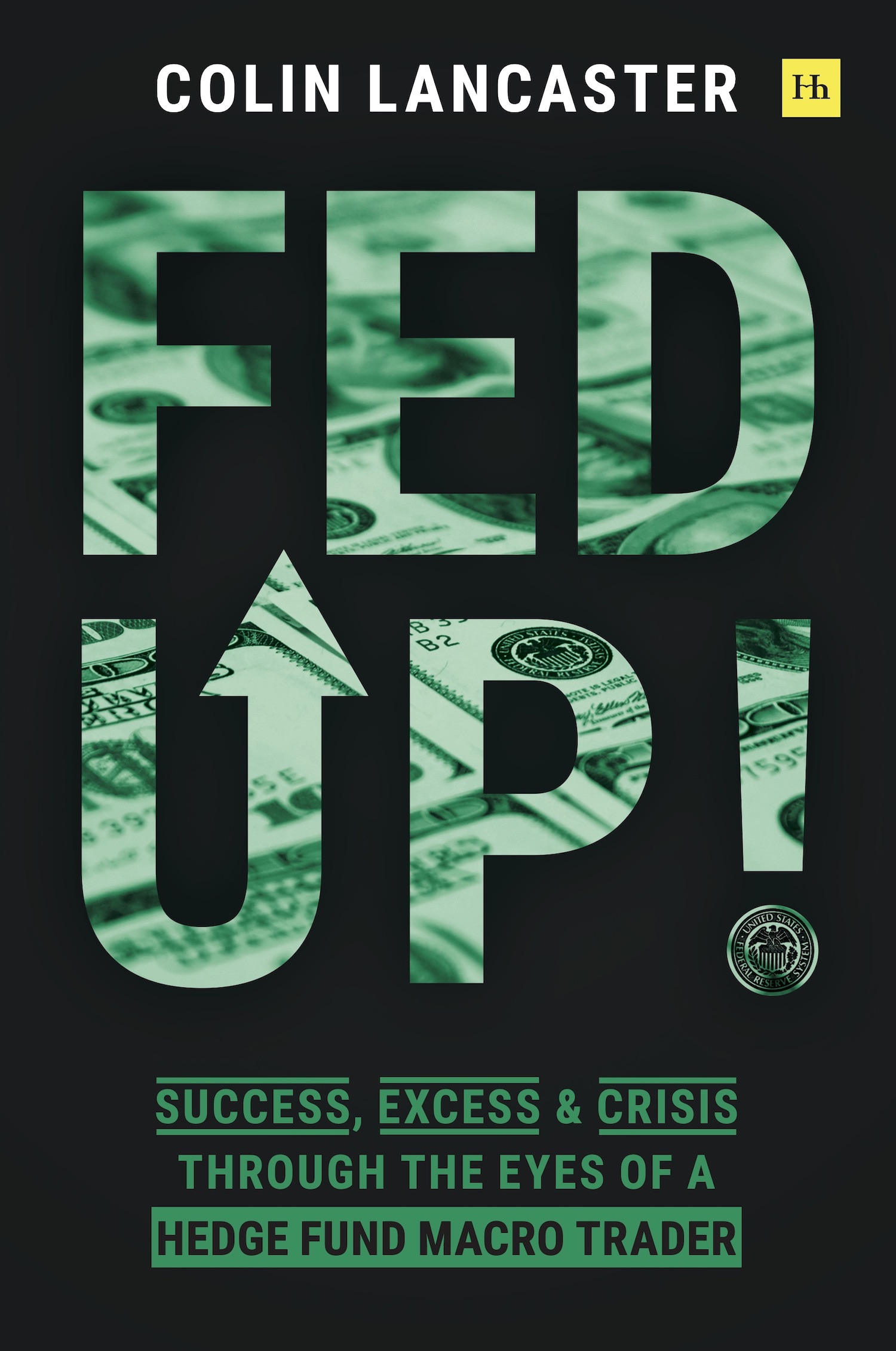

Colin Lancaster - Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader

Here you can read online Colin Lancaster - Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2021, publisher: Harriman House, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader

- Author:

- Publisher:Harriman House

- Genre:

- Year:2021

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Colin Lancaster: author's other books

Who wrote Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader? Find out the surname, the name of the author of the book and a list of all author's works by series.

Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Fed Up!

Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader

Colin Lancaster

For Tia, Victoria, Sophia, and Maria

We have always found, where a government has mortgaged all its revenues, that it necessarily sinks into a state of languor, inactivity, and impotence.

David Hume

Its also about money and opportunity. Its about the moral dilemma of a man who is struggling as he reaches his own peak. Readers will be drawn into a traders frenetic pace of life and witness his struggle to balance his personal values with the values of the world around him. It shines a light on the largest policy issues confronting the USA, while offering an entertaining and humorous look at the guys and gals who are the new market operators.

This riveting account of the 2020 market crash from inside the mind of a global macro trader will serve as an exciting, nail-biting record of current times. Its about making fortunes while the world slips into misfortune. Will he beat the markets, or will the markets beat him?

