Money. You work hard to get it. But it is easy to spend. You eat out with friends. Go to a movie. Buy a new shirt.

Before you know it, the money is gone. What if you want something big? A car. A trip. Money for college. These cost a lot. But you can get them.

You just have to plan to save. How do you save money? You set it aside. Dont spend it. This seems easy. But its not. There is so much to buy. Clothes. Clothes.

School supplies.  And there are bills to pay. Many people live paycheck to paycheck. They earn money each month. But they spend every penny. Some even spend more than they make.

And there are bills to pay. Many people live paycheck to paycheck. They earn money each month. But they spend every penny. Some even spend more than they make.

They want to save. But they dont.  Not saving can lead to big trouble. Times can get tough. People can lose their jobs. Things can happen they dont expect.

Not saving can lead to big trouble. Times can get tough. People can lose their jobs. Things can happen they dont expect.

A car accident. A hospital stay. No savings means no money for times like these.  People go into debt. They owe others money. They may lose things they have. Their car.

People go into debt. They owe others money. They may lose things they have. Their car.

Even their home. It is hard to get back on track. That is why you must plan. Plan to save.

Anyone can save. JUST FOLLOW THESE STEPS:

Anyone can save. JUST FOLLOW THESE STEPS:

- Set a goal.

- Find money to save.

- Treat savings like a bill.

First,

set a goal. What do you want to save for? It could be a car.

Or college. Or a place of your own.  Write down how much you will need. Set a date for reaching your goal. It might be six months. It might be a year.

Write down how much you will need. Set a date for reaching your goal. It might be six months. It might be a year.

It might be longer. Now do the math. How many months until you reach your goal? Divide how much you need by the number of months. This is what you must save each month.  Next, find money to save. You know how much you need to save. Subtract that number from what you make each month.

Next, find money to save. You know how much you need to save. Subtract that number from what you make each month.

What is left? There must be enough to pay your bills. What if there is not? You can still save.  But you will have to save less. It will take longer to reach your goal. What about things you want but dont need? Game tickets. Cable TV. Cable TV.

But you will have to save less. It will take longer to reach your goal. What about things you want but dont need? Game tickets. Cable TV. Cable TV.

Cut back on these. Then you can save more. You will reach your goal faster.  Time for the last step. Write down what you must save each month. Treat savings like a bill. Pay it each month.

Time for the last step. Write down what you must save each month. Treat savings like a bill. Pay it each month.

You can get help with this. Talk to your boss. Part of your pay can go to savings.  Your bank can help too. Money can go from checking to savings each month. You say how much.

Your bank can help too. Money can go from checking to savings each month. You say how much.

You say which day. The bank does the rest.  You made a plan. You are saving money. But you can do more. It is all about where you put your money.

You made a plan. You are saving money. But you can do more. It is all about where you put your money.

There are many ways to save. But there are rules for each one. Find out which way is best for you.

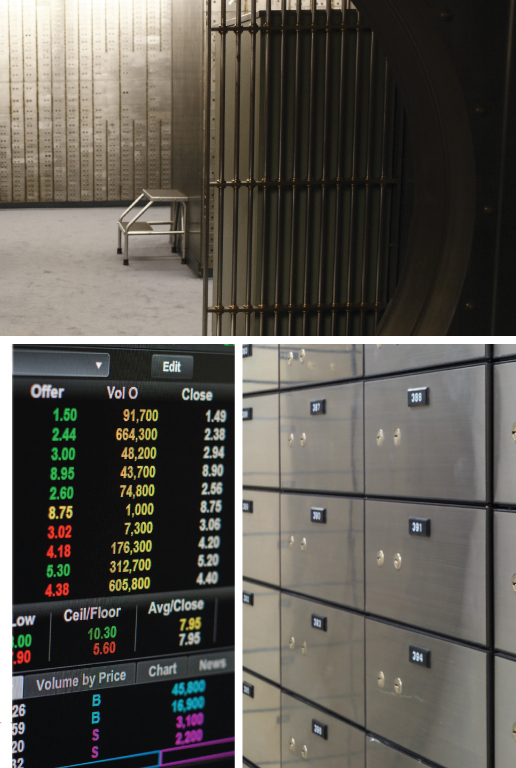

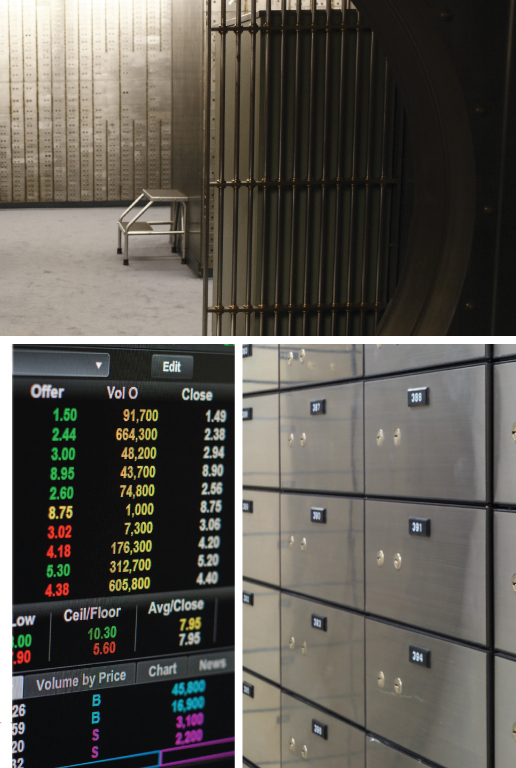

You can go to a bank. Or credit union. Open a savings account. This is a good way to start.

