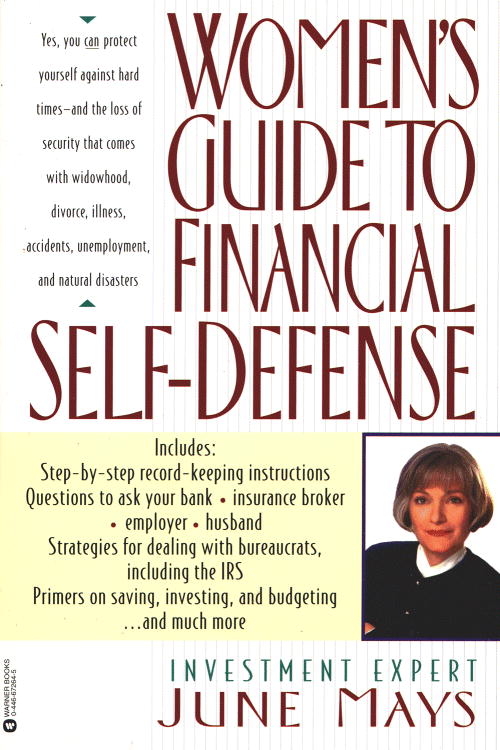

The vignettes in this book represent composites of many different women whom the author has known during her financial career; resemblance to any one actual person is purely coincidental.

Every effort has been made to give helpful advice, but no warranty against financial loss is given by the author or publisher. As laws and practices often vary from state to state, the reader is advised to consult with a professional regarding specific decisions.

WOMENS GUIDE TO FINANCIAL SELF-DEFENSE. Copyright 1997 by June Mays. All rights reserved. No part of this book may be reproduced in any form or by any electronic or mechanical means, including information storage and retrieval systems, without permission in writing from the publisher, except by a reviewer who may quote brief passages in a review.

For information address Warner Books, Hachette Book Group, 237 Park Avenue, New York, NY 10017.

The Warner Books name and logo are trademarks of Hachette Book Group, Inc.

A trade paperback edition of this book was published in 1997 by Warner Books.

Thanks to Jordan Ball, Rick Beiswenger, Betty Broome, Judy Crittenden, Ken Crowe, Jane Gaston, Rusty and Carolyn Goldsmith, Kim Harless, Paul Homan, Bob Mann, Joe Mays, Bill McLemore, Ron Meredith, Kathryn Miree, Wilmer Poyner, Rainer Twiford, Ralph Yeilding, Dolly Young, and to many women who were kind enough to share their stories. Thanks to my clients who tested the notebook in our Getting It Together seminars.

Authors Note

Are you a woman who would like to know more about the family finances, but your husband is reluctant to share financial information? If so,

THIS BOOK IS FOR YOU; READ ON.

Are you a busy wife with volunteer activities, children, or a career? Perhaps you welcome the fact that your husband is willing to take care of the money and feel you are smart enough to pick up the reins and manage the family finances should death, divorce, or disability strike. If so,

THIS BOOK IS FOR YOU; READ ON.

Are you a woman who has fallen into an easy routine of allowing your husband to handle money? You know youll be in trouble when death, divorce, or disability comes. If so,

THIS BOOK IS FOR YOU; READ ON.

Are you a man who wants to encourage and assist his wife or mother to get financially organized? If so,

THIS BOOK IS FOR YOU; READ ON.

Are you a woman who is frightened of money? When your husband starts talking about the family finances, do you cover your ears and leave the room? If so,

THIS BOOK IS FOR YOU; READ ON.

Are you a woman who can handle money but feels a need to be more organized? If so,

THIS BOOK IS FOR YOU; READ ON.

WOMENS

GUIDE TO

FINANCIAL

SELF-DEFENSE

Introduction

ONE BILLION DOLLARS. Lay a stack of that many dollar bills flat and it would reach around the world four times. Thats the amount of assets reported in 1994 as abandoned.* Its much more now. While the fate of this money varies among states, all of these assets have come from bank accounts or other liquid assets lost by their original owners. Some were even advertised publicly and still not claimed. Why were these assets abandoned? My guess is that a significant portion belonged to people who for different reasons didnt tell anyone about them, possibly forgot about them, and then died. One billion dollars is a lot of money to take out of use by individuals. Missing assets could mean the difference between survival and comfort for a deceased persons family.

* National Association of Unclaimed Property Administrators

Not only bank accounts, but also insurance policies are forgotten. Off the top of your headright nowcan you name all your insurance policies and who is to benefit? Are you sure? Could someone other than you find these policies?

In my career as an investment broker, I have seen widows in confusion and fear because they felt they did not have enough money to live on. These women would be grateful to know about missing bank accounts and insurance benefits.

I have seen women struggle to make ends meet, only to discover there was plenty of money all along in places they never knew. I have seen estates reopened at substantial expense because stray stock certificates and bonds turned up. I have seen families live in bitterness over misunderstandings on disposal of a deceased persons assets. I have seen divorced women taken advantage of because they did not know about existing family finances until it was too late.

A woman for whom everything is going well can be left, in a matter of hours, with a severely disabled or paralyzed husband who cannot tell her all the things he had been intending to tell her.

Do you see yourself in the future as an uninformed widow, divorcee, or spouse in charge? Because of death, divorce, or disability of your spouse, the chances are great that you will be left to handle the finances yourself. Nowwhile you and your spouse are still alive, well, and communicatingis the time to do something about it. You may be capable and sophisticated, but if you are uninformed, there may be a disaster waiting to happen. Now is the time for you to attend to your own financial self-defense.

The first part of this book relates stories of women who were uninformed and then gives advice that might prevent a similar fate for you.

The next section of the book is Your Notebook, a day-by-day, step-by-step guide to financial organization in thirty days. Your notebook, a collection of financial information about your family, will save you hours of frustration when you are left to make decisions and to act on your own.

The last section will provide you with strategies for your financial self-defense and with information you will need to understand your financial accounts, your investments, your insurance, and your long-term financial future.

DONT LET THIS HAPPEN TO YOU

Sharon

We seemed to have plenty. My husband always gave me money each month for maid service, dry cleaning, utilities, club dues, and pocket money. Anything else I wanted I charged, and he paid. I never questioned him. I had no idea what bad shape he was in until he filed for bankruptcy.

What could Sharon have done to prevent this from happening?

She could have questioned her husband about their financialaffairs. Together they could have taken a backward look at howthey spent their income,even if it appeared they did not needa budget.That examination would no doubt have brought to lighttheir cash flow problem, hopefully in time to do something about it.When things seem to be going well, it can be hard to rock theboat. As you can see from what happened to Sharon, sometimes the

A Time Warner Company

A Time Warner Company