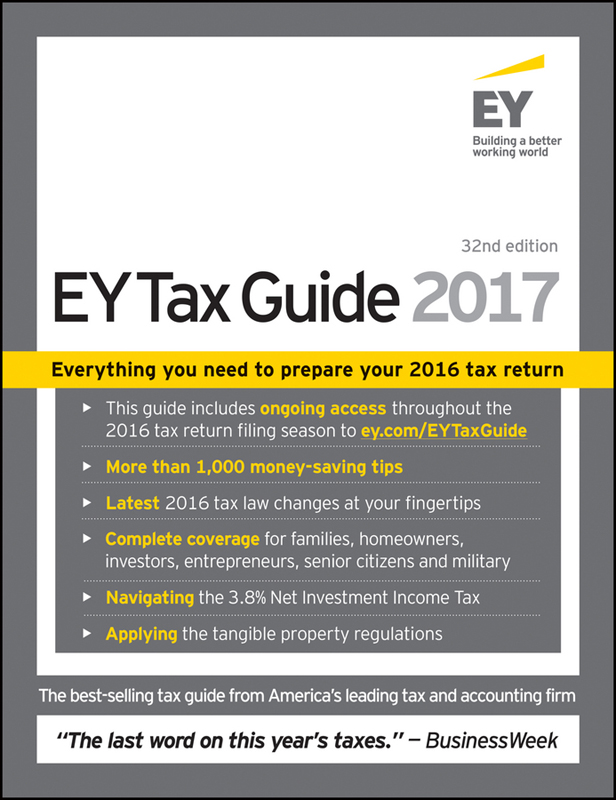

The EY Tax Guide 2017

Years of critical acclaim for America's no. 1 tax guide...

This is the best tax guide of the bunch... the most up-to-date guide.

USA Today

Hard to beat... [EY professionals] elucidate each point, giving examples, definitions and strategies that you won't learn about from the IRS.

Money

This book... has more up-to-date information on tax changes than its competitorsor even the IRS.

Chicago Sun-Times

Best of the commercially available guides.

New York Daily News

Destined to become the old standard,' all written in plain English .... If you can afford just one tax book, this could be the one.

Seattle Post-Intelligencer

The text-with-commentary approach makes the book both authoritative and easy-to-use.

People

The simplest tax guide to understand.

CBS This Morning

The explanations, examples, and planning advice are top-drawer.

Orlando Sentinel

Exceptionally detailed.

The Sunday Denver Post

An excellent book, full of clear explanations, planning hints, tax savers and sample forms.

Atlanta Journal Constitution

Our brand-name choice for filers with lots of questions for filing and planning situations.

Fort Worth Star-Telegram

... a veritable fountain of information.

Milwaukee Sentinel

... the best of the bunch for return preparation.

Des Moines Register

2017 tax calendar

| Date in 2017 | Action required |

| January |

| 17 |  Final estimated tax payment for 2016 due if you did not pay your income tax (or enough of your income tax) for that year through withholding. Use Form 1040-ES. Final estimated tax payment for 2016 due if you did not pay your income tax (or enough of your income tax) for that year through withholding. Use Form 1040-ES. |

| 31 |  If you did not pay your last installment of estimated tax by January 17, file your income tax return for 2016 on this date, thereby avoiding any penalty for late payment of the last installment. Use Form 1040 or 1040A. However, see below for special rules for farmers and fisherman. If you did not pay your last installment of estimated tax by January 17, file your income tax return for 2016 on this date, thereby avoiding any penalty for late payment of the last installment. Use Form 1040 or 1040A. However, see below for special rules for farmers and fisherman. |

| February |

| 15 |  File a new Form W-4 if you can claim exemption from withholding. File a new Form W-4 if you can claim exemption from withholding. |

| March |

| 1 |  Farmers and fishermen must file their 2016 income tax return (Form 1040) and pay all tax to avoid a penalty for underpayment of 2016 estimated taxes. Farmers and fishermen must file their 2016 income tax return (Form 1040) and pay all tax to avoid a penalty for underpayment of 2016 estimated taxes. |

| April |

| 18 |  File your income tax return for 2016 (Forms 1040, 1040A, or 1040EZ) and pay any tax due. File your income tax return for 2016 (Forms 1040, 1040A, or 1040EZ) and pay any tax due. |