Part 1: The Late Stages of a Bubble

Sushi, Sake and a Breakdown in the repo markets

October 2019

10/1/2019 Fed continues to pump liquidity via repo market; will continue at least until Oct. 10; balance sheet expanding, not QE QE.

10/4/19 Payrolls +136K for Sept. Unemployment rate drops to 3.5%, lowest since 1969.

10/11/19 President Trump announces US/China have reached an outline of a deal for phase 1 of trade negotiations.

10/11/19 Fed announces plans to buy $60B in T-bills each month. New actions are purely technical.

10/28/19 EC President Donald Tusk and UK Prime Minister Boris Johnson agree to flextension: Brexit deadline pushed from month-end to Jan. 31, 2020.

10/30/19 Fed cuts rates by 25 bps (1.51.75%), third cut in four months. Powell wants to pause unless the growth outlook deteriorates.

Month-end: UST 10s at 1.69%; S&P +2.2%; Nasdaq +3.7%.

And then this. A tweet from the President of the United States of America:

As I have stated strongly before, and just to reiterate, if Turkey does anything that I, in my great and unmatched wisdom, consider to be off limits, I will totally destroy and obliterate the Economy of Turkey (Ive done that before!).

Most of the world, me included, had become numb to this type of tweet. But this one, well, it broke my back.

It wasnt about the politics, or the fact that we had taken a long position in the Turkish lira, which was about to get jammed down our throats. The Big D, the leader of the free world, in his great and unmatched wisdom, had openly threatened another world power in a mere 140 characters. How could the US president post this to social media? Was this all a dream, some sort of parallel universe? A big mistake ?

But fuck it. Were in a ten-year bull market and are starting to make money again. A lot of money. Its been a while since we had a month like this. Its time to celebrate. Even the recent yield curve inversions, such as the three-month/ten-year Treasury spread, are back to positive. These positives might just be a nail in the coffin in terms of the predicted upcoming recession. After all, they say the market is the best predictor of recessions, and yield curve inversions like this dont lie. Theyre never wrong. But not today. The Federal Reservethe worlds biggest central bankis pivoting. Jerome (Jay) Powell, the head of the Fed, is making a mid-cycle adjustment that will drive stocks higher. And theres no way he can stop now. He has to cut rates again at the end of the month. Markets are going up.

As global macro traders we are paid to get these calls right. We are paid to understand what is going on in the world and to turn these views into cash. Think George Soros and Stan Druckenmiller, some of the best ever.

*

What is global macro, anyway?

When people say macro, a lot of people have visions of George Soros when he was breaking the Bank of England or Paul Tudor Jones when he predicted the 87 crash. These make or break trades helped to propel macro as an investment approach. But you have to remember that these guys are a lot more than one big trade. Their reputations were earned over decades of employing a disciplined, analytical investment process. Im talking years and years of long hours and hard work, trying to make money in both bull and bear markets. Its a hard thing to do.

The strategys broad mandate permits portfolio managers to invest in virtually any instrument, anywhere in the world. This makes it unique. It also makes macro managers great at cocktail parties since they can talk about almost anything. The origins of many high-profile global macro traders can be traced back to investment-bank proprietary trading businesses, and to places such as Commodities Corporation, and, of course, Soros Fund Management. These macro pioneers created platforms within their firms that trained a new generation of portfolio managers, a next wave of great macro investors, who started their careers at those earlier shops and went on to launch firms such as Duquesne Capital, Tudor Investment Corporation, Moore Capital, Caxton Associates, and Brevan Howard. Some started from a different lineage, launching their own firms, such as Ray Dalio at Bridgewater. More recently, firms such as Element Capital and Rokos Capital have risen in prominence. Many of the large multi-strategy hedge funds also have great internal macro teams working for them.

At its simplest, global macro investing can be boiled down to investing in assets on the basis of changes in the fundamental landscape: the ups and downs in growth and inflation and interest rates. Its understanding business cycles and how government spending and central bank policies will impact those cycles. As George Soros pointed out in his book The Alchemy of Finance , monetary policy and normal business cycles impact each other. Furthermore, variables such as credit, housing, employment, inflation, and consumption all flow into this analysis. Equity experts will do a tremendous amount of work in understanding how a company operates. A macro expert tends to do the same, but on countries, not companies. The Holy Grail of macro is finding an imbalance. Maybe its related to growth, or interest rates, or a central banks reaction function, and then profiting from the moves in that countrys interest rates, or foreign exchange, or equity, or credit markets.

Investments are often made in a number of markets around the world and across different asset classes so that the various investments are, theoretically, noncorrelated. This can be both a blessing and a curse to macro investors. For any core view you have, there are many, many ways to express that view, should it be in equities, in fixed income, or in FX. One of the most frustrating moments for macro investors is when they get a view correct but have on the wrong expression and end up with zero profit and loss (PnL).

Font size:

Interval:

Bookmark:

Similar books «Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader»

Look at similar books to Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.