Copyright 2022 by Nick Timiraos

Hachette Book Group supports the right to free expression and the value of copyright. The purpose of copyright is to encourage writers and artists to produce the creative works that enrich our culture.

The scanning, uploading, and distribution of this book without permission is a theft of the authors intellectual property. If you would like permission to use material from the book (other than for review purposes), please contact permissions@hbgusa.com. Thank you for your support of the authors rights.

Little, Brown and Company

Hachette Book Group

1290 Avenue of the Americas, New York, NY 10104

littlebrown.com

twitter.com/littlebrown

facebook.com/littlebrownandcompany

First ebook edition: March 2022

Little, Brown and Company is a division of Hachette Book Group, Inc. The Little, Brown name and logo are trademarks of Hachette Book Group, Inc.

The publisher is not responsible for websites (or their content) that are not owned by the publisher.

The Hachette Speakers Bureau provides a wide range of authors for speaking events. To find out more, go to hachettespeakersbureau.com or call (866) 376-6591.

ISBN 978-0-316-27307-7

E3-20220122-JV-NF-ORI

To my parents, Carol and Vicente, for encouraging me to follow my dreams

And to Mallie, whose support makes everything possible

O ver the weekend of February 22, 2020, Saudi Crown Prince Mohammed bin Salman hosted the finance ministers and central-bank governors from the Group of Twenty nations, a forum for the leaders of the worlds largest economies. The prince was eager to use the event in Riyadh to showcase his countrys modernization, although the progress was relative; one of his most radical steps was allowing women to drive.

The summit featured icons of Saudi culturewhich explains how Federal Reserve Chair Jerome Powell and Treasury Secretary Steven Mnuchin each ended up donning a leather glove and posing with a gray feathered falcon, Saudi Arabias national bird. The most powerful players in the global economy also held up their iPhones to video a white camel parading through a palace courtyard. The animal, named Most Beautiful Camel at the annual King Abdulaziz Camel Festival, had won hundreds of thousands of dollars based on criteria such as hair color and lip plumpness. Powells colleague at the Fed, governor Randal Quarles, and Franois Villeroy de Galhau, governor of the Banque de France, snapped a photo together in front of the mammal.

