This sixth edition published in 2017 by

John Wiley & Sons Australia, Ltd 42 McDougall St, Milton Qld 4064

Office also in Melbourne

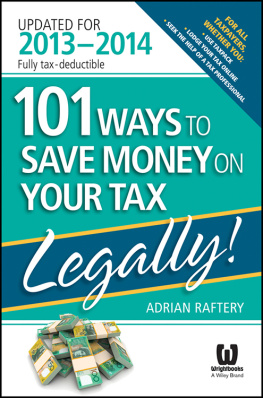

First edition published by Wrightbooks (an imprint of John Wiley & Sons Australia, Ltd) in 2011. New edition published annually.

Adrian Raftery 2017

The moral rights of the author have been asserted

National Library of Australia Cataloguing-in-Publication data:

| Creator: | Raftery, Adrian, 1971 author |

| Title: | 101 Ways to Save Money on Your Tax Legally!: 20172018

edition / Adrian Raftery. |

| Edition: | 7th edition. |

| ISBN: | 9780730344940 (paperback) |

| Notes: | Includes index. |

| Subjects: | Tax deductions Australia. |

| Taxation Australia. |

| Finance, Personal. |

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair dealing for the purposes of study, research, criticism or review), no part of this book may be reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means without prior written permission. All inquiries should be made to the publisher at the address above.

Cover design: Wiley

Tables 1.1, 1.2, 1.3, 1.4, 2.1, 2.2, 2.3, 2.4, 3.1, 3.2, 3.3, 4.2, 5.1, 6.1, 6.2, 6.4, 7.1, 8.1, 8.2, 8.3

Australian Taxation Office for the Commonwealth of Australia.

Disclaimer

The material in this publication is of the nature of general comment only, and does not represent professional advice. It is not intended to provide specific guidance for particular circumstances and it should not be relied on as the basis for any decision to take action or not take action on any matter which it covers. Readers should obtain professional advice where appropriate, before making any such decision. To the maximum extent permitted by law, the author and publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based on the information in this publication.

Dedicated to my mum and dad. Thank your for being my biggest supporters in life and my biggest critics! I hope I made you proud. And no mum, I have never forgotten where I came from ... but what an amazing journey since. Love you. Sunshine.

ABOUT THE AUTHOR

Adrian Raftery (PhD, MBA, B Bus, AFA, CFP, CPA, CTA, FCA, FIPA FFA, F Fin, MAICD), aka Mr Taxman, is one of Australia's leading commentators on all matters relating to tax and finance. With regular columns in various investment magazines, an Associate Professor at Deakin University and frequent appearances on TV and in the media, Adrian is one of Australia's leading tax experts.

Part of Adrian's tax' appeal as a financial media commentator is due to his personable and approachable style. Just as importantly, Adrian's 27 years' experience as an award-winning accountant working with small and medium businesses, and as a personal tax expert, means he has the relevant knowledge and experience to give qualified advice.

Adrian is considered so good at what he does that he is one of the youngest Australian accountants to have advanced to Fellowship with the Institute of Chartered Accountants at the age of 33 and had an award-winning Sydney accountancy firm at just 25! Adrian is also one of the country's leading experts on the rapidly growing Australian superannuation industry with work from his PhD on self-managed superannuation funds published in top-ranked international academic journals. These factors and Adrian's ability to translate complicated tax, superannuation and finance jargon into understandable and workable solutions are probably why Mr Taxman' is frequently called upon for his viewpoints by the Australian media.

HOW TO USE THIS BOOK

This book is designed to be of benefit to 99.9 per cent of taxpayers. If you have an investment property, own a share portfolio, have money in superannuation, have a family, work as an employee or run your own business, there will be something in here for you.

While it is extremely unlikely that all 101 tips will be applicable to you, your family or your business, just feel comfortable knowing that one tip alone will be more than enough to pay for the investment you make in buying this book. This book has been written to take into account all phases of life, so if you find that only a few tips apply to you right now, don't worry because more tips will become relevant as you grow older. Make sure that you consult your own adviser to assess your own particular needs before implementing any of these tips.

If there is one constant with tax, it is change. That is why I update this book every year to take into account the latest federal budget changes in May. If you intend to use this book as a reference guide over a number of years, you should always check the latest tax legislation for the current figures and thresholds.

Remember that tax planning should be a year-round exercise, not merely one that's done in the last few weeks before 30 June. A lot of these strategies are just as useful on 1 July as they are on 30 June.

TIP

When you see this box throughout the book, it will provide you with a handy suggestion in relation to the particular money-saving strategy.

Tax Fact

When you see this box throughout the book, it will provide you with an interesting fact.

Pitfall

When you see this box throughout the book, it will outline a potential pitfall in relation to this money-saving strategy that you need to look out for.

BONUS RESOURCES

When you see this box throughout the book, it will provide you with a tool or a calculator available on my website www.mrtaxman.com.au to help explain or work out a strategy.

Faq

When you see this box throughout the book, it will provide you with an answer to a frequently asked question that I have received from readers of previous editions of this book.

proposed change

When you see this box throughout the book, it will outline a tax change which has been proposed by the government but has not been put through as legislation as at date of publication. Before making any decisions, ensure that you check the status of these proposed changes as there may be variations to the original proposal as it passes through both houses of parliament.

INTRODUCTION

Five years ago, my wife and I were extremely fortunate to celebrate the birth of our son Hamish via a friend who acted as a surrogate mum. Before we started the surrogacy process, I remember her telling us that she had a gift to bear children, but a gift is not a gift unless it is given'.

I feel the same way about this book. Ever since I started working as an accountant at the age of 18, I have had a gift (some would say it is a curse) for understanding tax. But as a gift should be given, I have decided to share some great tax tips with you for a small tax-deductible fee (that is, the price of this very cheap book!).

Next page

TIP

TIP Tax Fact

Tax Fact Pitfall

Pitfall BONUS RESOURCES

BONUS RESOURCES Faq

Faq proposed change

proposed change