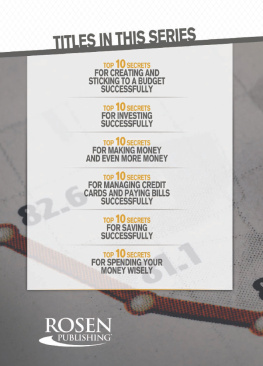

Published in 2014 by The Rosen Publishing Group, Inc.

29 East 21st Street, New York, NY 10010

Copyright 2014 by The Rosen Publishing Group, Inc.

First Edition

All rights reserved. No part of this book may be reproduced in any form without permission in writing from the publisher, except by a reviewer.

Library of Congress Cataloging-in-Publication Data

Bailey, Diane, 1966.

Top ten secrets to creating and sticking to a budget successfully/

Diane Bailey.1st ed.New York: Rosen, 2014

p. cm.(A students guide to financial empowerment)

Includes bibliographical references and index.

ISBN: 978-1-4488-9360-7 (Library Binding)

ISBN: 978-1-4488-9369-0 (Paperback)

ISBN: 978-1-4488-9370-6 (6-pack)

1. Finance, personalJuvenile literature.

2. MoneyJuvenile literature. I. Title.

HG173.8 .B35 2014

332.024

Manufactured in the United States of America

CPSIA Compliance Information: Batch #S13YA: For further information, contact Rosen Publishing, New York, New York, at 1-800-237-9932.

For many teens, the best defense against an empty wallet is a thoughtful budget: a plan to manage money sensibly so that income stays in line with expenses.

Introduction

S tories in the news tell it all: a successful executive making $1 million a year suddenly finds himself broke. Meanwhile, a single mother manages to stay afloat on a job that barely pays minimum wage. How does that work?

In the phrase money management, the key word is the second one. Some people, no matter how much money they earn, are always scrambling to make ends meet. Others live comfortably within their income, without seeming to make many sacrifices.

We all need money to live, but the old sayings are right: money doesnt buy happiness. It can buy some peace of mind, but even thats not guaranteed. Having more money doesnt necessarily make things easier. Often, people with high incomes believe they can afford much more than they really can.

Studies have shown that many teenagers dont have a good understanding of money. The credit card company Capital One conducted a poll on teenagers financial habits and beliefs. It showed that almost half of teens did not know how to make or follow a budget. Just over 25 percent had discussed with their parents the difference between items that were needs, versus those that were wants.

Many teens dont have realistic knowledge of what things cost, or even what things are necessary to function in todays society. Most people have heard that the necessities of life are food, clothing, and shelter. While those are indeed the bare-bones requirements, its also true that in order to get them, people depend on other items or services that cost money, such as transportation and insurance.

Good budgeting means being able to identify what your income and expenses are, deciding how to allocate your funds, and then making sure that how you spend money stays in line with your plan. A thoughtful budget takes into account not only how much you spend but also why youve chosen those particular goals.

Knowing how to budget and spend money isnt a difficult skill. Its simply one that takes a little knowledge and practice. Ultimately, financial success doesnt depend on how much money you earnbut how you use what you have.

Chapter 1

Understand the Purpose of a Budget

B udgeting is a necessary exercise in many households, but it also has a little bit of a bad name. Lets face it: budgeting is kind of boring. Who wants to draw up spread-sheets and spend hours with a calculator tallying up how much they spent on clothes and coffee? However, even if budgeting isnt your cup of tea (or iced coffee), its still important to do it.

See Where Its Going

An old joke asks, How do you make a small fortune? The answer: Well, first you start with a large one...

A good budget can help protect your fortuneeven if its small to begin with. Budgeting accomplishes several things. The most obvious one is that it clearly shows where, when, and how money is being spent. For someone who is struggling to make ends meet, or to save money for a larger purchase, a budget can prove invaluable because the numbers dont lie.

Seemingly small purchases can often sink a budget. Smart budgeters will include funds to cover everyday treats such as coffee but will avoid indulging in too much of a good thing.

A dollar in a vending machine every day, or $2 on french fries from a fast-food restaurant, or $3 on a gourmet coffee... small things add up fast. Its simple math. Five bucks a day, every weekday, adds up to more than $100 a month on things that lasted less than an hour and could have easily been skipped.

Fascinating Financial Fact

A poll of fourteen- to eighteen-year-olds conducted by the Junior Achievement and the Allstate Foundation showed that in 2012 more than one-third of teens admitted that they did not budget or manage their money.

Identifying these trends is another function of a budget. Theyre specifically designed to track spending over time. Patterns of spending are what demonstrate a persons financial responsibilityor lack thereof. Also, by adding up the amount of money spent over the period of several months, it shows how easy it is to fritter away large sums, $1 at a time. Fortunately, the reverse is also true: $1 or $2 saved every day by eating lunch in instead of out, biking to work instead of driving, or deciding you dont really need another bottle of nail polish can also add up to a sizable amount after several weeks.

A budget helps reward good behavior, financially speaking. Seeing the results of your spending habits written down in black and white reinforces when youve made good choices and when youve made poor ones. Knowing that your efforts to save helped you scrape together $50 for a concert ticket means youll likely be able to do it againand maybe for something bigger.

One Size Fits One

While there are definite guidelines for smart budgeting, there is no one-size-fits-all approach. Of course, many things will overlap from person to person. Many teenagers will spend money on food, clothing, transportation, and other discretionary expenses. However, each persons actual numbers will be different. More important, each persons priorities will be different.

Allocating money to keep her wardrobe up to date might be a must for one teen, but every person will have different priorities and must budget accordingly.

One person might choose to pay more for a cool leather jacket, while another prefers to shop secondhand in order to have extra funds for entertainment. Many teenagers have their own set of financial responsibilities that go beyond the fun stuff. They may have day-to-day expenses like gas and cell phones that their parents do not pay for, as well as longer-term goals like saving for college. A budget, therefore, should be a reflection of what you want right now and what you might want in the future.

Some people feel compelled to create a budget once theyve landed in some financial trouble. In todays credit-heavy society, its relatively easy to find yourself in debtand sometimes that debt can be significant. However, while a budget is an absolute necessity if youre trying to pay down debt, its not designed to be simply an emergency measure. Instead, putting a budget in place before youre facing financial problems can help prevent having them.