This book is dedicated to Jonathan Gottfried, who invests his time and efforts to help all of us. Thank you.

Published in 2014 by The Rosen Publishing Group, Inc.

29 East 21st Street, New York, NY 10010

Copyright 2014 by The Rosen Publishing Group, Inc.

First Edition

All rights reserved. No part of this book may be reproduced in any form without permission in writing from the publisher, except by a reviewer.

Library of Congress Cataloging-in-Publication Data

Hollander, Barbara Gottfried.

Top 10 secrets for investing successfully/Barbara Gottfried Hollander.1st ed.New York: Rosen, 2014

p. cm.(A students guide to financial empowerment)

Includes bibliographical references and index.

ISBN: 978-1-4488-9357-7 (Library Binding)

ISBN: 978-1-4488-9371-3 (Paperback)

ISBN: 978-1-4488-9372-0 (6-pack)

1. Finance, personalJuvenile literature. 2. InvestmentsJuvenile literature. 3. Saving and investmentJuvenile literature. 4. Finance, personal. 5. Saving and investment. I. Title.

HG4521.H65 2014

332.6'0835

Manufactured in the United States of America

CPSIA Compliance Information: Batch #S13YA: For further information, contact Rosen Publishing, New York, New York, at 1-800-237-9932.

Contents

Introduction

Secret #1

Know Your Goals

Secret #2

Determine Your Risk Factor

Secret #3

Make a Financial Profile

Secret #4

Speak the Language

Secret #5

Understand Investment Options

Secret #6

Diversify Your Investments

Secret #7

Play Games

Secret #8

Think About Retirement Now

Secret #9

Dont Forget About Taxes

Secret #10

Stay Informed

Glossary

For More Information

For Further Reading

Bibliography

Index

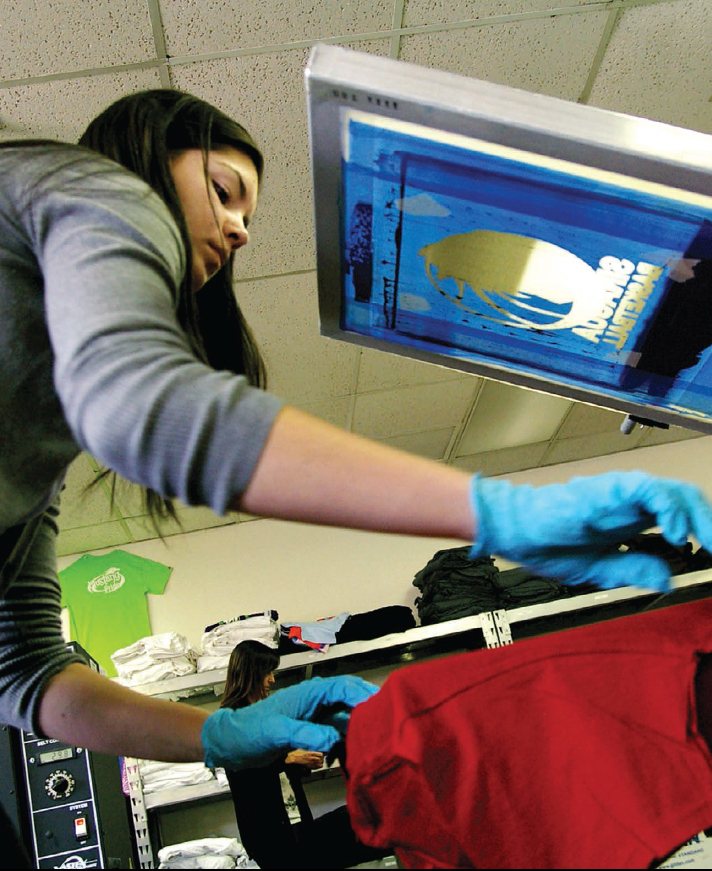

A high school student works in a student-run silkscreen business that prints T-shirts. Money earned from part-time jobs can be used for investments in your future.