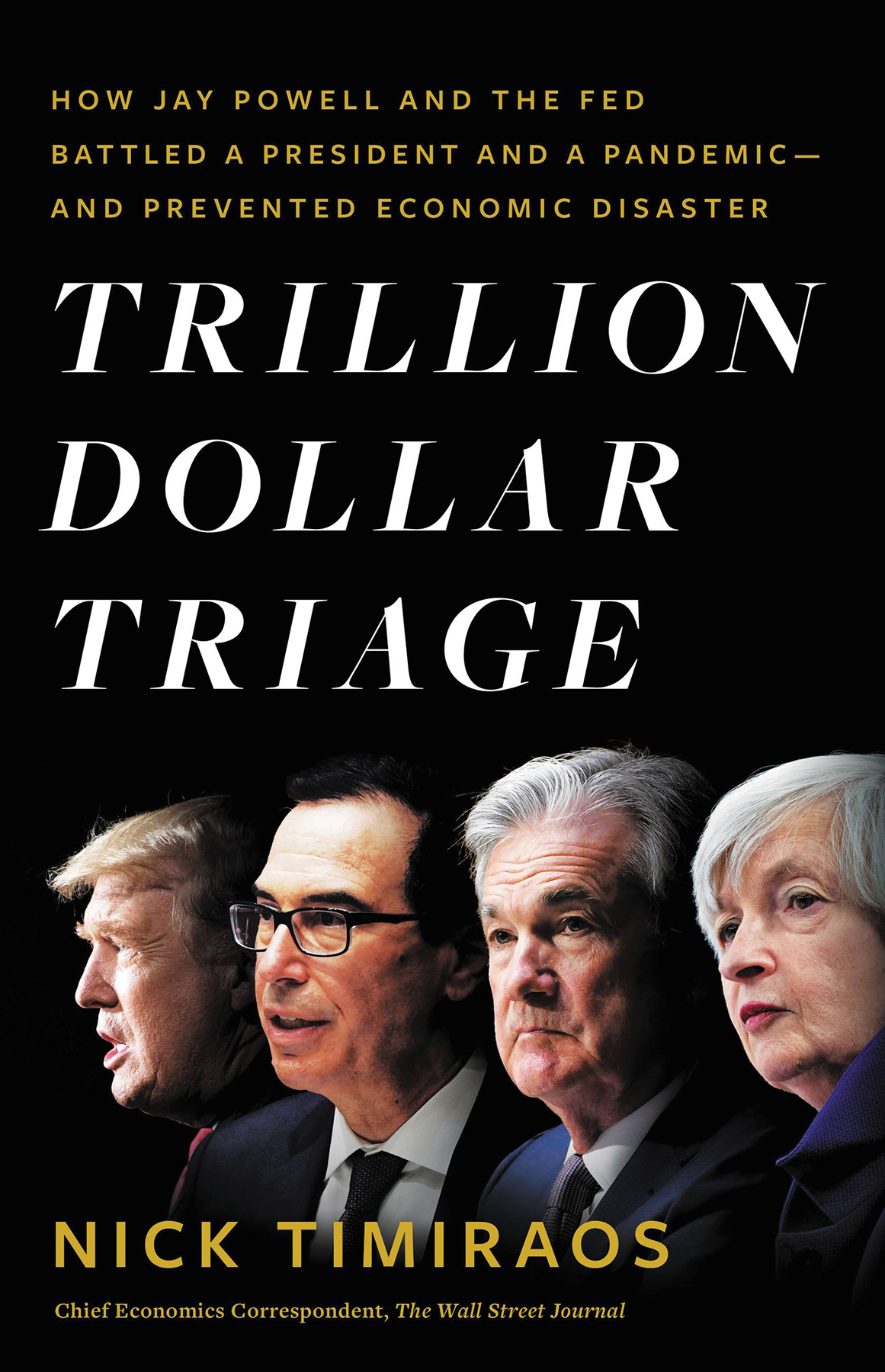

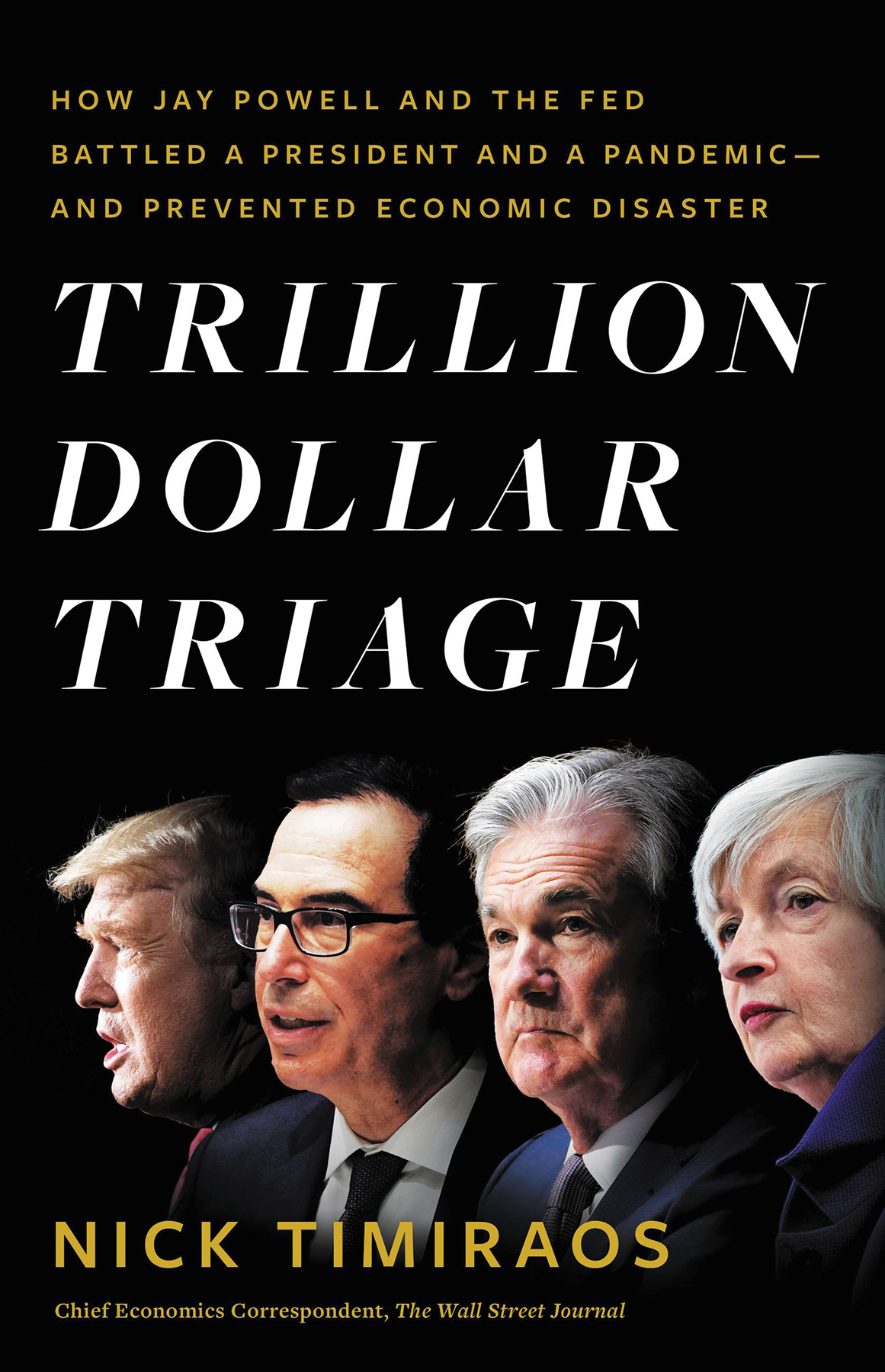

The trim, silver-haired Powell, who had spent his career at top-flight law firms, investment companies, and as a White House appointee, moved comfortably in these rarefied settings. He had survived a tumultuous first two years at the top of the Fed, earning the respect of Democrats and Republicans for his levelheaded leadership in the face of constant attacks from President Donald Trump. By most metrics, the US economy he was responsible for monitoring was in very good shape after the central bank had shifted from raising rates in 2018 to cutting them in 2019, a humbling U-turn. But the conferences luxuries and cultural trappings offered just a temporary distraction from unsettling news about a virus that had recently emerged in the Hubei province of China.

That weekend, the novel coronavirus had gone viral, with outbreaks now multiplying in Iran, South Korea, and Italy. In Riyadh, there was little opportunity for Powell or other global economic leaders to officially discuss global responses to the virusthe summit had been planned down to the minute many weeks earlier. Talk on the sidelines of the conference, however, quickly turned to how northern Italy was sealing off eleven towns inside a quarantined zona rossa, or red zone, enforced by military police. Major events such as the Venice Carnival were being canceled. Guests didnt know what to thinkit all sounded like something out of The Andromeda Strain, the 1969 Michael Crichton techno-thriller about a deadly rogue pathogen from outer space. Would it be a worse repeat of the 2003 SARS outbreak, which killed hundreds, primarily in East Asia? Or something more serious? Over 2,300 people had already died, almost all of them in China.

Powellwho was not trained as an economisthad spent hours poring over economic papers and textbooks when he first joined the central bank in 2012 so he could take part in monetary debates. In recent weeks, he had added the latest epidemiological research to his evening reading diet. There were still more questions than answersthe virus appeared to be less lethal than Ebola or SARS, but it was extremely contagious.

In Riyadh that weekend, Powell walked away from a private meeting with Lee Ju-yeol, the head of South Koreas central bank, struck by Lees firsthand report over the stringent public-health measures already being deployed in South Korea to prevent outbreaks. Not good, thought Powell. Until then, Powell shared the consensus view that the virus might sap Chinese demand and roil supply chains for a couple of quarters, denting growth in Asia, but it would not be memorable for the United States. The previous week, for example, Apple had announced it would miss its quarterly sales goal because of chaos caused by the coronavirus in China. Unfazed investors sent the tech-heavy Nasdaq stock index to a record high the following day.

