Ashvin B. Chhabra - The Aspirational Investor: Taming the Markets to Achieve Your Lifes Goals

Here you can read online Ashvin B. Chhabra - The Aspirational Investor: Taming the Markets to Achieve Your Lifes Goals full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2015, publisher: HarperBusiness, genre: History. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Aspirational Investor: Taming the Markets to Achieve Your Lifes Goals

- Author:

- Publisher:HarperBusiness

- Genre:

- Year:2015

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

The Aspirational Investor: Taming the Markets to Achieve Your Lifes Goals: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Aspirational Investor: Taming the Markets to Achieve Your Lifes Goals" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

The Chief Investment Officer of Merrill Lynch Wealth Management explains why goals, not markets, should be the primary focus of your investment strategyand offers a practical, innovative framework for making smarter choices about aligning your goals to your investment strategy.

Today all of us bear the burden of investing wisely, but too many of us are preoccupied with the wrong prioritiesincreasing returns at all costs, finding the next star fund manager, or beating the market. Unfortunately conventional portfolio theory and the grand debates in finance have offered investors only incomplete solutions. What is needed, argues Ashvin B. Chhabra, is a framework that shifts the focus of investment strategy from portfolios and markets to individuals and the objectives that really matter: things like protecting against unexpected financial crises, paying for education or retirement, and financing philanthropy and entrepreneurship.

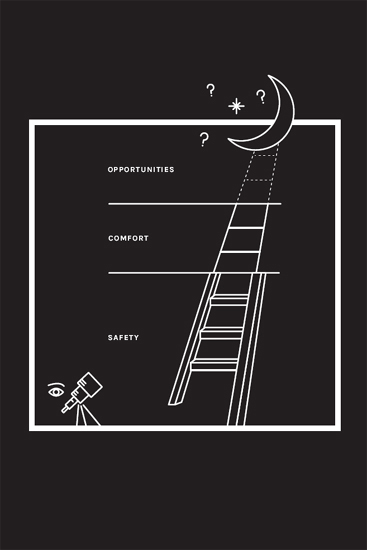

The Aspirational Investor is a practical, innovative approach to managing wealth based on key goals and the careful allocation of risks rather than responding to the whims of the financial markets. Chhabra introduces his Wealth Allocation Framework, which accommodates the three seemingly incompatible objectives that must underpin every sound wealth management plan: the need for financial security in the face of known and unknowable risks; the need to maintain current living standards over time despite inflation; and the need to pursue aspirational goals for wealth creation.

Chhabra reveals some surprising facts about wealth creation, reinterprets the success formulas of investing greats like Warren Buffett, and closes the gap between theory and practice by simplifying our understanding of key asset classes and laying out a concise roadmap for identifying, prioritizing, and quantifying financial goals. Raising the bar for what we should expect from our investment portfoliosand our financial advisorsThe Aspirational Investor sets us on a path to more confident and fulfilling financial lives.

Ashvin B. Chhabra: author's other books

Who wrote The Aspirational Investor: Taming the Markets to Achieve Your Lifes Goals? Find out the surname, the name of the author of the book and a list of all author's works by series.