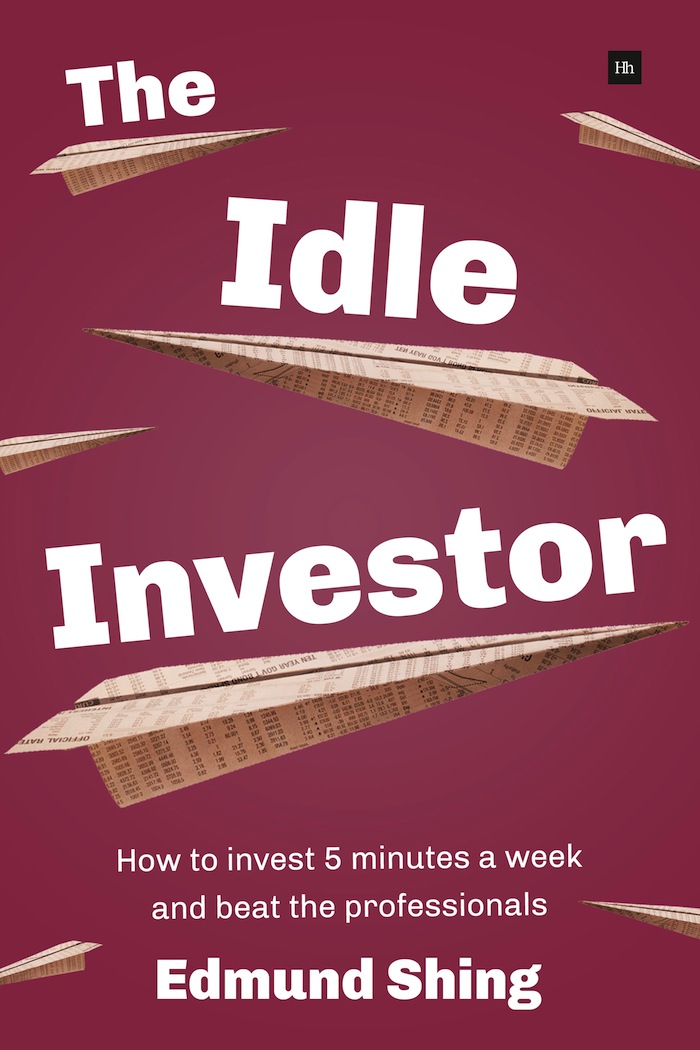

Edmund Shing - The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals

Here you can read online Edmund Shing - The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2015, publisher: HarrimanHouse, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals

- Author:

- Publisher:HarrimanHouse

- Genre:

- Year:2015

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Edmund Shing: author's other books

Who wrote The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals? Find out the surname, the name of the author of the book and a list of all author's works by series.

The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

The Idle Investor

How to Invest 5 Minutes a Week and Beat the Professionals

Edmund Shing

HARRIMAN HOUSE LTD

18 College Street

Petersfield

Hampshire

GU31 4AD

GREAT BRITAIN

Tel: +44 (0)1730 233870

Email: contact@harriman-house.com

Website: www.harriman-house.com

First published in Great Britain in 2015

Copyright Harriman House

The right of Edmund Shing to be identified as the Author has been asserted in accordance with the Copyright, Designs and Patents Act 1988.

Paperback ISBN: 9780857193810

eBook ISBN: 9780857194817

British Library Cataloguing in Publication Data

A CIP catalogue record for this book can be obtained from the British Library.

All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover other than that in which it is published, without the prior written consent of the Publisher.

No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the Employer of the Author.

All Figures created by Edmund Shing, with use of external data where attributed.

About the author

Edmund Shing is a Global Equity portfolio manager at BCS Asset Management, focusing on a combination of high-level investment themes and fundamental stock-picking. He is also a consultant for the Opportunit Idle Investor Fund, a French unit trust (SICAV) investing in a variety of smart beta ETFs based on the principles outlined in this book.

Edmund has previously worked at Barclays Capital (as Head of European Equity Strategy), BNP Paribas (as a Prop Trader), Julius Baer, Schroders and Goldman Sachs during a 20-year career in financial markets based in Paris and London. He also holds a PhD in Artificial Intelligence from the University of Birmingham. You can follow him on Twitter @TheIdleInvestor and his website featuring regular market commentary and investing thoughts can be found at

www.idleinvestor.com .