When it was his turn to address the international delegations, Powell slapped a huge disclaimer on his cautiously positive outlook. I hold these views with very, very low confidence, he said, and Im really wondering whether theyre right at this point. His private remarks would have been especially notable if they became public because the Fed leaders words can cause huge, nearly instantaneous drops in investor confidence and stock markets.

Officials from Hong Kong and Singaporeareas that had been heavily affected by similar earlier virusesskipped straight past standard monetary-policy measures and discussed extensive, much more radical, fiscal measures, such as income-replacement programs, that were being rolled out to defend against the viruss disruptions. It was a wake-up call for Western financial officials.

On his last day in Riyadh, Powell began to think it was only a matter of time before virus clusters would multiply through US cities. He called his colleagues at the Fed. What capabilities are available to the Treasury to do anything specific about this? he asked. And by the way, what authorities do we actually have?

During the previous years trade war, Trump had come up with a farmer-bailout program that ultimately directed nearly $25 billion to offset losses in exports. Was there a similar way for the Treasury Department to quickly make government payments available if American cities had to start shutting down commerce to stop the spread of the virus?

During a television interview from Riyadh on Sunday, February 23, Mnuchin, a former partner at Goldman Sachs with jet-black hair and black-framed eyeglasses, said there was no question that the US government had a backup plan to deal with a contagious virus, but he also said it was too soon to say what that would entail. In another three or four weeks, well have much better data, he said. I dont think people should be at the point where theyre panicked. On the other hand, it is concerning.

On Monday, February 24, Powell climbed on a jet for the flight back to Washington, DC. In 2018, hed been asked at a forum if he slept well at night. No one wants a central banker who sleeps well, he joked. What good is that? But there wasnt much he could do for the moment. He switched off his phone and settled in for the fourteen-hour flight.