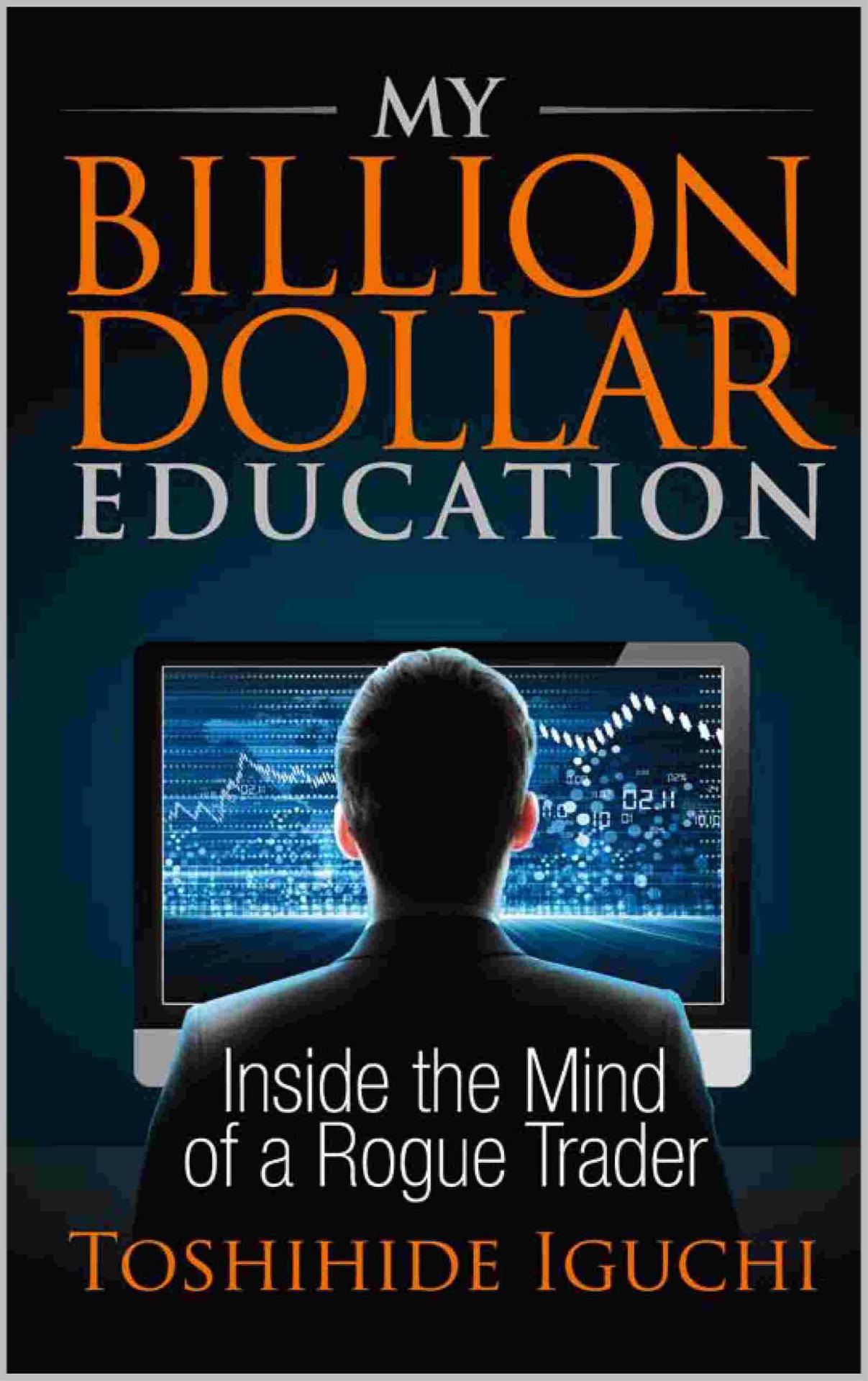

MY

BILLION

DOLLAR

EDUCATION

Inside the Mind

of a Rogue Trader

TOSHIHIDE IGUCHI

Copyright 2014 by Toshihide Iguchi

www.toshihideiguchi.com

All rights reserved

The moral right of the author has been asserted

ISBN: 978-988-13373-8-2

2 nd printing

This edition is sold subject to the condition that it shall not, by any way of trade or otherwise, be lent, resold, hired out or otherwise circulated in any form of binding or cover other than that is which it is published and without a similar condition, including this condition, being imposed on the subsequent purchaser.

The scanning, uploading and distribution of this book via the Internet or via any other means without the permission of the publisher or the author is illegal and punishable by law. Please purchase only authorized electronic editions and do not participate in or encourage electronic piracy of copyrighted materials. Your support of the authors right is appreciated.

About the Book

The untold story of a rogue trader, whose decision to right a wrong ignited a series of political maneuvering by American and Japanese officials, leading to the expulsion of a major Japanese bank from the U.S.

