Scott Pape is the founder of the Barefoot Investor.

For 15 years hes reached millions of Australians through his national weekend newspaper column, appearances on TV and radio, and bestselling books.

In 2010 independent research firm CoreData found that:

SCOTT PAPE is considered the most knowledgeable regarding financial matters, topping the ratings in the areas of superannuation, investment, taxation, insurance and economics. Pape is also considered the most trustworthy, truthful in how he presents himself and in touch with financial matters that affect everyday Australians.

In 2014 he was chosen to assist with the governments national financial literacy in schools program. He has worked with AFL and NRL teams, struggling single mums and elderly pensioners.

In 2016 he wrote The Barefoot Investor: The Only Money Guide Youll Ever Need. It has sold over one million copies.

Scott lives in country Victoria with his family, on their farm, and is often seen belting around in an old ute that doesnt need to be locked.

Theyve got this!

Parenting is a tough job.

Everyone wants to see their kids succeed.

Yet unless someone gives you a financial road map, how are you supposed to know what to do?

Look, everyone knows that feeding their kids junk food each day is bad... but when it comes to how to raise financially strong kids, where do they turn for that common sense advice?

After all, its not being taught in schools.

And marketers, banks and corporations are finding ever-increasing ways to target kids.

Thats why I wrote this book.

And its also why I wrote it in such a way that anyone can apply it: a single parent on Centrelink payments can do this with their pocket change and a few jam jars. There are deliberately no fancy apps and no specialist knowledge required. All it takes is a bit of time from a caring person.

So, I have a favour to ask of you:

If you got anything out of these pagesif you highlighted or circled anythingplease pay it forward and give this book to another parent. Ask them to read it. It could be responsible for changing their entire family tree.

And just like youve done for your kids, the greatest gift youll give is that their kids will never grow up and say:

If I knew then what I know now, things would be so different.

This country desperately needs a financial revolution, and it starts with our kids.

Spread the word.

Roughly once a week, a marketing guru contacts me with their ideas on how I can make a lot of cashola.

Their pitch is almost always the same:

I should capitalise on the success of the Barefoot Investor book by diversifying the product offering.

And their solution is almost always the same:

I should create an app that I can charge people $2.50 a month for.

Or sell Barefoot-branded piggy banks.

Or do a deal with a bank on a Barefoot-approved account.

And my answer is always the same:

No. No. And are you freaking kidding me? No!

I much prefer a no-technology method that I call three jam jars.

So, please put this book down right now, head to the pantry, and get some Tim Tams. While youre there, check and see if you have three jam jars.

(Actually, any three glass jars will do. We had the same big-arse jar of pickled onions in our pantry for my entire childhood. I guess Mum bought them thinking shed try that fancy Peter Russell-Clarke recipe, but never got around to it.)

Also check and see if you have stickers to get your kids to label their jarsthe more sparkly the better. If you dont, make a note to buy some jam and stickers next time youre doing the shopping.

Go on, do it.

Done? Good.

Okay, now as you munch on Tim Tams, lets jam... jars (and that is my first, and last, dad joke of the book).

Jam jars are the new buckets

If the whole idea of dividing your money into three sounds familiar, youd be right...

