CONTENTS

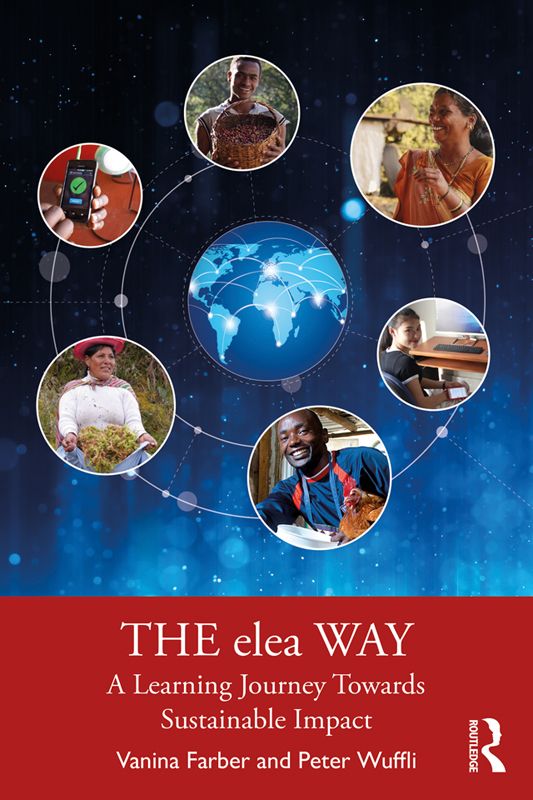

THE elea WAY

Social entrepreneurship and impact investing contribute to a more inclusive capitalism and bring innovative solutions to global challenges, such as fighting poverty and protecting planet earth. This book offers practical advice on how to best integrate entrepreneurship and capital for impact and innovation by using elea's philanthropic investing approach to fight absolute poverty with entrepreneurial means as an example.

Written by two leading experts, the book summarizes insights from elea's 15-year pioneering journey, from creating an investment organization, choosing purposeful themes, and sourcing opportunities, to partnering with entrepreneurs for impact creation. This includes suggestions on how to lead impact enterprises in such areas as developing strategies, plans, and models; building effective teams and organizations; managing resources; and handling crises. Using real-life examples, this is valuable reading for entrepreneurs, investors, executives, philanthropists, policymakers, and anyone curious about entrepreneurship and inclusive capitalism.

Vanina Farber, PhD, is an economist and political scientist with 20 years of teaching, researching, and consultancy experience. She holds the elea Chair for Social Innovation at IMD. Previously, Vanina was Dean of the Graduate School of Business and Associate Professor at Universidad del Pacfico in Peru.

Peter Wuffli, PhD, is a senior leader and entrepreneurial philanthropist. He is the Founder and Chairman of elea Foundation for Ethics in Globalization and the Honorary Chairman of IMD. Previously, Peter was a partner at McKinsey & Company, the CEO of UBS Group and the Chairman of Partners Group, respectively IMD. In 2015, he published the book Inclusive Leadership.

First published 2021

by Routledge

2 Park Square, Milton Park, Abingdon, Oxon OX14 4RN

and by Routledge

52 Vanderbilt Avenue, New York, NY 10017

Routledge is an imprint of the Taylor & Francis Group, an informa business.

2021 Vanina Farber and Peter Wuffli

The right of Vanina Farber and Peter Wuffli to be identified as authors of this workhas been asserted by them in accordance with sections 77 and 78 of the Copyright,Designs and Patents Act 1988.

All rights reserved. No part of this book may be reprinted or reproduced or utilisedin any form or by any electronic, mechanical, or other means, now known or hereafterinvented, including photocopying and recording, or in any information storage or retrievalsystem, without permission in writing from the publishers.

Trademark notice: Product or corporate names may be trademarks or registered trademarks, and are usedonly for identification and explanation without intent to infringe.

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library.

Library of Congress Cataloguing-in-Publication Data

Names: Farber, Vanina, author. | Wuffli, Peter A., 1957- author.

Title: The elea way : a learning journey toward sustainable impact / Vanina Farberand Peter Wuffli.