At 18, Toshihide Iguchi came to the U.S. with high hopes. Graduating from college in Missouri, marrying a St. Louis girl, and landing a promising job at Daiwa Bank in New York, he was ready to embark on his American dream. Unbeknownst to him, a storm of unprecedented financial deregulation on both sides of the Pacific was about to rage Twelve years later, he found himself in the maximum security ward of a Manhattan jail, surrounded by Arab terrorists and a Mafia boss.

The trader looks back on his psychology struggles and redemption, which gave him valuable insight in helping others to prevent future billion dollar trading losses.

About the Author

Toshihide Iguchi, as a trader at New York branch of Japans Daiwa Bank, amassed a $1.1 billion trading loss over a 12 year period. His voluntary disclosure to the CEO became the catalyst for the expulsion of Daiwa Bank from the U.S.

He is now a published author, speaker, and consultant, as well as a designer of innovative language software.

Please visit his website:

www.toshihideiguchi.com

To: Edward M. Stroz

Without his compassion for humanity and dedication to fairness,

I would not be here to write this book.

Contents

Prologue

The phrase rogue trader was first used by the media in 1995 when a trader at Barings Bank fled Singapore and was arrested in Germany. The incident was so sensationalized as his action directly brought down the 230-year-old bank. Until this incident, however, unauthorized trading activity had not been considered an illegal activity, therefore, the phrase rogue trader had not been commonly recognized.

In the following 18 years, there had been a half dozen known rogue trading incidents in which the loss exceeded $1 billion, namely: Barings Bank, Daiwa Bank, Sumitomo Corp, Societe Generale, UBS, and JP Morgan Chase. Of these rogue trading incidents, Daiwa Bank was the only one that took place on Wall Street, yet few Americans know much about it because the case was all wrapped up in a month as I pled guilty and gave the complete details of my activities. Without any elements of mystery or suspense as we have seen in other rogue cases, the media found very little to report. Nevertheless, the Daiwa scandal is not only the largest unauthorized trading loss which occurred in the U.S., but also the very first and the longest unauthorized trading on record. To that end, as the granddaddy of all rogue trading, it has a plethora of historical significance and lessons to be learned even today.

The 1980s was a transitional decade for the financial markets. After soaring interest rates in the early 1980s, financial business models were forced to change. The lending institutions especially, such as banks, were feeling a lot of pressure from the investment bankers who were reinventing themselves by securitizing the loans. Reeling from the deregulation of the brokerage commission structure, investment bankers were forced to become more innovative. The best example was the introduction of junk bonds and the demise of the S&L banks. Meanwhile, across the Pacific, the momentum of an export-led Japanese economy accelerated (much like that of China today) making it the second largest economy in the world. The burgeoning trade surplus against the U.S. and Europe drove the yen to record levels, necessitating the Japanese Government to encourage aggressive U.S. dollar investment.

With this backdrop, in 1982, without any prior experience, I was given a job by Daiwa as a trader. Some have labeled me the pioneer of rogue trading as I started my unauthorized trading less than six months later. Absolutely inconceivable as it may seem, a mere four years later, I had full banking functions under my control. In most rogue trading cases, the main culprit is the laxity in internal controls owing to an opportunistic corporate culture. But in Daiwas case, it was gross ignorance of the management in the risk business that resulted in a total lack of internal controls.

The uniqueness of my situation goes much further. I am also the only trader who didnt get caught. The $1.1 billion rogue trading loss came to light only because I came forward voluntarily. It is uncommon for anyone committing an impropriety to come forward because they are hopeful of never getting caught. In rogue trading, the end has to come, one way or another. I chose to end it.

Unfortunately, the scandal didnt end there. In fact, the most significant part of it started when I reported my $1.1 billion loss to the CEO of Daiwa Bank. What transpired after that is something out of the movies. Because the 179 audits performed by internal and external auditors, as well as the U.S. and Japanese banking regulators, failed to detect my unauthorized trading loss, a spate of blame shifting and face-saving tactics flew across the boardroom and the Pacific.

In the end, Daiwa was fined $340 million (a record criminal fine at the time) and ordered to close all of its 19 U.S. branch offices and leave the country for good. Losing its U.S. banking license meant a loss of its international banking functions for Daiwa, which had built one of the largest networks of international operations among Japanese banks.

When we hear about these astronomical unauthorized trading losses, one must understand that financial institutions only disclose these losses as unauthorized losses if the amount is too large to either report as an ordinary trading loss or to conceal altogether. It is my opinion that less than 5% of the unauthorized trading cases are actually reported as unauthorized losses. After all, losing a lot of money in and of itself is not a crime, even if it was unauthorized.

Unauthorized trading is an in-house violation and if the firm is willing to call it authorized, then neither the regulators nor the law enforcement has any ground for stepping in. In fact, during the 12 years of my unauthorized trading activity, I heard of unauthorized trading losses by Daiichi-Kangyo Bank in Singapore (1982), Fuji Bank in New York (1984), Daiwa Trust in New York (1985), Tateho Chemical (1987), and Tokyo Securities (1994), all of which were in the millions of dollars and none of whose traders were criminally prosecuted. Is it the amount of the loss that makes it criminally prosecutable? If so, where is the threshold?