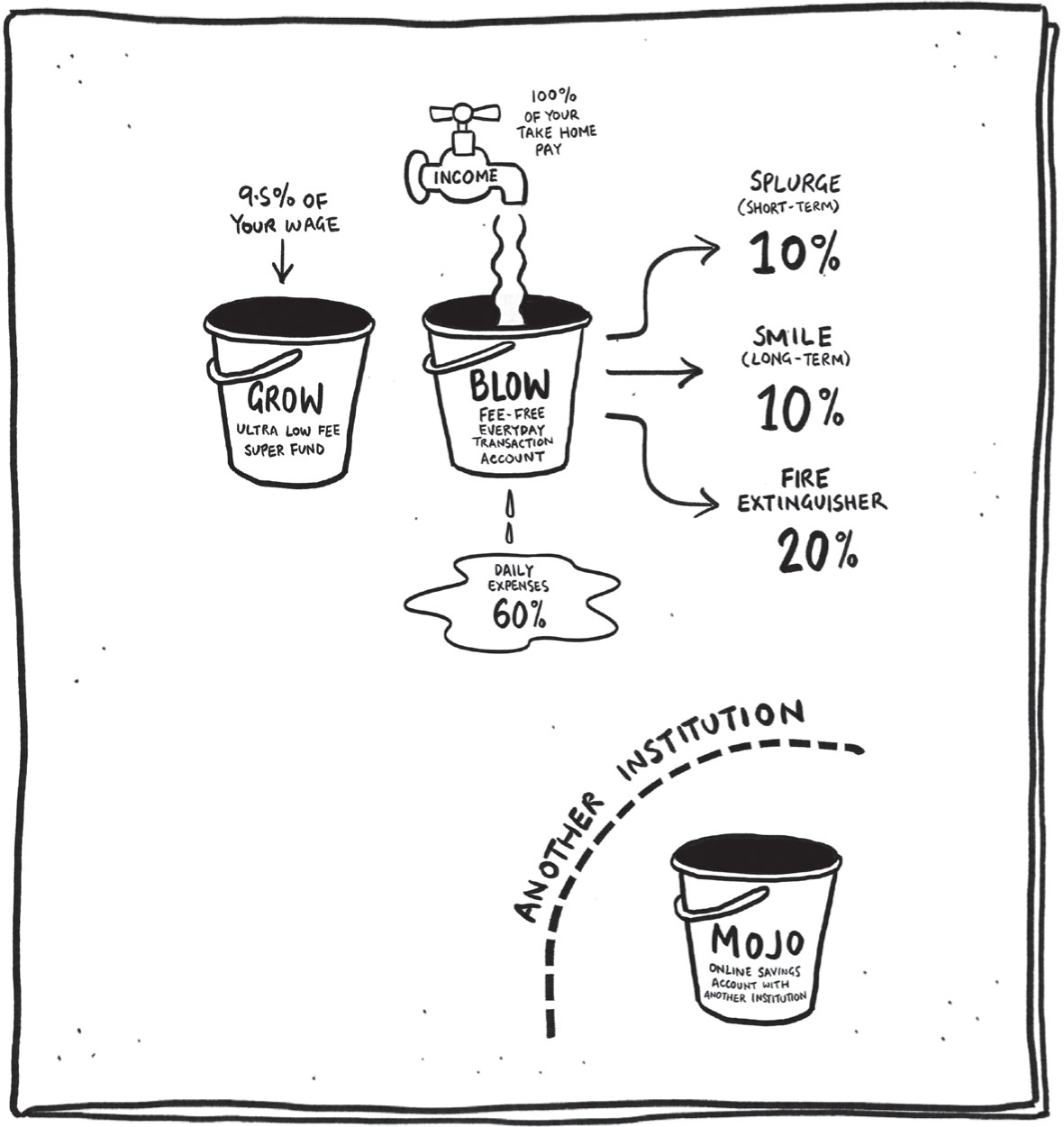

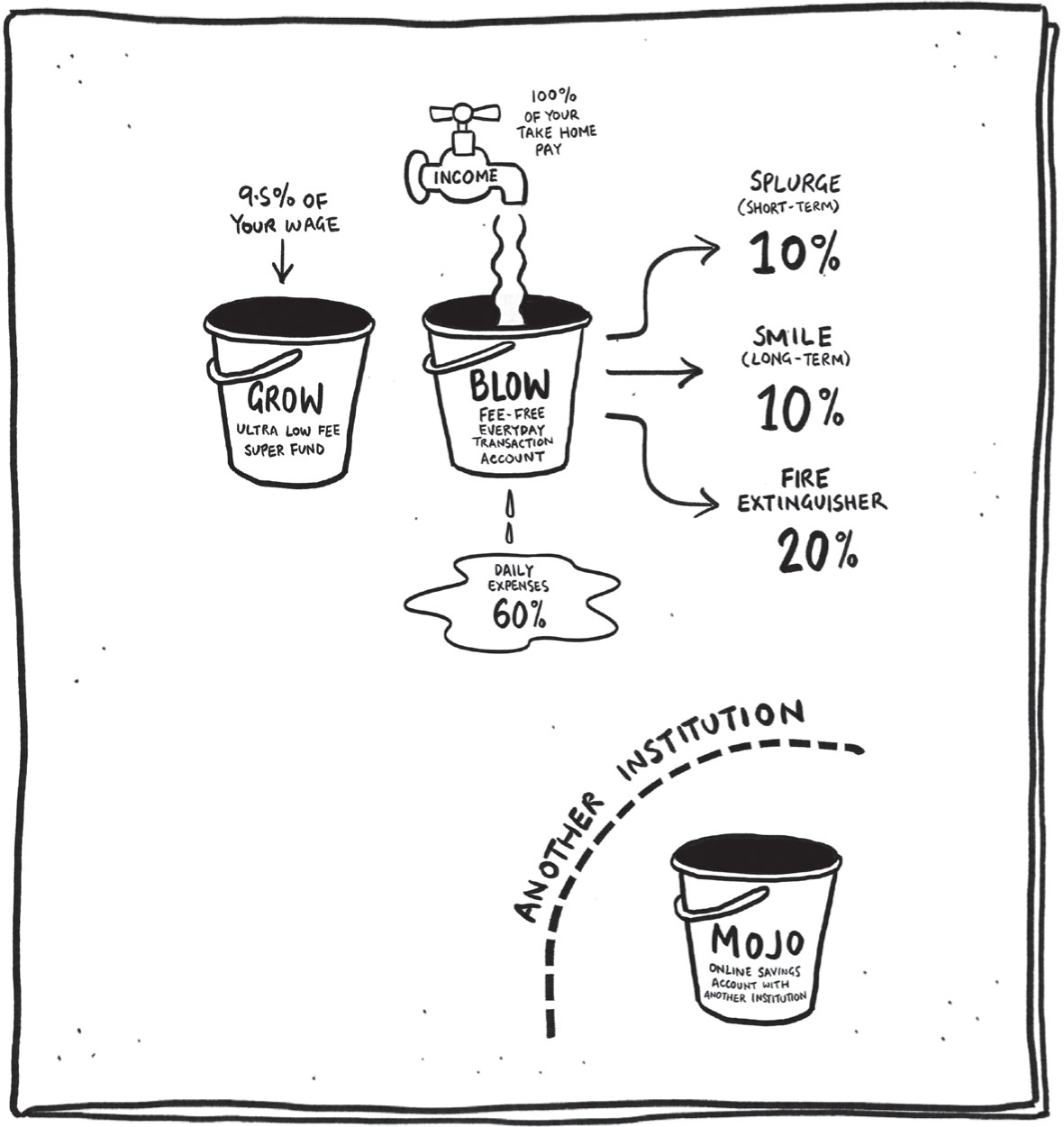

If you read The Barefoot Investor, youll know that I have the simplest money management system going round. In fact, its so simple I sketched it out on a serviette on my very first Date Night with my wife. Which is why I call it the Serviette Strategy.

As part of that strategy, I recommended dividing your money into buckets, and setting up several bank accounts: Daily Expenses, Smile, Splurge, Fire Extinguisher and Mojo.

It caught on so well that some in the media even referred to it as the biggest finance cult in Australia.

Why thousands of Australians have the same bank card, labelled Splurge.

Right now, thousands of Australians are flashing orange bankcards with mantras penned with sharpies and stickers. Splurge, they read. Daily expenses read others. And they all signal one thing: that you are following the biggest financial cult in Australia.

Well, for this book, jam jars are the new buckets for kids.

Its standard practice to use three containers to teach kids: there are fancy options like Moonjar Australias three-part Save, Spend and Share money box and US-based financial guru Dave Ramseys Smart Saver Bank, which does the same thing.

In fact, in my last book, I even recommended the concept of jam jars for little kids. However, Im now convinced that kids all the way up to 15 or so should have them (with a few age-appropriate variations which Ill explain in good time).

After all, the point is they will transition from the jars to bank accounts when theyre older.

And theres power in kids being able to see theyre using the same kinds of accounts their parents have.

