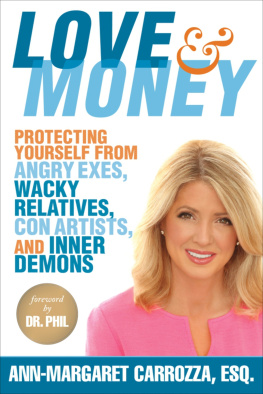

Copyright 2017 by Ann-Margaret Carrozza

All rights reserved. Copyright under Berne Copyright Convention, Universal Copyright Convention, and Pan American Copyright Convention. No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form, or by any means, electronic, mechanical, photocopying, recording or otherwise, without the express written consent of the publisher, except in the case of brief excerpts in critical reviews or articles. All inquiries should be addressed to Allworth Press, 307 West 36th Street, 11th Floor, New York, NY 10018.

Allworth Press books may be purchased in bulk at special discounts for sales promotion, corporate gifts, fund-raising, or educational purposes. Special editions can also be created to specifications. For details, contact the Special Sales Department, Allworth Press, 307 West 36th Street, 11th Floor, New York, NY 10018 or .

20 19 18 17 16 5 4 3 2 1

Published by Allworth Press, an imprint of Skyhorse Publishing, Inc.

307 West 36th Street, 11th Floor, New York, NY 10018.

Allworth Press is a registered trademark of Skyhorse Publishing, Inc., a Delaware corporation.

www.allworth.com

Cover design by Brian Peterson

Cover photo credit Douglas Gorenstein

Library of Congress Cataloging-in-Publication Data is available on file.

Print ISBN: 978-1-62153-554-6

Ebook ISBN: 978-1-62153-563-8

Printed in the United States of America

For Bill, Billy, and Danny

TABLE OF CONTENTS

FOREWORD BY DR. PHIL

I n Love and Money , Ann-Margaret Carrozza, a preeminent asset protection attorney, teaches us how to keep those people with larceny in their hearts out of our pockets, bank accounts, retirement funds, and every other accumulation of our hard-earned money. Sometimes those who seek to redistribute the fruits of your labors are those closest to you, those with whom you have been the most intertwined. Across forty-plus years in dealing with relationships, I have observed that people certainly divorce a different person than they marry! Ann-Margaret teaches us that the old saying is true: Good fences make good neighbors. More important, in Love and Money she teaches us all when, where, and how to build those fences.

There are many terrific books out there on investing and wealth building. Ann-Margaret understands it is not what you make but rather what you keep that matters. Love and Money goes that important step further and asks us to consider the folly of focusing exclusively on building wealth when it can be so easily lost to destructive breakups, lawsuits, sinister con artists, and ill-advised business dealings. She teaches us how to effectively utilize contracts for a variety of personal situations that could otherwise turn messy, and she also shows us how to erect legal barriers against those outside of our personal lives who may try to take advantage of us and destroy any wealth we may have accumulated. And she does so in language we can all understand, which is why she is such a valued expert contributor on Dr. Phil .

I have often said that money problems are not solved with money. There are powerful internal factors responsible for most lottery winners and other windfall recipients who blow through everything in short order. Ann-Margaret teaches us how to identify the traits within ourselves, such as low self-esteem, fear, and stress, which can negatively affect wealth. In Love and Money , she shares the actual internal strategies she utilized to go from being in debt up to her eyeballs to a successful real estate investor and business owner.

I highly recommend this book if you wish to protect your finances from costly legal and relationship troubles while simultaneously strengthening your financial bottom line. You will read this once and then continue to refer to it for years to come.

Dr. Phil McGraw

November 2016

INTRODUCTION

R elationships with loved ones can dramatically impact our financial security. Our level of financial security, in turn, can profoundly alter the course of romantic and other relationships. The many intersections of love and wealth can produce explosive and potentially devastating legal consequences. Examining the effects of personal relationship fallouts on ones wealth has been largely uncharted territory in the realm of personal finance. Ignorance about the legal consequences of troubled relationships with loved ones, however, is the single biggest threat to ones wealth.

Broken hearts can be very expensive. We know that a contentious breakup can reduce our assets by halfnot to mention the legal fees. Happy relationships can also cost us. This is because all relationships will eventually end. Our weakened state, in the wake of a loved ones death, can leave us vulnerable to con artists, greedy relatives, and inadvisable legal dealings.

What good is building up a nest egg if failed relationships and ill-advised legal dealings can wipe us out? The average American is far more likely to be involved in a costly legal dispute with a former loved one than with a stranger. Developing the ability to identify and avoid relationship landmines by implementing a few structures on the front end can prevent you from legally battling someone with whom you once shared Thanksgiving dinner (or a pillow).

The themes of love and money are inextricably intertwined. A problem with either of these areas can wreak havoc with the other. Conversely, getting a handle on either one of these areas will pay dividends in both. Improved relationships with loved ones can facilitate wealth building. A strong financial foundation, in turn, helps eliminate the single biggest source of relationship disputeslack of money.

In terms of legal preparedness, an estimated 60 percent of American adults have gone through the exercise of creating a will. In the pages that follow, I will show how a will alone is incapable of protecting a familys wealth and relationships from todays unique challenges. A typical will utilizes a template that hasnt changed much in more than two hundred years. Often, only the names are changed, and the new document can be created in less time than it takes to boil water. This document, acting alone, fails miserably to adequately protect most families, and, moreover, is a pitiful last form of communication to our loved ones.

This book will introduce the love contract and other legal structures that are designed to protect wealth for us and our loved ones while also protecting wealth from our loved ones and their problems.

This is not a book about financial planning. Someone might be a financial genius and still lose more than half of his assets in a breakup because he wasnt legally protected. What does it matter whether our investment rate of return is 3, 4, 5, or 6 percent if we have a 40 to 50 percent chance of losing one-half of the assets to a bad breakup? Think the assets are safe if you are in a blissfully happy relationship? Not if you require extended long-term care or face other unexpected legal liabilities.

In the following pages, we will look at prenuptial, postnuptial, and cohabitation agreements, which have evolved in my law practice into a document I call the love contract. We will examine the contract process itself and use it to deal with not only financial and legal problems but also love and relationship issues. Working with thousands of couples over the years, I have discovered that the contract process provides a unique and animus-free framework with which to resolve a wide variety of problems. Ultimately, the love contract can be used as a couples personal mission statement.