Acknowledgements

First and most importantly, I would like to thank my wife Kim for all her love, support and patience throughout firstly my doctorate, then my career in finance and most recently the writing of this book. I dedicate this book to her.

My mother and father, Teresa and Yuk Wah, have also been instrumental in my orientation towards education and then finance, having seen the enormous amount of hard work that they have put into their own various businesses over the years. Frankly, after working with them in catering and the hotel trade throughout my student years, one thing I realised very early on was that I wanted a career that was not going to be as tough as catering!

My four children Benjamin, Lucy, Oliver and William have been a key source of inspiration I originally wrote the book as a form of legacy for them, hoping to give them a simple investing system which they can understand, and that they will be able to follow themselves in the years to come when they start out on their own career paths. So I hope they find the time to read this book and then put the strategies contained within into profitable action.

I want to show gratitude to both my mother- and father-in-law Huw and Heather for reading the manuscript at various stages of development and giving me valuable feedback, preventing me from descending into the language of financial jargon.

Thanks go also to the team at the Paris-based Opportunit socit de gestion with whom I work on the Idle Investor fund, a UCITS IV fund based on the principles and strategies outlined in this book, and in particular to Pierre Krief at Opportunit, who has been instrumental in bringing the fund from initial concept to final existence.

Last but not least, my editor Stephen Eckett at Harriman House has been indispensable with his words of advice gleaned from years both writing and publishing financial tomes; I thank Stephen for honing what was initially a rather unwieldy first draft into something that I hope you will find far more readable!

Preface

Who this book is for

Tick all that apply:

- Are you tired of the paltry interest rates on offer at banks and building societies?

- Do you have long-term savings that you probably do not require access to for at least the next three years?

- Are you interested in investment (i.e. growing your own money), and would like to know more?

- Are you unsure where to start when investing your own money?

- Are you cash-rich, but time-poor due to a busy lifestyle?

- Are you concerned about investing in shares given the two sharp drops since 2000?

- Would you like to use a simple investing system that beats the broad markets over time, while limiting the risk taken?

- Would you like to learn an investing system that only needs a few minutes each month?

If you have ticked several of the boxes above, then this is the book for you!

What this book contains

In this book you will find three simple investing systems for long-term savings. Each of these systems require only a limited amount of your time per month and all use low-cost index funds. The simple systems here are mechanical, so there is no need for you to figure out what to do each month you simply have to consistently follow the system.

The systems are based on five tried and tested, durable share market anomalies that have persisted for a long time.

Of course, as with any investing system, there may be short-term periods of underperformance but the systems outperform in the long-term as long as you stick to them . This will therefore require a good amount of self-discipline and patience, but should over time handsomely reward the disciplined, patient investor.

What knowledge is assumed

Ive assumed that you are likely to:

- be interested in investing your own long-term savings in something other than a (very low-yielding) cash deposit account, and

- have already had some experience in investing, be it via funds of one sort or another (unit trusts, ETFs, investment trusts, pension funds, life assurance products), or even directly in individual shares, bonds and other financial instruments.

If you are a complete novice in the world of investment and have never before bought shares, unit trusts or even funds via an ISA, let me be honest: this is not the ideal first investment book for you. In the Appendix I have listed a number of books that I consider to be excellent introductions to the world of investment. Such an introduction is outside the scope of this book.

In contrast, if you have at least dabbled in investment in shares and bonds, either directly or via funds, then this book could be very useful to you in providing a clear framework for investing in shares and bonds via low-cost funds.

I would also suggest that the investing systems in this book are best applied by those with at least 10,000 of starting capital.

Structure of the book

This book is divided into three main parts:

- Part A: Checklist of key investing concepts . A brief introduction to the investing concepts you should know before investing your own money. This includes various potential homes for your cash savings, and why just taking the easy option of handing control of your investment capital over to active fund managers is not necessarily a good idea.

Font size:

Interval:

Bookmark:

Similar books «The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals»

Look at similar books to The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Idle Investor: How to Invest 5 Minutes a Week and Beat the Professionals and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.