You can go to a bank. Or credit union. Open a savings account. This is a good way to start.

The money is out of your hands. You are less likely to spend it. You dont have to worry. Your money is very safe. The government protects it. This is called FDIC insured. Your bank may shut down.

But you will get your money.  Look for this when you open an account. Ask about interest rates too. Your money will earn more money. It will not be much. But you will get a little interest each month.

Look for this when you open an account. Ask about interest rates too. Your money will earn more money. It will not be much. But you will get a little interest each month.

The higher the rate, the more money you earn.  Money in a savings account is safe. It is also liquid. This means you can take it out any time. You will get a card. You can use it to take money out.

Money in a savings account is safe. It is also liquid. This means you can take it out any time. You will get a card. You can use it to take money out.  Do you want to earn more money? There are ways to do that.

Do you want to earn more money? There are ways to do that.  Do you want to earn more money? There are ways to do that.

Do you want to earn more money? There are ways to do that.

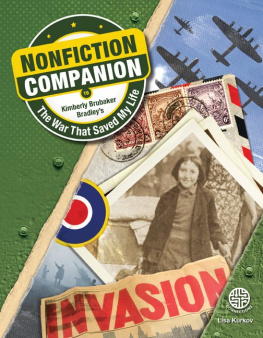

But they are less liquid. You cant take your money out for a while. How long? It depends.  A CD is a certificate of deposit. Most banks have CDs. Your money is still safe. It is FDIC insured.

A CD is a certificate of deposit. Most banks have CDs. Your money is still safe. It is FDIC insured.

CDs have higher interest rates than savings accounts. You earn more money. But the money is not liquid. You must have enough money to get a CD. It might be $100. It might be more.

Ask your bank. Choose the kind of CD you want. It might be three months. Or six months. Or a year.  This is its term. Your money stays in for that long.

This is its term. Your money stays in for that long.

The term will end. You will get your interest. Then you can sign up again. Or you can take your money out. Can you wait five years to get your money? Or even longer? Then

Money. You work hard to get it. But it is easy to spend. You eat out with friends. Go to a movie. Buy a new shirt.

Money. You work hard to get it. But it is easy to spend. You eat out with friends. Go to a movie. Buy a new shirt.  And there are bills to pay. Many people live paycheck to paycheck. They earn money each month. But they spend every penny. Some even spend more than they make.

And there are bills to pay. Many people live paycheck to paycheck. They earn money each month. But they spend every penny. Some even spend more than they make. Not saving can lead to big trouble. Times can get tough. People can lose their jobs. Things can happen they dont expect.

Not saving can lead to big trouble. Times can get tough. People can lose their jobs. Things can happen they dont expect. People go into debt. They owe others money. They may lose things they have. Their car.

People go into debt. They owe others money. They may lose things they have. Their car.

Anyone can save. JUST FOLLOW THESE STEPS:

Anyone can save. JUST FOLLOW THESE STEPS: First, set a goal. What do you want to save for? It could be a car.

First, set a goal. What do you want to save for? It could be a car.  Write down how much you will need. Set a date for reaching your goal. It might be six months. It might be a year.

Write down how much you will need. Set a date for reaching your goal. It might be six months. It might be a year. Next, find money to save. You know how much you need to save. Subtract that number from what you make each month.

Next, find money to save. You know how much you need to save. Subtract that number from what you make each month. But you will have to save less. It will take longer to reach your goal. What about things you want but dont need? Game tickets. Cable TV. Cable TV.

But you will have to save less. It will take longer to reach your goal. What about things you want but dont need? Game tickets. Cable TV. Cable TV. Time for the last step. Write down what you must save each month. Treat savings like a bill. Pay it each month.

Time for the last step. Write down what you must save each month. Treat savings like a bill. Pay it each month. Your bank can help too. Money can go from checking to savings each month. You say how much.

Your bank can help too. Money can go from checking to savings each month. You say how much. You made a plan. You are saving money. But you can do more. It is all about where you put your money.

You made a plan. You are saving money. But you can do more. It is all about where you put your money.

You can go to a bank. Or credit union. Open a savings account. This is a good way to start.

You can go to a bank. Or credit union. Open a savings account. This is a good way to start. Look for this when you open an account. Ask about interest rates too. Your money will earn more money. It will not be much. But you will get a little interest each month.

Look for this when you open an account. Ask about interest rates too. Your money will earn more money. It will not be much. But you will get a little interest each month. Money in a savings account is safe. It is also liquid. This means you can take it out any time. You will get a card. You can use it to take money out.

Money in a savings account is safe. It is also liquid. This means you can take it out any time. You will get a card. You can use it to take money out.  Do you want to earn more money? There are ways to do that.

Do you want to earn more money? There are ways to do that.  A CD is a certificate of deposit. Most banks have CDs. Your money is still safe. It is FDIC insured.

A CD is a certificate of deposit. Most banks have CDs. Your money is still safe. It is FDIC insured. This is its term. Your money stays in for that long.

This is its term. Your money stays in for that long.