Description: Abingdon, Oxon ; New York, NY : Routledge, 2021. | Includes bibliographicalreferences and index. |

Identifiers: LCCN 2020026556 (print) | LCCN 2020026557 (ebook) | ISBN 9780367549213(hardback) | ISBN 9781003094807 (ebook)

Subjects: LCSH: elea Foundation for Ethics in Globalization. | Social entrepreneurship.| Venture capitalSocial aspects. | InvestmentsSocial aspects. | Socialresponsibility of business.

Classification: LCC HD60 .F367 2021 (print) | LCC HD60 (ebook) | DDC 362.5/8dc23

LC record available at https://lccn.loc.gov/2020026556

LC ebook record available at https://lccn.loc.gov/2020026557

ISBN: 978-0-367-54921-3 (hbk)

ISBN: 978-1-003-09480-7 (ebk)

Typeset in Scala Sans Pro and Bembo Std

by KnowledgeWorks Global Ltd.

Capitalism at a crossroads

Over the past two centuries, capitalism twinned with scientific revolution has enabled unprecedented growth in wealth and well-being, globally. Billions of people have lifted themselves out of poverty. Middle-income people in many countries now enjoy lives that are longer, healthier, and richer in choice than kings and queens in the 18th century. Yet this breathtaking achievement is incomplete and inadequate. For all the progress, capitalism has left billions of people behind, vulnerable, and excluded from modern economies. In fact, four billion people half of humanity are accessing none or few of the many products, services, and support that would enable them to change their own lives. This uneven and unequal progress is a threat to the sustainability of social order and economic growth and to human flourishing for us all.

We are in urgent need of an improved kind of capitalism that helps to solve the most pressing global challenges of today and tomorrow.

Growing up in apartheid South Africa, the structural origins of inequality and exclusion were apparent to me daily. It was only later, while studying politics and philosophy in the UK and the U.S. and then helping to finance social enterprises around the world, that I came to understand the extent to which other societies contain their own discriminatory structural barriers. This is not about cosmic unfairness; rather, we have made economic choices, and reform is within our collective grasp.

State resources and political will are inherently limited. So markets and business have a powerful role to play in leveling the playing field and empowering vulnerable people as agents of their own destiny.

In 2007, I founded LeapFrog Investments to invest in and grow businesses that serve lower-income people with essential services. My dream was to demonstrate our credo and methodology of Profit with Purpose: there can be strong synergies between outsized social impact and financial returns. Later that year, the term impact investing was coined.

As of today, LeapFrog companies reach over 200 million people with financial tools or healthcare. Over 80% of those people are low-income, living on an income of under USD 10 per day, as defined by the World Bank. Over 100 million of the individuals empowered via access to these products and services are women and girls. At the same time, LeapFrog has been able to raise over USD 1.5 billion from private equity investors utilizing this investment strategy, and has often doubled or tripled institutions money after repeatedly growing and selling successful social businesses.

As is evident from these numbers, we place a high value on rigorously measuring and consistently managing impact applying the same level of discipline as in financial measurement and management. In the comparatively new, unfamiliar, and diffuse domain of impact, it is crucial to understand what metrics best capture the social success of one's mission and how those metrics link to commercial sustainability. Otherwise, impact too easily becomes a sideshow to the old mode of capitalism. We do this for every one of the dozens of companies we own stakes in, grow, and govern. Truly symbiotic profit and purpose require intentionality and the tracking of impact to be at the core of every major investment and operating decision.

This symbiosis also requires integrity and accountability. As many institutions followed us into the impact investment industry, we supported the development of industry-wide Operating Principles for Impact Management under the International Finance Corporation (IFC), which is part of the World Bank Group. LeapFrog announced the world's first impact audit based on those agreed principles. Many others have also recorded decisive successes in impact investing.

![Keith A. Allman [Keith A. Allman] - Impact Investment: A Practical Guide to Investment Process and Social Impact Analysis](/uploads/posts/book/124124/thumbs/keith-a-allman-keith-a-allman-impact.jpg)