The Gist of GSTN

An engine that can define the Commerce of the Future

SREE IYER

Why this book?

Having spent about 20 plus years in Startups in Silicon Valley as an Engineer, I accidentally fell into a vat called Systems Engineering . This discipline of Engineering is not taught in any school but as more and more complex devices are being built, the need for a Systems Engineer, who can look at the various aspects of a complex device or system encompassing several branches of science and math (think of Engineering as an application of science) and come up with a commercially viable solution is great. Often times, this breed of fearless warriors are thrown in the deep end of a pool and asked to swim to safety.

As I started reading up on the Goods and Services Tax (GST) Bill as it was being readied, I was struck by its noble ambition - being a single tax collector which will allow goods to move seamlessly across states, languages and reach the destination in a time that is a fraction of what it is today. What was even more impressive was the stated goal of the Cyber backbone that was going to run this engine The Goods and Services Tax Network (GSTN) . If designed correctly, GSTN can create thousands of jobs for computer programmers who can build models, analytics, forecasting etc. so that the nation as a whole can weather droughts/ natural calamities etc. easily as all the information will be available on the touch of a button.

Who should read this?

If you are curious about how GST is going to change your life (believe me when I say this it will), then this book is for you. You may experience a hiccup or two while the new method takes shape but in the end it will catapult India to that of a developed country.

Many new companies will be formed to take advantage of the Data that GSTN can provide. To every new entrepreneur, this book is for you. These are jobs that are yet to be defined and therefore you can have a head start.

Sree Iyer

Table of Contents

Table of Figures

Figure 4. Receiver places an order

Introduction

What was the need for GST and GSTN? This excellent video by Spine describes how GST simplifies the life of a Taxpayer (think Goods manufacturer/ Service supplier) etc. by creating a single window to pay taxes. From the Tax Collector side, which typically is the State Governments through which the goods will pass, the collection is made automatic and seamless. This is a win-win situation, as long as it is conceived, designed and developed properly.

As the GST Bill starts taking shape, four different rate slabs have emerged 5%, 12%, 18% and 28%. Essential items such as food will not be taxed. Could this have been simplified to just 3 slabs, such as 5%, 10% and 25%? Because remembering three things is easy it has been proven in social research. Also, computing tax is easier. Consider a pair of shoes for Rs. 900. If the tax were to be 10%, drop one zero and it is Rs. 90. If it is 5%, halve it after dropping a zero Rs. 45. And if it is deemed a luxury good and taxed at 25%, it is a quarter of the price Rs. 225. This will hopefully move pricing to be similar to that of the Metric system, meaning Rs. 10, Rs. 100, Rs. 1000 etc. It will also mean the demise of Eclairs chocolate as a means of currency, which is not a bad side effect how many diabetics bring home the chocolate?!

How should GSTN be designed?

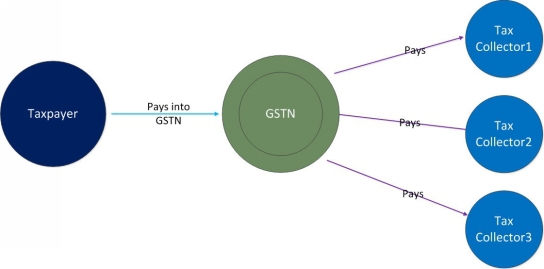

A simple design of the network would just have a limited interface for Tax payers and Tax collectors. In this simplistic model, the tax payers can login to find out the amount owed on a day-by-day basis. Tax paid will be kept by GSTN until it has determined the apportionment to various collectors. Based on how robust the software is, it can even do the laborious job of filling up the 30 odd forms and send them to the appropriate departments. The collectors could be one or more (typically it will be more than one State Excise/ Central Excise alone make up two in a transaction that moves within a single state). How long will the money stay in GSTN before it gets disbursed? This has not been answered yet. It would be ideal to have the money be moved within 48 hours or less this will ensure that the velocity of money supply will be robust.

Figure 1. A simplistic implementation of GSTN

Since all the transactions are computerized, GST with the help of GSTN should bring corruption down significantly in fact well implemented GSTN software can reduce corruption down to almost zero. Safeguards can be built into the GSTN software that can ensure that goods move freely and quickly across the country with minimum friction (e. g. no stops at state crossings). Some states currently are demanding that the goods be stopped at the state border and their concerns must be addressed and traffic must be allowed to proceed smoothly otherwise it defeats the very purpose of GST. It is a well known fact that checkpoints are dens of corruption.

But is this all GSTN needs to do? With a few enhancements in the design, built into the plumbing, GSTN can be a treasure trove of data, which with orderly access can help several vertical applications (i. e. new companies) be developed and provide thousands of jobs. By orderly access I mean a method by which data is access controlled with scope defined as needed but at the same time have a robust Application Programming Interface (API) that allows third party software to access the data that GSTN servers will hold for performing various tasks.

GSTN Basics

In its first avatar, GSTN tries to provide a simple Tax interface to tax professionals and Government departments such as the Income Tax, Central Board of Excise and Customs (CBEC) and State Tax Departments.

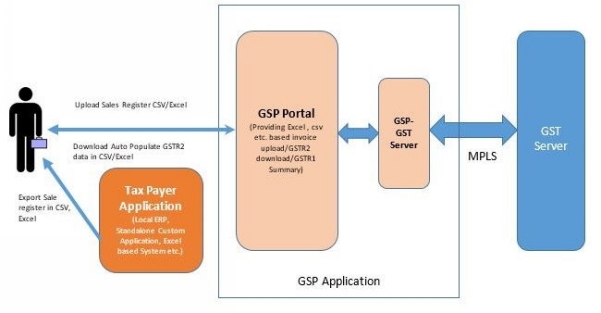

Figure 2. Typical GSP interface for third party developers

Figure 2 is a demonstration of how a third party can design their software/ application to talk to the GST Server. All such applications are grouped into a category that GSTN refers to as GST Suvidha Provider (GSP). In the above figure, the GSP application has its own server, which in turn connects to the GST Server in a Secure manner (think of it like a user buying goods from Amazon online store. An observant user will see a lock at the beginning of the site link to denote that the connection is secure ). As a rule, I would recommend that you only visit secure sites on the web. These will start with https:// instead of http://. GSTR1, GSTR2 etc. are standard terms used to denote specific functions; GSTR1 refers to data of Outward supplies of goods and services and is a form that needs to be filled electronically. Similarly GSTR2

refers to details of Inward supplies of goods and services, also a form.

While it is possible to manually fill in these forms and submit them into the GSTN servers, it is highly recommended that all vendors use computerized GSP applications to automate this process. This will minimize errors, save time and cost and also keep track of records. This alone will create a lot of jobs for programming, data entry and so on. GSTN has provided a useful slide deck that describes how the typical use cases will be for GSPs from Slide 12 onwards.

A robust GSP would be able to display on many devices such as a Laptop, a Desktop, a Tablet or a Smartphone. All of these come with their own display sizes and features and therefore the GSP software that renders data on these devices needs to be smart about the device it is talking to. Many Open Source frameworks exist today that can form a starting point for simple GSP applications. Different departments will need to look at different aspects of a companys operations. A well designed GSP app would show the tax information to the accountant, the status of various carriers to the logistics person, information on where the raw materials are for the production person and so on. Figure 3 shows a typical GSP that would perform such functions. In this instance, all the devices use Wi-Fi network to connect to their server (GSP Server). The GSP Server itself uses any of the connectivity interfaces such as Ethernet/ Fiber/ Satellite etc. to connect securely to the GST Server. This is the preferred configuration for most GSP apps.