Contents

Guide

Page List

THE STORY OF

SILVER

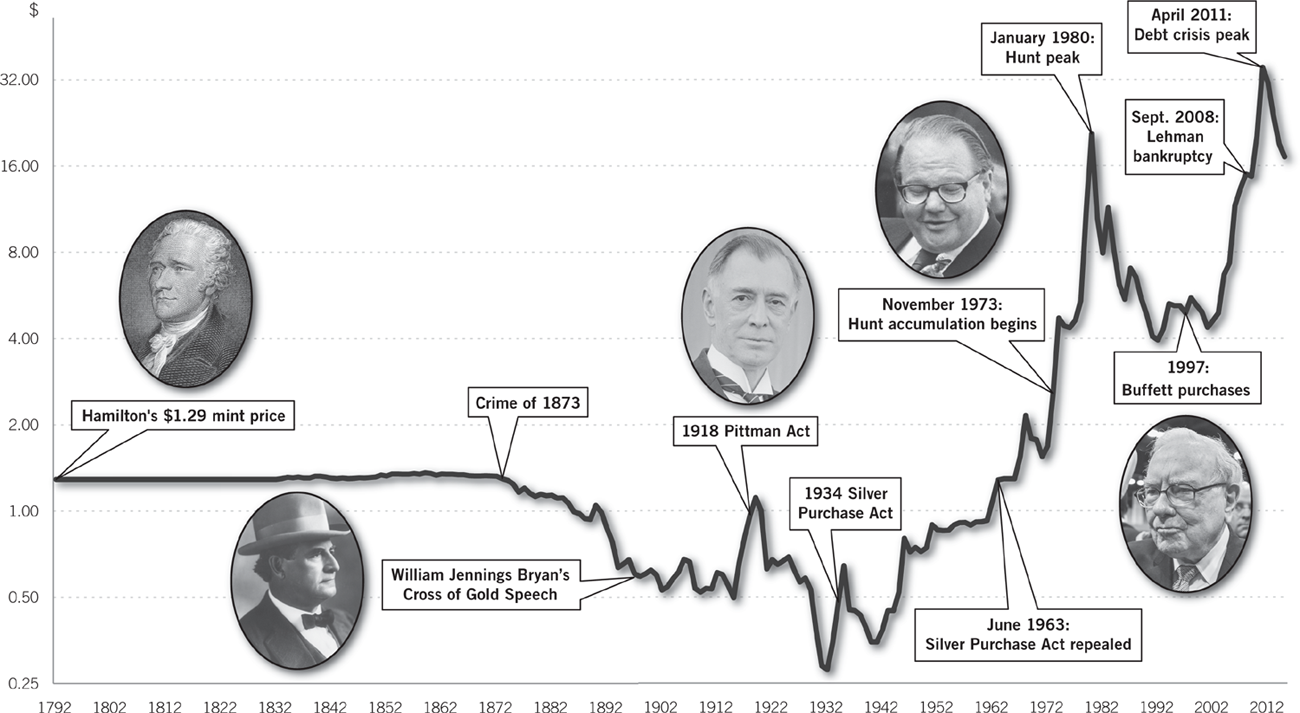

Silver Prices for 200 Years

This semi-log chart shows the annual average price per troy ounce of pure silver in U.S. dollars from 1792 through 2015 and some of the major events influencing the white metal during that period. The data are spliced from the following sources: 1) The U.S. Mint price from 17921833; 2) The average market price reported by the Department of the Mint, 18341909; 3) The average of monthly prices reported by the CRB database, 19101946; 4) The average of daily prices reported by the CRB database, 19472015. The annual average price in 1980 is lower than in 2011, even though the daily peak price ($50) was higher in 1980, because daily prices fell more precipitously during 1980 compared with 2011. Note: Because of inflation, the value of $1.29 in 1792 is equivalent to $31.30 in current dollars of 2011, when silver hit a peak of $48 (based on the consumer price index calculator from the EH.net website of the Economic History Association).

By the Same Author

Volcker: The Triumph of Persistence

When Washington Shut Down Wall Street:

The Great Financial Crisis of 1914 and the Origins of

Americas Monetary Supremacy

Financial Options: From Theory to Practice (coauthor)

Principles of Money, Banking, and Financial Markets (coauthor)

Financial Innovation (editor)

Money (coauthor)

Portfolio Behavior of Financial Institutions

THE STORY OF

SILVER

HOW THE WHITE METAL SHAPED

AMERICA AND THE MODERN WORLD

WILLIAM L. SILBER

PRINCET ON UNIVERSITY PRESS

PRINCETON & OXFORD

Copyright 2019 by Princeton University Press

Published by Princeton University Press

41 William Street, Princeton, New Jersey 08540

6 Oxford Street, Woodstock, Oxfordshire OX20 1TR

press.princeton.edu

All Rights Reserved

LCCN 2018941299

ISBN 9780691175386

eISBN 9780691184517 (ebook)

Version 1.0

British Library Cataloging-in-Publication Data is available

Editorial: Peter Dougherty and Jessica Yao

Production Editorial: Natalie Baan

Text and Jacket Design: Leslie Flis

Production: Jacqueline Poirier

Publicity: James Schneider

Jacket Credit: 1879 US silver dollar

To

Danny

You left us too soon

CONTENTS

xiii

xvii

A lover of silver will never be satisfied with silver.

