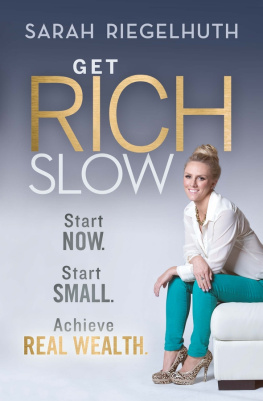

THE SECRETS OF

GETTING RICH

Amazing Ways to Build Your Wealth

David J. Perel

EDITOR OF THE FRANKLIN PROSPERITY REPORT

www.humanixbooks.com

Humanix Books

The Secrets of Getting Rich

Copyright 2020 by Humanix Books

All rights reserved

Humanix Books, P.O. Box 20989, West Palm Beach, FL 33416, USA

No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any other information storage and retrieval system, without written permission from the publisher.

Humanix Books is a division of Humanix Publishing, LLC. Its trademark, consisting of the words Humanix Books is registered in the Patent and Trademark Office and in other countries.

ISBN: 9781630061616 (Hardcover)

ISBN: 9781630061623 (E-book)

Table of Contents

Y ou dont have to be born rich to grow wealthy. Nor do you have to strike it big in the stock market or invent an app that goes viral. In reality, wealth is the result of the decisions you make every day. Make enough of the right ones, and youll see the rewards in your bank account.

This guide isnt about pinching pennies or learning how to scrape by with the bare minimum. You dont have to give up your morning latte or drive a 15-year-old car. You simply have to plug the money leaks that are draining your wealth and take advantage of some smart, yet simple, ways to grow your nest egg.

Lets face it: The odds are stacked against the average person. The big money on Wall Street has an advantage. Those investors not only have plenty of money to begin with, they also have access to the best research money can buy. But what about the regular Joes the ones who dont have a pile of cash sitting in a trust fund?

Fortunately, there are plenty of ways for regular people to grow wealthy, too. And every one of these techniques will work for you, whether you have an MBA from Wharton or a degree from the school of hard knocks.

It doesnt matter if your goal is to stop living from paycheck to paycheck, retire as a multi-millionaire, or simply maximize the income you have, this book is for you.

As famed billionaire Warren Buffett once said, Do not save what is left after spending; instead spend what is left after saving.

IF YOU WOULD KNOW THE VALUE OF MONEY, GO AND TRY TO BORROW SOME; FOR HE THAT GOES A BORROWING GOES A SORROWING . . .

A decade of extremely low interest rates has had a huge effect on traditional banking. Interest paid to depositors has been nearly zero for years, leading a variety of new competitors to try to pick off bank customers by offering more.

Credit unions, brokerages, investing apps, and financial technology firms everyone seems to want your cash. And theyre offering enticing rates to get it. But what do you get and what do you give up bypassing the savings account at your bank?

Here are some of the non-traditional places aside from certificates of deposit and money market accounts you can put your savings, as well as the pros and cons of each.

N ON- B ANK A PPS

One startup that made a big splash recently was Robinhood, an app that offers commission-free stock and mutual fund trades. At one point its founders claimed that the app would start paying 3% on deposits then they had to backtrack.

The problem was that the money was not FDIC-insured, but instead offered insurance coverage from the brokerage-world equivalent, the Securities Investor Protection Corporation (SIPC).

The SIPC pushed back, saying it wouldnt cover Robinhood depositors in the same way the FDIC covers bank accounts. Its protection is designed to insure customers against losses incurred when their brokerage firms go bankrupt.

In response, Robinhood switched gears, and instead of offering a high-yield checking or savings account, it offered a cash management account. At one point that paid 1.8%.

Other money management startups are offering similar compelling deals. Virtual wealth manager Wealthfront, for instance, has also given similar rates on cash accounts.

These companies do this the same way any brokerage firm might. They take your money and spread it across several banks with which it has partnerships, with no one bank holding more than $250,000. That way your money is FDIC-insured.

Personal Capital, another investment app, offered 1.55% on deposits. Meanwhile, credit information site Credit Karma joined the race to suck up cash, and was offering 1.9% to its clients on a high-yield product. (Rates for all products are subject to change.)

Is It Worth It? If youre already a customer of one of these firms and expect to deposit money there to invest in the relatively short or medium term, sure, its worth it.

Those types of returns are likely a far better deal than holding cash in your bank savings account where it earns practically nothing, then transferring it to invest later. On the other hand, if you dont plan to become a customer of one of these organizations, its not necessarily worth your time to switch.

Traditional brick-and-mortar banks are taking notice of the rush of non-bank offers, says Brendan Willmann, a certified financial planner. They are offering more attractive yields on select savings accounts for good customers, but youll likely have to ask for an alternative to the meager interest rates offered to the masses.

O NLINE B ANKS

Online banks have long been the heavyweights of the high-yield world. The idea of putting your cash in a distant vault with no local branch can be off-putting to some, so high yields help offset the hesitance and draw in new clients.

The argument the online banks give is that not having branches means they can pass along operational cost savings to customers in the form of better rates. Bankrate.com listed a number of online banks paying north of 1.8% in a recent survey, for instance.

Minimum deposits in that ranking ran anywhere from zero up to $1,000. Some of the names offering these high rates include firms better known for credit card services, such as American Express and Discover, investment banks such as Goldman Sachs online brand Marcus, and big global banks Citibank, HSBC, and Barclays.

Is It Worth It? If youre accustomed to banking entirely online, it may be worth it. Watch out for hidden fees, and make sure you can get cash from an ATM without paying for it. Some online banks have no ATM network agreements or only a limited geographical presence. If you have money that you dont need for six months or so, and you cant get a good rate at your regular bank, consider it.

H IGH- Y IELD C REDIT U NION A CCOUNTS

Credit unions have long been known for offering high yield checking accounts. Sometimes theyre a full percentage point or more above typical rates elsewhere.

Part of the reason credit unions can do this is that they have a lower cost of doing business, because their depositors are the owners of the credit union. Any profits are funneled back into lower lending rates, higher interest on deposits, or simply year-end cash distributions.

Next page