style="page-break-before: always;" Published in 2013 by The Rosen Publishing Group, Inc.

29 East 21st Street, New York, NY 10010

Copyright 2013 by The Rosen Publishing Group, Inc.

First Edition

All rights reserved. No part of this book may be reproduced in any form without permission in writing from the publisher, except by a reviewer.

Library of Congress Cataloging-in-Publication Data

Hollander, Barbara Gottfried.

How deflation affects you/Barbara Gottfried Hollander.1st ed.

p. cm.(Your economic future)

Includes bibliographical references and index.

ISBN 978-1-4488-8342-4 (library)

1. Deflation (Finance) 2. Monetary policy. 3. Economic development.

4. Finance, Personal. I. Title.

HG229.H6535 2013 332.4'1dc23

2012011127

Manufactured in the United States of America

CPSIA Compliance Information: Batch #W13YA: For further information, contact Rosen Publishing, New York, New York, at 1-800-237-9932.

Contents

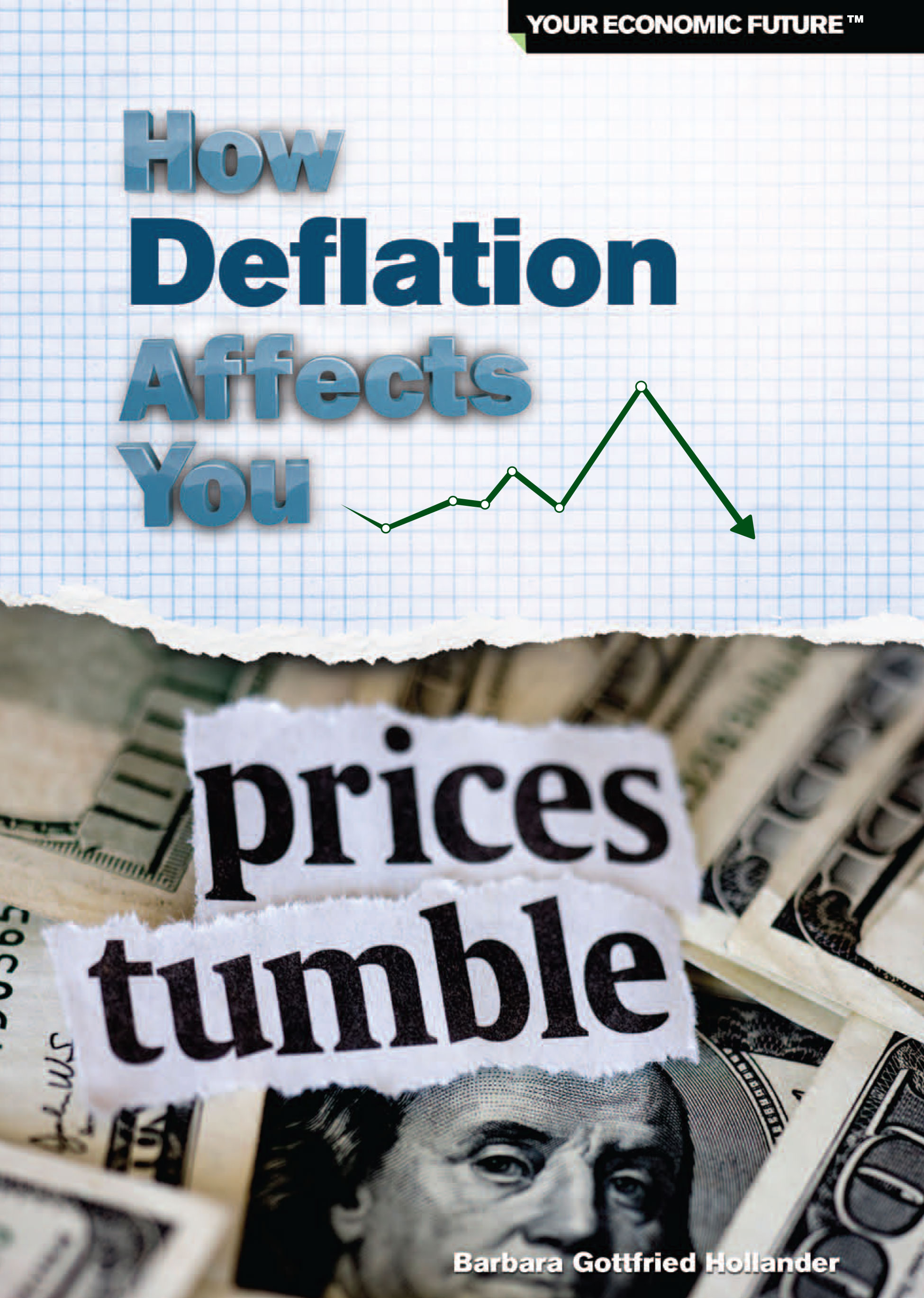

Lower prices may seem like a good idea. But is paying less always good for the economy? What if your wages (the price of labor) fall, too? Will you be able to afford those bargains?

