T he opinions expressed in this book are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. It is only intended to provide education about the financial industry. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

Acknowledgements:

I owe a debt of gratitude to all of those who helped to make this book possible, as well as those whose accumulated wisdom is the foundation of the concepts discussed here.

First and most importantly, it would never have been possible to write this book without the comprehensive research and insights of the great people at the MIT AgeLab. Dr. Joseph Couglin and his colleagues at the AgeLab provided the research and the insight to develop the 8,000 days framework described here, as well as the various stages of aging in the Exploration stage of life. Their work is the primary basis for this book. I would also like to recognize the Hartford Funds for having the foresight to create a partnership with the AgeLab, and for making their research available to financial advisors throughout the country. It is through that partnership that I was exposed to the wonderful work of the AgeLab.

I also owe a huge debt of gratitude to author Nick Murray, whose philosophy of investing and wealth planning inspire my wealth management practice.

I also thank my dedicated team at Concentus Wealth Advisors, the foundation of my success in business: my father Jerry, who started it all; my brother Paul, who keeps our business running smoothly and efficiently; and my team: Tom Greco, Nathan Hayward, Bryan Dalesandro, Jack Liberatore, Donna McNally and Tracy Hudash, who bring passion and a deep sense of commitment to client service with them to work every day.

I would also like to thank all of the clients who have entrusted our team with the financial well-being of their families. These wonderful relationships, many of them lasting many years, have enriched my life tremendously, and provided me with the framework under which to develop many of the insights that I write about in this book.

Finally, I could never be the man I am today in business or in life without the incredible relationships I have with my wife Karen, and our children Carter, Max and Emma. They make me incredibly happy, and their support encourages me to be everything that I am today.

About the MIT Age Lab

The AgeLab was established at MIT in 1999 as a multidisciplinary research program that works with business to improve the quality of life of older people and those who care for them. The AgeLab applies consumer-centered thinking to understand the challenges and opportunities of longevity and emerging generational lifestyles, to encourage innovation across business markets. Their insights are critical for anyone who is nearing retirement, or who has loved ones such as parents, aunts, or uncles who are entering this stage of life.

The folks at the Hartford Funds have a keen interest in studying the future of the wealth advisory industry, and trends which will impact the delivery of financial advice in the future. They had the wisdom and foresight to partner with the AgeLab to develop content specifically tailored to helping financial advisors better understand the needs of investors as they live through the Exploration stage of their lives. This book is based on the research and insights which were developed in the MIT/Hartford partnership, which they have generously made available to our team at Concentus.

Living Life 8,000 Days at a Time

We have a longevity paradox. Now that we have achieved what humankind has tried to achieve since it has walked living longer we really dont have a good idea of what to do with all that additional time.

