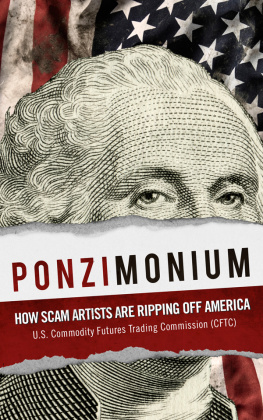

Commodity Futures Trading Commission (CFTC)

www.cftc.gov

Three Lafayette Centre

1155 21st Street, NW

Washington, DC 10581

Phone: 202-418-5000

It is easy for folks to get frustrated by their government and the people who work in government. I get it, and am also frustrated and disappointed with how things are done. That said, public servants, in general, get a bad rap. Our frustration with one employee at a division of motor vehicles shouldnt color our view of government employees at large. Ive had the honor to work with thousands of dedicated public servants who sacrifice much in order to do tough jobs, often times on a salary much less than they could command in the private sector. For each of those folks we read about who enter the revolving door from government to the private sector to get a pay day by touting their government work, there are hundreds of thousands of individuals who make government work surprisingly well every single day. The work government employees do is not only a noble profession, it is every bit as important to our democracy as are members of the health care profession, the clergy or even the armed forces. They should be recognized as such. Unfortunately, that doesnt happen, at least not so much.

In that regard, I thank the following attorneys in the CFTCs Division of Enforcement for their tireless efforts and aggressive prosecution of the cases described in Ponzimonium and for their support in writing this book: Kathleen Banar, James Deacon, John Dunfee, Rick Glaser, Susan Gradman, James Holl, Daniel Jordan, Luke Marsh, Kenneth McCracken, Diane Romaniuk, and Anne Termine. I also thank Steve Obie, who served as the Acting Director of the Division of Enforcement in 2009. These employees are superlative public servants, and American taxpayers and consumers owe them a debt of gratitude.

I also thank Elizabeth Ritter, Laura Gardy, Katie Hoard, Clay Pederson, Stacy Yochum and Jonathon Urban for their work. All of them helped out at some point on this effort.

Thanks also to the folks at GPO (the Government Printing Office). The agency is one of the most professional organizations around. In particular, thanks to the designer, Jon Raedeke. Jon is one such example of someone who chooses to serve in government, but could easily work in the private sector. Hed put many design professionals on Madison Avenue to shame.

Finally, many thanks to Ronald Petti for his encouragement and creativity, including his inspiration for Ponzimonium.

For sale by the Superintendent of Documents, U.S. Government Printing Office

Internet: bookstore.gpo.gov | Phone: toll free (866) 512-1800 | DC area: (202) 512-1800

Fax: (202) 512-2104 | Mail: Stop IDCC Washington, DC 20402-0001

ISBN 978-0-16-089079-6

About the U.S. Commodity Futures Trading Commission (CFTC)

Congress created the U.S. Commodity Futures Trading Commission in 1974 as an independent agency with the mandate to regulate commodity futures and option markets in the United States. The CFTCs fellow federal financial regulatory agencies include the Securities and Exchange Commission (SEC), the Federal Deposit Insurance Corporation (FDIC)  , the Federal Reserve Board

, the Federal Reserve Board  , and the Office of the Comptroller of the Currency (OCC). The CFTCs mandate has been renewed and expanded several times since 1974, most recently with the Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law by President Barack Obama on July 21, 2010. Dodd-Frank ushers in a new era for the CFTC by expanding its regulatory authority to the over-the-counter derivatives markets. Over-the-counter derivatives previously have not been regulated in the United States and were at the center of the 2008 financial crisis.

, and the Office of the Comptroller of the Currency (OCC). The CFTCs mandate has been renewed and expanded several times since 1974, most recently with the Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law by President Barack Obama on July 21, 2010. Dodd-Frank ushers in a new era for the CFTC by expanding its regulatory authority to the over-the-counter derivatives markets. Over-the-counter derivatives previously have not been regulated in the United States and were at the center of the 2008 financial crisis.

In 1974, the majority of futures trading took place in the agricultural sector. The CFTCs history demonstrates, among other things, how the futures industry has become increasingly varied over time and encompasses a vast array of complex financial futures contracts.

Today, the CFTC assures the economic utility of the futures markets by encouraging their competitiveness and efficiency, protecting market participants against fraud, manipulation, and abusive trading practices, and by ensuring the financial integrity of the clearing process. Through effective oversight, the CFTC enables the futures markets to serve the important function of providing a means for price discovery and offsetting price risk.

The CFTCs mission is to protect market users and the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and optionsand now, over-the-counter derivativesand to foster open, competitive, and financially sound futures and option markets.

The CFTC relies on the public as an important source of information in carrying out its regulatory and enforcement responsibilities. Under a new provision in the Dodd-Frank Act, whistleblowers may be awarded monetarily by the CFTC for original information that leads to the successful enforcement of a CFTC action. This provision will make it easier for whistleblowers to come forward with relevant information, helping to prosecute more scam artists and thus saving American taxpayers and consumers money in the long run. You may contact the CFTC to report suspicious activities or transactions which may involve the trading of commodity futures contracts or commodity options, including those that involve foreign currency. The CFTC may be contacted through its toll-free telephone number, 1-866-FON-CFTC (1-866-366-2382), via email at enforcement@cftc.gov , or by submitting an online form available through www.cftc.gov/ConsumerProtection . The Commission may use this information in its investigations or enforcement actions, but it does not act on your behalf or represent you in any way.

The CFTC also offers a reparations program which provides an inexpensive, impartial, and efficient forum for customer complaints against futures industry professionals. Customers may bring complaints against futures industry professionals currently or formerly registered with the CFTC if such individuals or firms allegedly violated the antifraud or other provisions of the Commodity Exchange Act. Reparations cases are decided by Judgment Officers or Administrative Law Judges, depending on the size of the claim. For more information, please contact the Office of Proceedings at 202-418-5350 or via email at questions@cftc.gov . Additional information is available online at www.cftc.gov/ConsumerProtection .

FDIC Federal agency that regulates national banks

Federal Reserve Board Federal agency that regulates certain state banks, bank holding companies, and foreign bank activity in the U.S.

Foreword

Every single day, someone somewhere makes a gigantic mistake by giving his or her money to a fraudster. Im not referring to those suckers born every minute types. Im talking about regular, hard-working folks who play by the rules and think they are making sound investment decisions, often with significant sums of their non-disposable cash. Smooth talking masters of illusion are out there, twisting and turning their stories to convince would-be investors to hand over their funds. The consequences for these investors turned victims can be horrific: people losing money for their kids college funds; for detrimental health care expenses; or for their own retirement. Some lose their entire life savings. Others unknowingly bring friends and family into the scam thinking they are doing them a favor.

, the Federal Reserve Board

, the Federal Reserve Board