I magine walking into a store and your favorite clothes cost even less than they did several months ago. Your first thought is that the clothes are on sale. It must be your lucky day! Then you notice that different goods and services in other stores also cost fewer dollars. The newspapers report that the economy is experiencing deflation. Could this explain the lower prices?

Deflation refers to falling prices throughout the economy. It does not mean lower prices in only one store or one sector (like clothing). Deflation is part of a bigger economic picture. It involves consumers, producers, the government, and the central bank, which is called the Federal Reserve in the United States. Both the government and the central bank use tools to affect the amount that consumers spend, which then influences how much producers supply. The existence or threat of deflation can affect these institutions policies.

Falling prices may seem good because they reduce the costs of goods and services. But deflation can also be part of a vicious cycle that includes lower company profits, lower salaries, and fewer jobs. For example, during Japans lost decade, there was deflation and limited economic growth. By the end of 2001, land values in Japan dropped by 70 percent. This means that a house bought for $100,000 in the 1980s was only worth $30,000 by 2001. Yet, even at reduced prices, people were not willing to spend their money.

Think about a country, like Japan, that experienced falling prices and fewer economic opportunities for more than ten years. Logically, lower prices should encourage consumers to spend their money. After all, there are bargains everywhere! But psychologically, people are afraid to spend. They are earning less money and are uncertain about having their jobs in the future. Therefore, people save their money because they fear the worst. They do not buy all those bargains around them, and companies do not sell these goods and services. This leads to even more economic hardships.

Does deflation always accompany economic downturns, like recessions or depressions? Can a country experience deflation and economic growth? An economy involves many participants, including consumers, producers, and investors both at home and in other countries. The actions and decisions of these market participants, along with government and central bank policies, affect price behavior and economic growth. So the answer to both questions is It depends. What is certain is that deflation is a global economic phenomenon, which affects people like you.

J apan used to be so flashy and upbeat, but now every- one must live in a dark and subdued way, said Japanese small business owner Masato Y in 2010. This owner was once part of a middle class that could afford expensive homes, vacations, and luxury cars. But in the late 1980s and early 1990s, Japans economic growth slowed and prices fell. Twenty years later, Masato Y was still struggling to repay his mortgage. Deflation happens in countries throughout the world. It is a persistent decline in the general prices of goods and services, which can have real consequences for individuals and businesses.

Measuring Deflation

Deflation can be measured by a decrease in the consumer price index (CPI). The CPI describes the average change in prices of a market basket of goods and services paid by consumers living in cities or towns. The market basket consists of items that are commonly used by individuals and families. It includes food and beverages (like milk and chicken), housing (such as rent and bedroom furniture), apparel (like clothes), transportation (such as new cars and gas), medical care (like hospital visits and medications), recreation (such as pets and sports equipment), education and communication (including college tuition), and other products (like haircuts).

Economists compare the changes in the prices paid for these products over time. Then they decide if the price level is rising or falling. Most of the time, the price level in the United States is rising. This means that the American economy is experiencing inflation, or an increase in the general prices of goods and services. For example, from 2009 to 2010, prices rose 1.6 percent. So a cell phone that cost $100 in 2009 would cost $101.60 in 2010just from inflation.

Changes in the price of oil also affect gas prices. A 2012 decrease in the oilsupply contributed to gas prices of over $4 per gallon (3.8 liters). A car with a12-gallon (45.4 l) tank cost about $50 to fill up.

Sometimes, the inflation rate slows down. This is called disinflation. Disinflation is not the same as deflation. Disinflation happens when prices are rising more slowly, but deflation is about falling prices. Consider that prices changed by -0.4 percent from March 2008 to 2009 in the United States. This negative number means that the price level decreasedso prices were falling. This was the first deflation in the United States in more than fifty years and was fueled by a drop in oil prices.

Deflation refers to price decreases in different industries. But sometimes, there is a good, such as oil, that significantly influences the consumer price index because it affects many sectors. In the CPI, oil is found directly in products, like gasoline or energy for homes and businesses. Oil is also used to transport goods and maintain businesses. For example, factories transport their goods to stores by truck, plane, or ship, which all use gas. For these businesses, the cost of oil is part of the cost of making their products, so it is reflected in the products prices. When the price of oil decreases, it can also decrease the costs of these products. From March 2008 to March 2009, oil prices fell and heavily affected the CPI. In fact, if food and energy prices were removed from the CPI during this time, prices actually increased!

.jpg)

.jpg)