Dr. Joe Coughlin, PhD, Director

of the MIT AgeLab

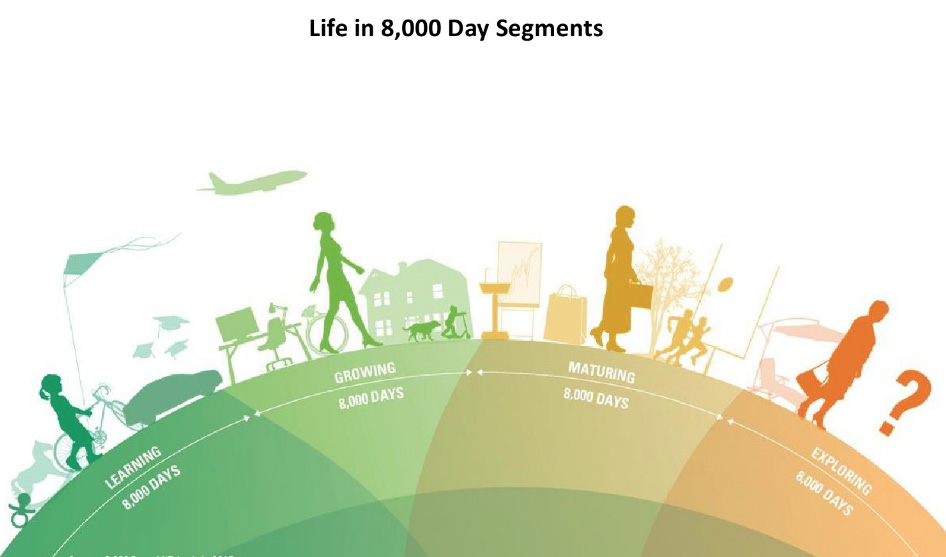

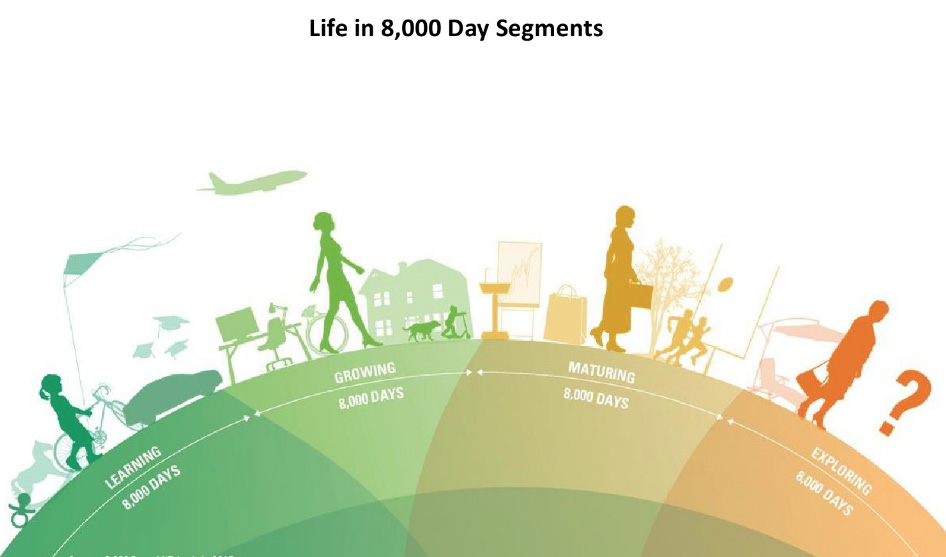

T he MIT AgeLab has come up with an interesting model to describe the basic math about modern lives. Lets assume that a person, with a college education and good income, is now likely to live well into their 80s. This persons life can be divided into four segments, averaging approximately 8,000 days, or 22 years, each. Your first 22 years of life are spent Learning, primarily attending school. You graduate from college when you are right around 22, and you enter a period when you are Growing. Perhaps you get married, and take on a first job, you buy your first home and start raising young children. Then right around the time you hit 44 or so, you reach a period we traditionally call Middle Age, when you are Maturing: your kids are getting older, and probably heading off to college. Your professional capabilities are really growing, as are your financial responsibilities. Finally, right around age 66 comes a time we traditionally call Retirement. We can think of these life segments in the following way:

Learning (Birth to Age 22)

The first stage of our lives is mostly about learning, and our primary focus is on obtaining new skills and knowledge to prepare us for the challenges and opportunities we will face over the rest of our lives. During these years, we spend most of our time in school, and are taught and mentored by our parents, grandparents, teachers and coaches.

Growing (Age 22 44)

In the next stage, we begin to build upon all that we learned in the first 22 years of our lives. This is the time for us to strike out in the world and use that knowledge to build our own lives. We begin our professional career, establish a relationship or find our spouse and marry, possibly have babies and raise young children, and buy our first home.

Maturing (Age 44-66)

Between age 44-66, we are hitting our stride professionally and experiencing our peak earning years. That is a good thing, because our lifestyle is also becoming more expensive. We may now be paying for college for our children, or even supporting our own aging parents. We buy a nicer car, a bigger house, and perhaps a vacation home. We may even welcome grandchildren. These are busy years in which our responsibilities are at a peak: our professional responsibilities are the most demanding of our lives, we are focused on the task of raising adolescent and teenage children, and we may even be responsible for caring for our own parents.

Exploring (Age 66-?)

Finally, we reach the Exploring stage of our lives. During this time, which has been traditionally known as Retirement, our responsibilities to others begin to diminish, and we are afforded the opportunity to enjoy and explore our lifestyle more than ever before. By this time our children have grown and are on their own, our financial and professional responsibilities become easier, and we have the time and the money to take a step back and enjoy life on our own terms.

The focus of this book will be to discuss and understand the challenges and opportunities which are presented in this final phase of our lives, in hopes to help readers to better prepare for these challenges and opportunities, and maximize their happiness and satisfaction during these years.