Ecclesiastes 5

F ROM THE A UTHOR

ACKNOWLEDGEMENTS

I DID NOT KNOW N ELSON B UNKER H UNT, WHOSE DEATH IN 2014 spawned this book project, but many who knew him well shared their insights and recollections. I could not have written the story of silver without them. Phil Geraci of the Kay Scholer law firm that represented the Hunt brothers during their silver manipulation trial was a young lawyer back then and provided key personal observations from his six-month interaction with the Hunts. His assistant Patricia Apuzzo made it easy to use the related material. Henry Jarecki, whose business dealings with the Hunts while chairman of Mocatta Metals Corporation lasted more than a decade, gave me access to his unpublished manuscript that offered details unavailable elsewhere. His assistant Emily Goodnight made the process enjoyable and productive. Professor Jeffrey Williams served as an expert witness for the Hunts at their 1988 trial and provided copies of plaintiff and defendant expert reports that had been stored in his garage since then. I also relied on his excellent book on the economic testimony at the trial.

But this book is more than just about the Hunts. It is the story of silver, so at the beginning I spent a day with silversmith Geoffrey Blake at Old Newbury Crafters in Amesbury, Massachusetts, watching him mold the white metal into sterling silver flatware with the same tools and techniques that Paul Revere might have used. The ancient craft practiced in Blakes dusty basement workshop contrasted with the modern spectrograph used by Don and Angelo Palmieri in their Gem Certification & Assurance Lab to determine whether sterling silver jewelry contains the required 92.5% pure silver. But some things do not change. I watched Albert Robert (Irina and Gabriels cousin) of the New York Gold Refining Company turn a silver coin into molten metal by heating it in a blackened crucible over an open flame as in ancient times.

My research work benefited from the cheerful effort of many individuals. I owe Carol Arnold-Hamilton, Alicia Estes, and Robert Platt, librarians at NYUs Bobst, for recovering source material that challenged Googles algorithms. Jack Shim, an outstanding PhD student at NYU Stern, and Omer Morashti, a great Stern MBA, analyzed the data with surgical skill. Bob Oppenheimer shared firsthand observations of the silver ring at the Commodity Exchange (Comex). Bernard Septimus, my friend for as long as I can remember, applied his biblical expertise to keep my references consistent with modern scholarship. Seth Ditchik and Bruce Tuchman read an early draft and molded the framework of the story for the better. Dick Sylla, Ken Garbade, and Paul Wachtel read the entire manuscript as if it were their own and scrubbed the fuzzy logic from the final product. Peter Dougherty, my editor at Princeton University Press, offered sage advice and gentle encouragement throughout the process. His e-mails at 5 a.m. were just the tip of the iceberg. My wife, Lillian, let me work on the book whenever I wasnt playing golf, read every word, and excised most (but certainly not all) of the annoying metaphors. And I apologize to my children and grandchildren for not calling the book Silber on Silver, a unanimous recommendation at our family gatherings that fell to the cutting room floor like so many other gems.

SOURCE MATERIALS

No one needs to read the notes appearing at the end of the book, but they are there to expand on historical details and to provide technical information. The notes contain citations to newspapers, periodicals, academic articles, and books to support specific opinions and quotations appearing in the text. Statistical tests and a precise explanation of silver price data also appear in the notes. Silver prices usually refer to the price of physical silver in the form of bullion bars. These are sometimes called cash prices to distinguish them from prices in the futures market that become important in the second half of the book. The silver price data come from a variety of sources: 1) annual data during the nineteenth century come from the Annual Report of the Director of the Mint, Washington, DC: Government Printing Office, 1936; 2) daily data on silver prices during the 1930s were hand-collected from the Wall Street Journal, which published cash market quotations by bullion dealer Handy & Harman; 3) daily data on cash prices since 1947 and futures prices since 1963 were purchased from the Commodity Research Bureau (CRB), an independent data distributor that was a division of Knight-Ridder Financial Publishing and is now a division of Barchart.com, Inc., a Chicago-based vendor of financial data; and finally, (4) daily data on the London silver fix since 1968 come from the London Bullion Market Association as published by Quandl, an internet provider of economic and financial data.