Time Investor

Copyright 2020 Renae Grace

Published by Renae Grace at Smashwords

Version 1- Last update: August 2020

seb@bankstermind.com

Other books by thisauthor

Renae Grace has produced many books and trainingcourses about Financial Freedom, Real Wealth and PersonalPower.

If you liked this book, you should probablycheck out:

Online Gigs and Jobs( http://onlinegigsandjobs.com)

Passive Income in the21stcentury (withSebastian, http://passiveincome21.com )

Bankstermind: how to safely compoundReal Wealth at 25% per month (training course)

http://bankstermind.com

About the authors

Renae Graceand her husbandSebastian are authors, investors and perpetual travelers. Theyworldschool their twin boys and are gaga about animals.

Table of Contents

Chapter 1: Never sell yourTime

Chapter 2: Your mostprecious asset

Chapter 3: How to investin Time

Chapter 4: Risk

Chapter 5: Two gift from Heaven: Barrier to Entry and TheCompetition

Chapter 6: The 3 Forgottenskills

Chapter 7: The secrets ofOPW

Chapter 8: The most powerful Force in the Universe

Chapter 9: Compounding Real Wealth at 25% per month

Chapter One: Never sell your Time

(This book is the product of an extensiveinterview of my husband Sebastian. In the family, he's thefinancial guru and I'm the writer. His vision of success is to berich and anonymous. I want to help people. I convinced him to letme borrow his words so we could teach Financial Freedom to as manypeople as possible. I hope this will help you. Renae Grace.)

###

SPOILER ALERT: This ebook is like agood thriller without an ending. It is the introduction to my newtraining course Bankstermind: How to safely compound RealWealth at 25% per month .

I will guide you on the lesser know path ofwhat the Smart Money and multi-generational Family Offices do toget richer. There's only one twist: you can start with no moneyto speak of.

If that's something you might be interestedin, keep reading on. I promise I'll make it worth your while. Afterthe first few steps, though, you'll be by yourself. If you dig theway I look at things, shoot me an email at saying Seb, you motherf****r, how do you do it? and I'llgive you a 50% off voucher for the Bankstermind course.

###

Let me start at the beginning. I don'tremember it, but my father swears that I wanted to be rich from avery young age. Since he's a hardcore Marxist, I can only guesswhat that means

As you grow up, there are phrases,situations, concepts that stay with you for no apparent reason,like a sliver in your mind. Or a seed. You can't really understandthe meaning of it yet, but your subconscious brain is workingovertime to solve these existential puzzles.

There is one phrase that always gave me adouble-take:

Never sell your time.

What is that supposed to mean? From where Istand , the entire education system is entirely dedicated tobrainwash students to do just the opposite. Selling your timeAKA Get A Job.

It's pretty easy to see that nobody ever gotrich getting a job. Look further, and you'll spot an army ofentrepreneurs that started a business, but actually created a24/7 job for themselves.

Simply put, if you don't sell your time, WTFare you supposed to do with it? And how is that going to make mericher?

Fast forward a few years. Another whiterabbit pops up, this time under the form of a quote from WarrenBuffet (who else!):

Think about it. How do you invest intime?

To make a long story short: There is thispiece from the late Richard Russell, called Rich Man, Poor Man.( clickhere to read it ).

His description of the wealthy investor hitme hard. And it made me take the first steps on a path that changedmy life forever.

Chapter Two: Your most precious asset

Human Activity is a wonderful thing. One ofthe nicer by-product of Human Activity is money. I like to seemoney as a communication tool and a proxy for energy.

The World GDP is about $80 Trillion. US GDPis roughly $20 Trillion. That's a lot of Human Activity. There's noshortage of money.

I should add that there's more than $1.5Quadrillion worth of financial derivatives slushing around theglobal financial system, keeping this giant casino afloat. AQuadrillion is 1 Trillion x 1000. If you try to visualise that muchmoney your head will explode!

My point is, the amount of money out thereis basically infinite.

