Copyright 2013 by The McGraw-Hill Education. All rights reserved. Printed in the United States of America. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher.

ISBN: 978-0-07-176832-0

MHID: 0-07-176832-7

The material in this eBook also appears in the print version of this title: ISBN: 978-0-07-176831-3, MHID: 0-07-176831-9.

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill Education eBooks are available at special quantity discounts to use as premiums and sales promotions, or for use in corporate training programs. To contact a representative please e-mail us at bulksales@mcgraw-hill.com.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, securities, trading, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles Jointly Adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations.

TERMS OF USE

This is a copyrighted work and McGraw-Hill Education and its licensors reserve all rights in and to the work. Use of this work is subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hill Educations prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED AS IS. McGRAW-HILL EDUCATION AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. McGraw-Hill Education and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill Education nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting there from. McGraw-Hill Education has no responsibility for the content of any information accessed through the work. Under no circumstances shall McGraw-Hill Education and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

CONTENTS

Chapter 1

What Is a Hedge Fund?

Chapter 2

Regulation of Hedge Funds

Chapter 3

Hedge Fund Organization

Chapter 4

Hedge Fund Service Providers

Chapter 5

Short Selling and Leverage

Chapter 6

Derivatives: Financial Weapons of Mass Destruction

Chapter 7

History of Hedge Funds

Chapter 8

Hedge Funds, Shadow Banking, and Systemic Risk

Chapter 9

Key Events in the Development of Hedge Funds: Long-Term Capital Management and the Credit and Liquidity Crisis

Chapter 10

Mounting Criticism of Hedge Fund Performance

Chapter 11

Is Smaller Better in Hedge Funds?

Chapter 12

Statistical Measures of Performance

Chapter 13

Aggregate Measures of Hedge Fund Performance

Chapter 14

Hedge Fund Returns from the Investors Viewpoint

Chapter 15

Overview of Hedge Fund Strategies

Chapter 16

Equity Hedge Strategies

Chapter 17

Event-Driven Strategies

Chapter 18

Relative Value Strategies

Chapter 19

Global Macro and Commodity Trading Adviser Strategies

Chapter 20

Hedge Fund of Funds

Chapter 21

Modern Portfolio Theory and Efficient Market Hypothesis

Chapter 22

Behavioral Critique of Efficient Market Hypothesis

Chapter 23

Institutionalization of Hedge Funds

Chapter 24

Hedge Funds and Retail Investors

Chapter 25

Manager Selection and Due Diligence

Chapter 26

Risk Management

Chapter 27

Recent Hedge Fund Controversies

PREFACE

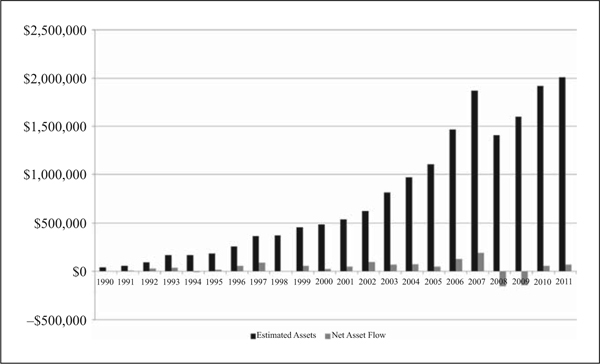

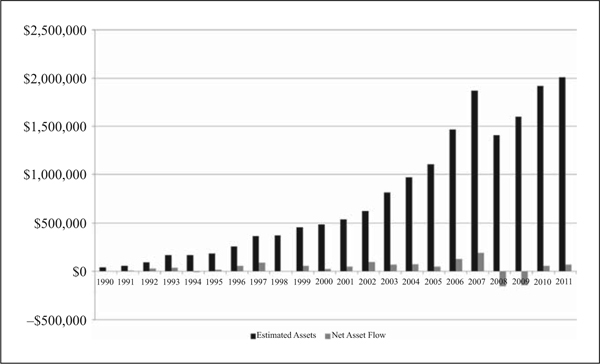

I founded a hedge fund in 1991 and spent the subsequent 20 years in the hedge fund industry, participating in its amazing transformation. There were fewer than 1,000 hedge funds managing $58 billion in 1991 compared with over 10,000 funds managing $2 trillion today. The dominant hedge fund strategy in 1991 was global macro, which entailed leveraged bets on the direction of global currency, interest rates, commodities, and stock markets, whereas today the strategies pursued by hedge funds are diversified and divided between equity, fixed income, global macro, and others. Finally, the investors in 1991 were predominantly wealthy individuals while today they are largely institutions, including pension funds, university endowments, and sovereign wealth funds ().

FIGURE 0 1

It is fair to say that hedge funds have evolved from marginal investment vehicles for the rich into mainstream investments for the worlds largest institutional investors, including CalPERS (the largest U.S. pension fund), the Yale Endowment, State of Massachusetts $50 Billion Pension Reserves Investment Management Board, and the China Investment Corporation.

And yet, most peoples knowledge of hedge funds comes from the news headlines, which tend to focus on the sensational aspects of the industry: the incredible wealth of some of its managers; the out-sized gains (i.e., Paulson & Company, which made billions by correctly predicting the collapse of the U.S. housing market) and losses (i.e., Long-Term Capital Management, which lost billions in 1998 and caused a major crisis in the global financial system) of some of the larger funds; the frauds perpetrated by some managers (frequently including Bernard Madoff, who was