To Mum and Dadthank you.

To Cameron and Madisonlisten up.

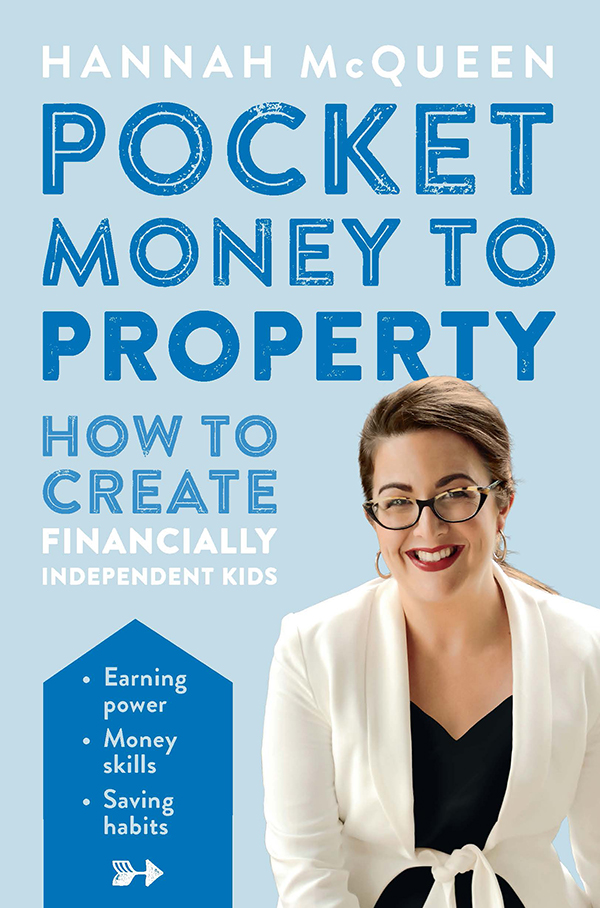

Every effort has been made to provide accurate and authoritative information in this book. Neither the publisher nor the author accepts any liability for loss caused to any person acting as a result of information in this book nor for any errors or omissions. Hannah McQueen is a registered financial advisor and a director of enableMe NZ Ltd, a seminar presenter and a bestselling author on personal finance. Her opinions are personal and are of a general nature. She is not aligned to any bank or investment product. Readers are advised to obtain specific advice from a licensed financial adviser before acting on the information contained in this book.

First published in 2017

Copyright Hannah McQueen, 2017

All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without prior permission in writing from the publisher.

Allen & Unwin

Level 3, 228 Queen Street

Auckland 1010, New Zealand

Phone: (64 9) 377 3800

Email:

Web: www.allenandunwin.co.nz

83 Alexander Street

Crows Nest NSW 2065, Australia

Phone: (61 2) 8425 0100

A catalogue record for this book is available from the National Library of New Zealand

ISBN 9781877505836

eISBN 9781760638085

Internal design and figures by Kate Barraclough

Cover image: Verve Magazine

Cover design: Kate Barraclough

CONTENTS

We are facing one of the most uncertain economic times in the history of the developed world. The motto is too big to fail, the answer for mass overspending to print money. Consumerism, as a by-product of advertising, has infiltrated our subconscious. We are taught a sense of entitlement from such an early age. Schools are trying (unsuccessfully) to improve financial education, but unless teaching the consequences of financial choices is adhered to at home, all that our children are being taught is that it doesnt really matter. When the times are good you dont care, because rising property prices cover a multitude of financial sins. When times are bad well, you just use your credit card.

Too many of us are taught that the world owes us a living and that the universe is on our side. Schools create an environment where we are taught that failure is bad and we can all be winners. I get itits admirable, to a degreebut it does little to prepare our kids for the brutality of the real world.

In the financial sense, it heavily disadvantages them. Don Draper, the iconic Mad Men character, was probably more realistic when he said the universe is indifferent. My experience with money has shown me that the world owes us nothing. It will be OK in the end if its OK in the end.

However, for many of us, this wont be the case. I have worked with thousands of clients to help them get control of their money, kill their mortgages and sort their retirements, and for many of them the number-one drain on resources or distraction from future planning is an adult child who should be independent but is not. As a parent, the one non-negotiable cost that overrides any retirement goals is often to help your kids.

As we know, there are limited funds available for the government to pay pensions. Over the next generation, our parents will be forced to use all their equity to fund their own retirement. The government will run out of money, or significantly drop or delay the already meagre state pension. There will be no inheritance, no head-start or hand up. Our kids will be on their own. They will need to navigate their way through a quagmire of obstacles, but we can help them. We need to help them. We need to teach them because no one else will, and as we teach them we will probably learn a few things ourselves.

There are reasons why becoming financially independent is harder for kids today than it was in the past, and these reasons are discussed in subsequent chapters. Work is a four-letter word that fewer of our teenagers are experiencing before or during university, and that is putting them at a disadvantage for future employment. Student-loan sizes are epic and, for some, the process of going to university has only helped them realise that they no longer want a career in the path they had chosen. This is not bad or new, but the difference for our kids is that they have the privilege of a $60,000 loan in exchange for changing tack. But, if it is any consolation, todays kids seem to be better and brighter than us, and are evolving to be more agile and able to cope with change at a faster rate than we can. Some call them digital natives. But they are not financially smart or savvy.

Despite their ignorance, many are bold. They respect their elders if they are worthy of respect, not because they are told to respect them. They tend to scoff at hierarchy and think they are the first person to be philosophical or to understand psychology or social sciences in general. Their brashness is often interpreted as arrogance, but I am not sure thats the whole story. The media gives them a bad rap, and uses a broad brush to dismiss them.

But they will not be dismissed, and within the group of crazies there is a growing number who do want to do well in life and get ahead. They dont buy into the narcissism of the standard millennial stereotype. They are more grounded and are prepared to work hard. For these people, I write this book; for people like Anna and Asher, two students from my old high school to whom I have offered internships. There is no doubt in my mind that they are smarter than me. Inexperienced, but smarter. They will be better than me, and they deserve to be. My job as their mentor is to help them become what they are capable of being. I imagine it is a relief to their parents to have someone watching out for them, and I hope that someone will think to do it for my kids.

One of the lessons we learn is that before you know what you can be, sometimes you need to realise what you are not and should not be. Sometimes you must fail. Failure leads to innovation, growth and becoming more agile. (Well, its supposed to.) But at the very least it creates necessity, and necessity creates invention.

Agility and adaptability are the most important concepts in the current landscape. They underpin successful entrepreneurship and radicalise the speed of change. Albert Einstein said a person who never made a mistake never tried anything new. The problem, however, is our school system teaches our kids only how to succeed, and measures success with exams. This does not translate to the real world, on any meaningful level. The system is not designed to help our kids cope with life.

Certainly teenagers can be selfishthats part of their rite of passage. Selfish, yes; misunderstood, probably; but stupid, no. (Well, some are. Usually the loudest ones.) They are just not sure how to succeed, because they also recognise that the school and university system barely equips them for adulthood. But they have been taught to think criticallywhich means if you are going to teach them you need to be sure that you can back up your claims with fact, research or proven examples; otherwise, they wont buy into it. This is possibly where most parents tap out because it feels hard, and it is hard.

Some of the topics I plan to cover in the coming chapters are genetics, biases and family influences on our financial behaviour, and how these tendencies need to be identified early so that they can be cultivated, or further skills developed to offset weaknesses or take advantage of opportunities.