Introduction

I t is easy to live in the moment and spend all your money on your wants. Grab lunch with friends! Go shopping for new clothes! Order that concert ticket! Your income from work or an allowance can pay for these things. You may even crave the satisfaction that comes from spending all of your money on todays wants.

Remember that your financial decisions have both short- and long-term consequences. In the short run, you enjoy lunch, new clothes, and the concert. But in the long run, you now have less money for tomorrows wants. Investing money is about using todays money to earn more money for the future. Can you imagine having even more cash to spend in ten or twenty years? You could afford even more clothes, more restaurant lunches, and more concerts.

Successful investing goes beyond these shortterm goals. Think bigger financial goals or purchasable aims. For example, suppose that you earn income from a part-time job. You invest some of the earnings, rather than spend them all. When you graduate, you find a full-time job and invest some of these earnings, too. Soon, you have enough money from your investments to afford a car and a home.

Did you notice that investing is about giving up and gaining? You give up the use of some of your money today in hopes of gaining more money later. You give up some of todays goals, like having new clothes this week, to gain possibly a new car or house in the future. Short-term costs can have big long-term payoffs!

As with all money choices, investing means making decisions and taking risks. Figure out how to invest your money by exploring your options. Investments are not foolproof. You do not automatically earn more money because you invest. Investments are risky because things may not turn out as planned. How do you invest successfully, protect yourself from risks, and increase your chances of reaching your goals? Read on.

Secret #1

Know Your Goals

S uccessful investing means seeing yourself in the future. Think about where you want to be in five, ten, twenty, and fifty years from now. Talk to your mentors (such as relatives and teachers), and discuss your education, work, and life plans.

Will you attend college?

If yes, what kind of college and for how many years?

How are you going to pay for your schooling?

Do you want to buy a car or home?

Would you like to own a business?

Are you planning to have a family?

What kind of life do you want when you retire?

Think about your answers to these kinds of lifestyle questions. Envision the kind of life that you want, and be realistic. Next, list the top five financial goals that will help you achieve this life. How can you afford these goals? Invest successfully!

Fascinating Financial Fact

Does money grow on trees? It did when the Aztecs used cacao beans for cash. Just as trees grow bigger with time, so can your earnings from most investments!

Paying for It

Remember that investing today is the key to achieving your long-term goals. How much money will you need? It depends on the costs of your goals and your time frame. For example, suppose your goals include buying a new car and home. According to Forbes, the average price of a new car in April 2012 was about $30,000. YCharts, a company that provides analytical tools and marketing trend information to investors, reported that the average price of a new house in August 2012 was about $300,000.

Most people take out loans for big-ticket purchases, such as cars and homes. But you still need to put down a part of the items cost (the down payment) at the time of purchase. Items that cost more (like a house) require higher down payments. So you need to use more money from your investments to pay for the house than for the car.

Also, beware of rising prices. Consider the cost of college. According to the National Center for Education Statistics, the average tuition for a four-year public college was $6,381 in 1980. By 2010, it rose to $15,605. Prices usually increase. Your investment money needs to cover the future costs of your goals.

Teens usually need help from their parents to buy their first car, unless they have saved most of their earnings from a steady job for several years. Investing helps you achieve your long-term goals such as buying a car. Youll need money for a down payment at the time of purchase and for sales tax, auto insurance, gas, maintenance, and repairs.

Timing Counts

Next, consider your time frame. It is usually easier to pay for a goal that is farther away. Imagine that your goals include paying for college and buying a home. College is right around the corner, while owning a home is a longer-term goal. Suppose that you invest money today. You might have only one to four years worth of earnings to pay for college. But you would have even more earnings in five to ten years to pay for a house.

Investing includes using an automated teller machine (ATM) to deposit money in an interest-bearing account.

To see how timing matters, think of an investment as putting money in the bank. Suppose you deposit $100 in a savings account that earns 10 percent annual interest. Now assume that you will not deposit or withdraw any money from this account. In three years, you have $133.10 in your savings account. You earned $33.10 in interest. But in ten years, you will have $259.37 and $159.37 in interest.