Table of Contents

Also by Frank Partnoy

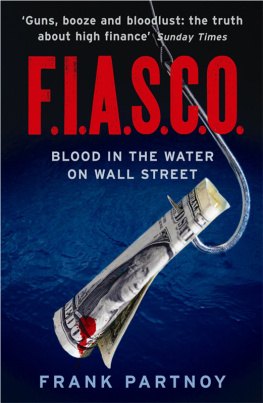

F.I.A.S.C.O. Infectious Greed

For Dad

He must surely have been the best-liked crook that ever lived

Frederic Whyte

Boiler-room operators, peddlers of stocks in the imaginary Canadian mines, mutual-fund managers whose genius and imagination are unconstrained by integrity, as well as less exotic larcenists, should read about Kreuger. He was the Leonardo of their craft

John Kenneth Galbraith

Everything in life is founded on confidence

Ivar Kreuger

PREFACE

By Thursday, October 24, every market in the world was in freefall: mortgages, stocks, bonds, and even derivatives that were supposed to act as insurance against losses. For most investors, it had been the worst week of the worst month of the worst year in financial history. Housing prices plunged. Lenders froze. Foreign markets crashed. By the time the closing bell rang at the New York Stock Exchange, many nest eggs were empty shells.

Officials at the Exchange announced that the markets would not reopen until Monday. Given the ferocious selling that afternoon, everyone needed some time to calm down. A record number of shares had traded on Thursday, and the market overall was down nearly 20 percent for the month. Prominent bankers and regulators scheduled closed-door meetings to discuss how they might stem the panic.

That evening, one of the worlds wealthiest men stood at a precipice. He had been at the center of a seven-year stock market boom, and had pioneered many of the complex new instruments that had come to dominate modern finance. His securities were among the most widely held in the world, and, incredibly, even as the markets collapsed, investments in his companies were holding firm.

As this remarkable man surveyed the turmoil, he worried that investors might lose faith in him, just as they had turned on other companies. The markets were volatile, and when people abandoned an investment, they did so in herds. Voracious short sellers bet against securities, vaporizing their value within days, or even minutes, as bad news spread to worse. One day a firm was a healthy household name, known and respected throughout the world. The next day that firm teetered on the edge of bankruptcy and disrepute. The victims of the crisis already included several prominent institutions.

This was not a time to disappoint anyone. Yet during the next few days, this man would be at risk of disappointing everyone, including his closest advisors. For the first time, his accountants and investment bankers were seriously questioning some of his transactions. They especially wanted to know about the debts of some secret subsidiaries he had incorporated in Luxembourg. These debts, known as off balance sheet obligations, didnt appear in any of his companies financial statements, and his advisors wanted proof that there was money to repay them.

The man insisted there was no reason to worry. He promised that during the next few days he would close his biggest deal yet, a massive loan to a government that was hungry for cash. The markets would be closed Friday, and he was scheduled to meet with this countrys finance minister on Saturday morning, to finalize the terms of the loan. This deal, he assured them, would erase any doubt about his finances. It would be front-page news in The New York Times and the Wall Street Journal. The editors at Time already were planning to put his face on their upcoming cover and to run a feature story about how he continued to defy the deepening financial crisis.

But in order for his plans to work, the man had to take one massive risk. Given the panic, he could not raise all of the cash needed to fund the loan right away. Instead, he would have to promise to cover the loan himself. Until the markets recovered, his entire fortune would be staked on that one foreign government loan. It was a stunning and unprecedented idea, but he was prepared personally to guarantee one of the largest loans in history.

On the Monday after he signed the loan, in October 1929, the markets crushed his hopes with the largest collapse in financial history, the events that people called the Great Crash. Instead of soaring, as he had hoped and imagined, stocks fell by 25 percent in two days - days that came to be known as Black Monday and Tuesday.

This man became the symbol of the 1920s excesses. The congressional investigation into his companies led to the securities laws that govern todays markets. His colleagues and advisors were publicly humiliated. His once-prestigious investment bank fell into disgrace and then dissolved in bankruptcy. Regulators, who had welcomed the man as a financial savior of investors and a high priest of business, suddenly claimed he had been the worlds greatest swindler.

Today, the need to understand this mans rise and fall is greater than ever. Financial markets leave most of us mystified and helpless. We have so many questions. Where should we put our money? Which investments are safe? Should we trust our brokers? Will the institutions we work for or invest in suddenly implode, like Bear Stearns or Enron or Lehman Brothers or Bernard L. Madoff Securities? When will the next crisis hit, and who will it hurt?

Most people cannot spot financial crises in advance. We buy just before the collapse, when in retrospect we realize that we should have sold. Then we sell at the bottom, when we should have bought. At the same time, we are spell-bound by the people who outsmart the markets - Warren Buffett, George Soros, and the hundreds of hedge fund managers who somehow pocket nine-and ten-figure bonuses, even during times of panic and crisis.

What do they see that we do not? One view is that they understand the complexities of modern finance, including the $600 trillion derivatives market, which average investors cannot hope to penetrate. Indeed, the sharp contrast between bewildered masses and financial lite might seem unprecedented today. Even the language of modern finance sounds new: swaps, off balance sheet liabilities, offshore subsidiaries, complex corporate voting structures, hybrid securities, credit default swaps, and collateralized debt obligations.

But in truth not so much of this is new, and the new part is not why the savviest people make so much money. Warren Buffett and George Soros eschew derivatives. Hedge fund managers bet against the Wall Street banks that develop complex products. The best investors - today and yesterday - make money not because they understand abstruse mathematical models, but because they have a deep intuition about the timing and machinations of financial markets. Markets have been complex for a long time, and their ebbs and flows always have depended, not only on intricate disclosures about assets and liabilities, but also on human psychology. That has not changed since the 1920s.

The man whose life forms the basis of this book was a master of investor psychology, and his various schemes - legitimate and not - captured the imagination of shareholders in the 1920s in the same way dot.com internet ventures, auction rate securities, analyst stock tips, and derivatives backed by subprime mortgages have recently. We tend to think of these kinds of investments as scandalous because ultimately they caused so many people to lose money. But each of them also enriched those who understood what the schemes were designed to do, as well as the investors who knew when to buy and when to sell.