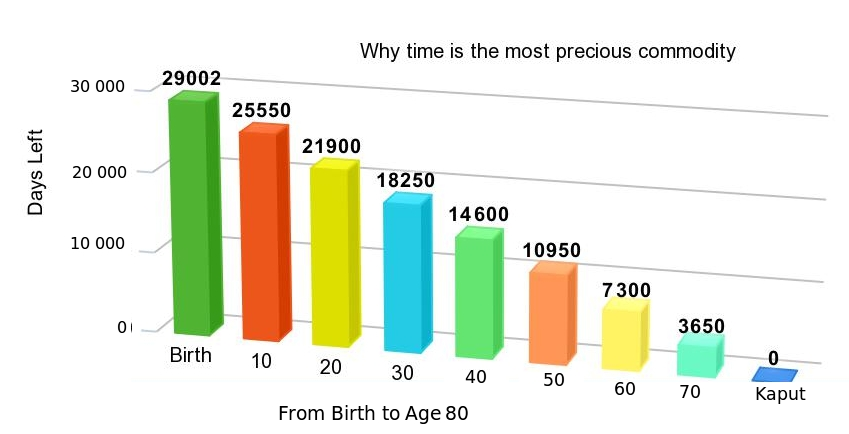

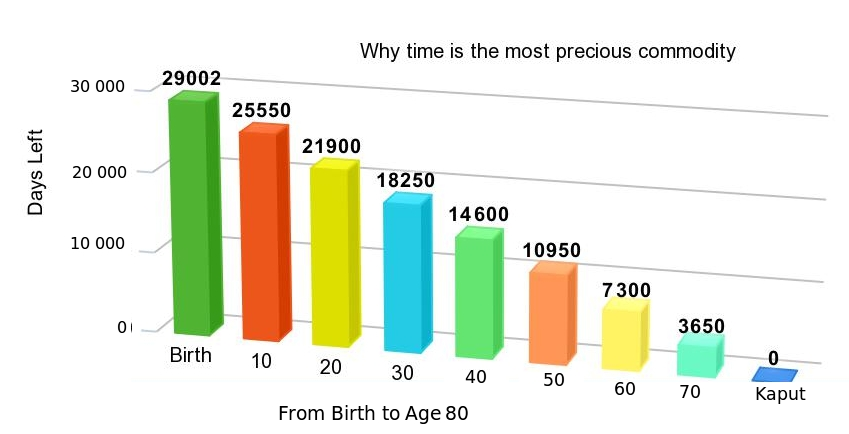

Contrary to money, time is limited. In, letsay, 80 years of life, you get 29 200 days. That's it.

By far, that makes Time your most preciouscommodity. And this is why, if you're wise, you don't sell it. YOUINVEST IT.

The good news is that you have the sameamount of time in a day as a billionaire does.

The bad news is you don't know how to invest.Or do you?

Chapter Three: How to invest in time

You are a Time Investor. You just don't knowit yet!

Most people don't see themselves asinvestors.

Still, you are allocating your most preciousasset (time) on a daily basis!

From the moment you roll yourself out of bed,to how you'll get to school or work or maybe staying at home allday smoking cigarettes and watching Captain Kangaroo.

You make decisions all day regarding the mostprecious asset you'll ever have! Think about it.

Remember that quote The rich invest in time,the poor invest in money ?

Well as it turns out, a dude named RobertKiyosaki wrote a great book about it. And he spells it out loudand clear.

Not only are you a Time Investor, but youhave a life worth of experience doing it. And if you're honest withyourself, you know very well when you are making a good investmentvs when you're wasting your time

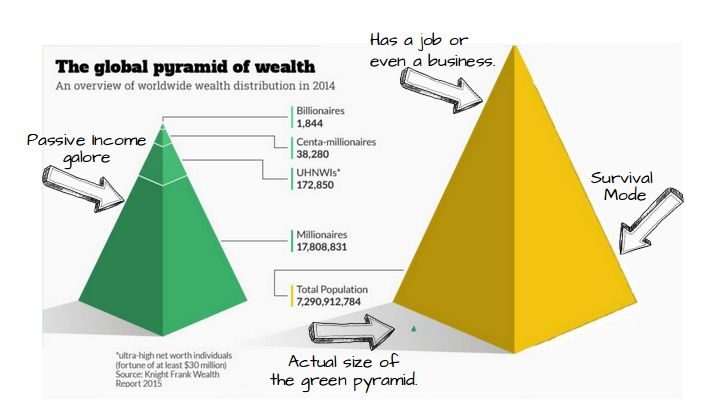

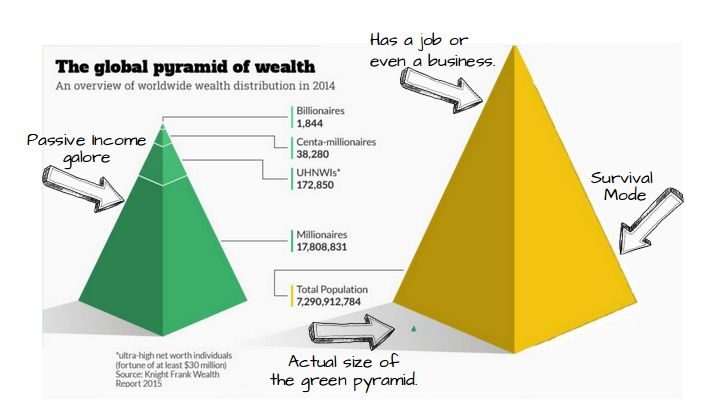

The graphic below represent humanity splitaccording to their financial net worth (ex principalresidence).

If what you invest your time in gives you theluxury of time (green pyramid), you are on track. If what youinvest your time in leaves always short on time (yellow pyramid),you're doing it wrong.

The only reason most people are in the yellowpyramid is because they get conditioned by their environement tosell their time instead of investing it.

There are powerful ways to leverage yourtime. This is what the rest of this book is about.

Chapter Four: Risk

The reason why most people are petrified ofinvesting is the risk of losing money. And most do.

Next page