Published in 2014 by The Rosen Publishing Group, Inc.

29 East 21st Street, New York, NY 10010

Copyright 2014 by The Rosen Publishing Group, Inc.

First Edition

All rights reserved. No part of this book may be reproduced in any form without permission in writing from the publisher, except by a reviewer.

Library of Congress Cataloging-in-Publication Data

Swanson, Jennifer A.

Top 10 secrets for saving successfully/Jennifer A. Swanson. First edition.

pages cm.(A students guide to financial empowerment)

Includes bibliographical references and index.

ISBN 978-1-4488-9356-0 (library binding)

ISBN 978-1-4488-9378-2 (pbk.)

ISBN 978-1-4488-9379-9 (6-pack)

1. TeenagersFinance, Personal. 2. Finance, Personal. 3. Saving and investment. I. Title. II. Title: Top ten secrets for saving successfully.

HG179.S8948 2011

332.02400835--dc23

2012047194

Manufactured in the United States of America

CPSIA Compliance Information: Batch #S13YA: For further information, contact Rosen Publishing, New York, New York, at 1-800-237-9932.

Contents

Introduction

Secret #1

Set a Savings Goal

Secret #2

Increase Your Income

Secret #3

Develop a Strategy for Saving

Secret #4

Keep to a Budget

Secret #5

Spend Smart

Secret #6

Cut Back, but Not Out

Secret #7

Start an Education Fund

Secret #8

Build an Emergency Fund

Secret #9

Invest It!

Secret #10

Make It a Habit

Glossary

For More Information

For Further Reading

Bibliography

Index

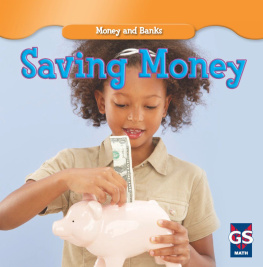

Opening a savings account is the first step toward planning your financial future. Learning to save money now can lead to great benefits later.

Introduction

B uilding the bank account of your dreams starts during the teenage years. Do you find that hard to believe? Take a look at some prominent, and very wealthy, people who believed in saving. Businessman and investor Warren Buffett got his first job delivering newspapers at the age of thirteen. He began saving and investing the money he earned. By the time he graduated from college, he had $10,000 saved. Today, Buffett is worth more than $21 billion. When he was twelve, Michael Dell, founder of Dell Computers, got a job washing dishes. At the time, he just wanted to save enough money to fund his stamp collection. He liked saving so much, he kept at it, and eventually he bought his first computer at the age of fifteen. The experience and information he learned using that computer showed up later in his multibillion-dollar computer company.

Do these two examples mean that saving money at a young age will enable every teenager to become a billionaire? Not necessarily. Saving money isnt easy. It requires planning, patience, and most of all, persistence. The secrets contained here will help teenagers gain saving practices that will last far into the future. From setting goals to creating a budget, every teen will learn helpful methods for keeping savings on track. They will find ideas for increasing earning power so that they have more to saveand to spend. Teens will also discover ways to spend smart and keep their costs low. Sticking to these ideas may mean saying no to buying a new shirt or skipping the download of a new song to your MP3 player, but, in the long run, it will be worth it.

Knowing where to keep money is as important as learning to save it, so tips are included on what makes a good place for saving money and how to make it grow. Do you have an emergency and need cash fast? No problem. The ideas outlined here are designed to guide every teen toward becoming financially strong and able to deal with any crises that might arise.

Most important, teens will learn that saving money now, although not glamorous or even fun, will set them up for exceptional results in the future. As Benjamin Franklin put it, A penny saved is a penny earned. If you can see the significance of saving money at an early age, perhaps you will find yourself rubbing shoulders with the billionaires of the world someday!

Secret #1

Set a Savings Goal

L ike many things in life, most people find that it is much easier to achieve something if they first set a goal. Setting a goal applies to all aspects of life: sports, academics, personal, and in this case, financial. Outlining a specific savings goal helps an individual to stay focused on the process of saving so as not to be distracted from achieving it.

Goal Setting 101

The best way to identify your savings goals is to make a list. Take out a sheet of paper and write down everything you want to buy or save for, or maybe type up a list on your laptop. Next to the first item, put down how much money it will cost to buy it. For example, if you wrote down new laptop, you might put $600 as its cost. To the right of the cost, put down the time needed to accomplish this goal. Do you need the laptop in five weeks, five months, or longer? Be sure to note the time it will take you to purchase every item you wish to buy. Dont forget to include all the costs necessary for the purchase. Buying a pair of jeans or a new shirt over the Internet will mean accounting for the shipping costs and tax on that item. If you want to buy a car, dont forget to include money for any recurring costs, such as the car insurance payment, any maintenance the car might need, and, of course, the weekly gas bill.

Make a list of your savings goals. Seeing the costs associated with an item can be helpful in determining if you are serious about saving for it.

The next step is to prioritize each savings goal. What is most important to you? A long-term goal, like buying a car or saving for college, may take months or years to attain. Reaching a long-term goal requires the three Ps: persistence, perseveranceand most of allpatience. But sticking to a plan will help you get there. Maybe one of the savings goals is to buy a new cell phone or a dress for a dance, which you could save for in only a few weeks. A short-term goal like this one is much easier to achieve because it requires less money. Whatever the case, you now know exactly what you are working toward. Thats half the battle.

Fascinating Financial Fact

According to the American Automobile Association (AAA), the average cost of a used car today is $10,000, whereas the average price of a new car is $28,000. It typically costs far less to insure a used car. Keep that in mind when shopping.

Keep Your Eye on the Prize

The other half of the battle is staying motivated. As the saying goes, you must keep your eye on the prize. How do you accomplish that? Make the savings goal visible. If your goal is to buy a car, find a dozen pictures of the car you want to purchase. Put them up around your room. When you look at the pictures, imagine yourself behind the wheel of the car. Can you envision it? This image will keep up the motivation for you to save.

Another way to see actual progress toward a savings goal is to make a bar graph or chart for it. On a piece of graph paper, draw an X-axis and Y-axis. On the X-axis, mark off increments of $5 or $10. Next, draw a bar on the graph to show how much money you need to meet your savings goal. If your savings goal is $500 for a new laptop, the top of the bar would reach to five hundred. Every time money is added to the savings goal, color in part of the bar graph. If you are good with computers, you could do this monitoring on an Excel spreadsheet and make a pie chart or fancy bar graph with a variety of colors.