VALLEY BOY

ALSO BY THE AUTHOR :

Experiments in Physical Optics Using Continuous Laser Light

Classic Supercharged Sports Cars

Sex and the Single Zillionaire

VALLEY BOY

The Education of

Tom Perkins

Tom Perkins

First published in the UK by

Nicholas Brealey Publishing in 2007

35 Spafield Street | 20 Park Plaza, Suite 1115A |

Clerkenwell, London | Boston |

EC1R 4QB, UK | MA 02116, USA |

Tel: +44 (0)20 7239 0360 | Tel: (888) BREALEY |

Fax: +44 (0)20 7239 0370 | Fax: (617) 523 3708 |

www.nicholasbrealey.com

Published by arrangement with Gotham Books, a member of Penguin Books (USA) Inc.

Copyright 2007 by Thomas J. Perkins

The right of Thomas J. Perkins to be identified as the author of this work has been asserted in accordance

with the Copyright, Designs and Patents Act 1988.

ISBN-13: 978-1-85788-505-7

ISBN-10: 1-85788-505-9

Photo credits:

Pages x, 103, 118, and 130: KPCB achive; Pages 2 and 7: Associated Press; : Russ Fischella

Portraits; :

The Hewlett-Packard Company; : Rolex;

:

HarperCollins; : K. Freivokh

Set in Electra with Industrial 736 and Lord Swash

Designed by Sabrina Bowers

British Library Cataloguing in Publication Data

A catalogue record for this book is available from the British Library.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording and/or otherwise without the prior written permission of the publishers. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form, binding or cover other than that in which it is published, without the prior consent of the publishers.

Printed in Finland by WS Bookwell.

To Kathy, Richard, Chris, Gillian, Justin,

Brian, Angela, and Morena, with thanks

I have observed that both optimists and pessimists seem

to leave this world in the same way

but the optimists live better lives.

SHIMON PERES

Contents

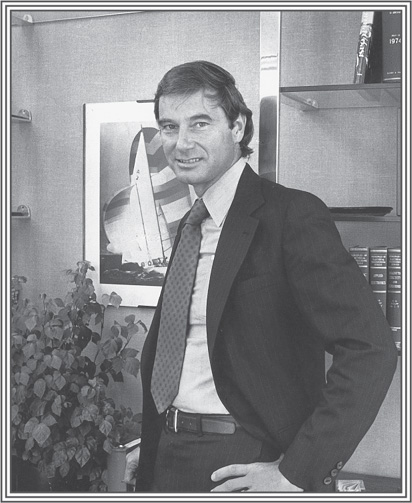

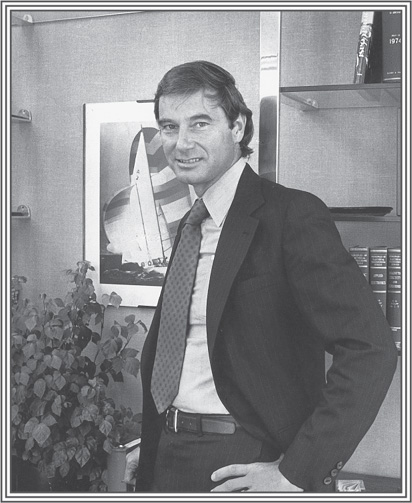

Tom Perkins in 1973 in the first Kleiner & Perkins office

Authors Note

If you are looking for something like Investing in High Techthe Seven Secrets, I confess right now I dont have these secrets. You wont find checklists or tips in this book. But I have been privileged to be on the ground floor of Silicon Valley, and these are stories from that world. The building of Kleiner Perkins Caufield & Byers is such a story, and the creation of Genentech another. I will share some of this history, together with a number of other events in my life that are personal and not venture-oriented, like the toughest assignment I ever hadincredibly, it was for the San Francisco Balletand being tried for manslaughter in a backwater French town. You will see that I am both a passionate player, and one who is still learning.

In places I have changed names and identities to protect the innocent. (Or to shield myself from the wrath of the not-so-innocent!) But these tales are the truth, unvarnished, and as beautiful or as ugly as you may find them. The subtitle is a reference to The Education of Henry Adams. Adams was a self-proclaimed boy of the eighteenth century who was amused and bemused by the world about him, always learning, always finding more to learn. With a tip of the hat to that masterful autobiographer, this boy of the twentieth century will do his best.

So this book is an autobiography, but it does not remotely intend to include everything. It does not focus much on dates and numbers, nor does it follow the usual chronology. Others have done, and will do, a better job in documenting the history of the Valley. Rather, if we were together over a few dinners, or were traveling on a voyage, when it was my turn these are the stories I would tell. You wont find them elsewhere.

And, as I said in my souffl of a novel, Sex and the Single Zillionaire, for better or worse, no ghost did the writing.

VALLEY BOY

Chapter One

Sometimes in Cat and Mouse, the Mouse Wins! Even If She Doesnt Play the HP Way

Most board of directors meetings are pretty dull, and the bigger the company, the more true this becomes. The Hewlett-Packard Company is very big, one of the biggest in the world. So, when in early 2005 the board unanimously voted to invite me back, I didnt anticipate much excitement. But I soon discovered that the old warhorse (me) was being summoned back for one final battleand after the battle was won they found that the horse ate, as usual, too much hay and crapped, as usual, all over the landscape But wait! I am getting ahead of the story.

My history with the company goes back decades, and later Ill get to my experiences working directly for Dave Packard and Bill Hewlett. Even though I had already resigned from HP three times, twice as a kid employee and once as a director, I loved the place. I had no thought of resigning, in May 2006, from the board in cold fury!

The day was typical Palo Alto beautiful, and the boardroom had its usual bland and modest look. But there were deep tensions around the table. We directors had been through a struggle that had left ugly wounds. I had originally joined the board in 2001 when HP acquired Compaq, a Kleiner & Perkins company on whose board I sat. The merger was a tough-fought battle, brilliantly waged by Carly Fiorina, HPs celebrity CEO.

Carly and I met for the first time just before the merger at that famous place for deal-making, the Village Pub in Woodside. Over dinner I agreed to join the new HP board if the merger went through, helping to represent the Compaq shareholders, myself included, who would be traveling along with a couple of other original Compaq directors into the future of the new HP.

Carly Fiorina, former CEO of the Hewlett-Packard Company

Carly is a star: an assured personality, attractive, and with a mind of the highest caliber. At that dinner I suggested that we establish a technology committee of the new board, like an audit committee but focused on the nearly five billion dollars per year that the combined companies would be spending on research and development. She loved the ideaan industry firstand made me the new committees chairman.

The merger, which cost HP nineteen billion dollars, was the biggest in high-tech history. Not only did Dave and Bills heirs hate itvoting against the combination, losing a very close proxy war (during the battle, Carly made a rare public relations faux pas, demeaning Walter Hewlett, then on the HP board, by calling him just an academic and musician)but Wall Street hated it too, mostly. The family members didnt like the idea of diluting their ownership by issuing all those new shares to acquire Compaqthey thought HP could do fine on its ownand Wall Street was fully aware that virtually all big mergers in high technology failed. They werent convinced that the synergies could be achieved. After 9/11, the stock really tanked.

Next page