So let me introduce you to the three jam jars your kids (under the age of 15) will be using...

The Splurge Jar

Okay, its time to walk off those Tim Tams.

Get up! Stretch!

Put a sticker on one of the jars, grab a texta, and write Splurge.

This jar is for your kids day-to-day spending.

Hang on, am I saying that I want your kids to splurge part of their money?

Yes, thats exactly what Im saying.

The truth is that sometimes pocket money works a little too well: kids can get so addicted to watching the coins pile up in their jars that they dont want to spend it:

Little Mickey is such a good little saver; he wont spend his money on anything! brag his proud parents.

Twenty years later...

Michael is such a miserable tightarse! He wont spend money on anything or anyone. No wonder he cant get a girlfriend, snivels his frustrated friend.

You dont want your kids to grow up with an unhealthy obsession with money. Neither do you want your kids to grow up like one of those twatty teenagers on Instagram who posts a selfie with their $900 handbag (#myparentsfailed).

This jar will help turn your kids into well-adjusted, savvy spenders.

Theres just one caveat with this jar for older kids:

No self-respecting 12-year-old is going to the mall with a jam jar tucked under their arm.

Hey Todd! Check out my jam jar, man. Not going to happen.

So, in addition to their jam jars, Id suggest you get them a wallet or purse that they can transfer their Splurge money to.

The Smile Jar

Grab the second jar, with sticker, and label it Smile.

Like the Smile account in my Serviette Strategy, the Smile Jar is for saving up for things that will make your kids smile.

Next page