Individuals who have a financial interest in or signature authority or other authority over certain bank, securities, or other financial accounts in a foreign country must file FinCEN Form 114. Individuals who have a financial interest in or signature authority or other authority over certain bank, securities, or other financial accounts in a foreign country must file FinCEN Form 114. |

Make your 2016 IRA contribution. Make your 2016 IRA contribution. |

If you are not extending your return, make your Keogh or SEP-IRA contribution if you have self-employment income. If you are not extending your return, make your Keogh or SEP-IRA contribution if you have self-employment income. |

For an automatic 6-month extension, file Form 4868 and pay any tax that you estimate will be due. Then file Form 1040 or 1040A by October 16. If you get an extension, you can't file Form 1040EZ. (You can use one Form 4868 to file for both your income tax and gift tax extensions.) For an automatic 6-month extension, file Form 4868 and pay any tax that you estimate will be due. Then file Form 1040 or 1040A by October 16. If you get an extension, you can't file Form 1040EZ. (You can use one Form 4868 to file for both your income tax and gift tax extensions.) |

Pay the first installment of your 2017 estimated tax if you are not paying your 2017 income tax (or enough of it) through withholding tax. Pay the first installment of your 2017 estimated tax if you are not paying your 2017 income tax (or enough of it) through withholding tax. |

If you made any taxable gifts during 2016 (more than $14,000 per donee), file a gift tax return for that year (Form 709 or 709-A) and pay any tax due. If you made any taxable gifts during 2016 (more than $14,000 per donee), file a gift tax return for that year (Form 709 or 709-A) and pay any tax due. |

| June |

| 15 |  Pay the second installment of 2017 estimated tax. Pay the second installment of 2017 estimated tax. |

If you are a U.S. citizen or resident alien living and working (or on military duty) outside the United States and Puerto Rico, file Form 1040 and pay any tax, interest, and penalties due. Otherwise, see April 18. If you are a U.S. citizen or resident alien living and working (or on military duty) outside the United States and Puerto Rico, file Form 1040 and pay any tax, interest, and penalties due. Otherwise, see April 18. |

| September |

| 15 |  Pay the third installment of your 2017 estimated tax. Pay the third installment of your 2017 estimated tax. |

Last day for employer to make a required minimum contribution to a defined benefit or money purchase plan. Last day for employer to make a required minimum contribution to a defined benefit or money purchase plan. |

| October |

| 16 |  If you requested an automatic 6-month extension to file your 2016 income tax return, file Form 1040 or Form 1040A and pay any tax, interest, and penalty due, and file any gift tax return if due. If you requested an automatic 6-month extension to file your 2016 income tax return, file Form 1040 or Form 1040A and pay any tax, interest, and penalty due, and file any gift tax return if due. |

If you received a 6-month extension to file FinCEN Form 114, you must file it on or before October 15. If you received a 6-month extension to file FinCEN Form 114, you must file it on or before October 15. |

Last day to make a Keogh or SEP-IRA contribution deductible for calendar year 2016 if you requested a 6-month extension of time to file your tax return. Last day to make a Keogh or SEP-IRA contribution deductible for calendar year 2016 if you requested a 6-month extension of time to file your tax return. |

| December |

| 1 |  If you claimed exemption from withholding in 2017 but you expect to owe income tax for 2018, you must file a new Form W-4 by December 1, 2017. If you claimed exemption from withholding in 2017 but you expect to owe income tax for 2018, you must file a new Form W-4 by December 1, 2017. |

| 31 |  Last day to establish a Keogh plan for 2017. Last day to establish a Keogh plan for 2017. |

Copyright 20092017, Ernst & Young LLP

Copyright 19892008 by Ernst & Young LLP and Peter W. Bernstein Corporation

Copyright 19841988 by Arthur Young & Company and Peter W. Bernstein Corporation

All rights reserved. No part of this publication may be re- produced or transmitted in any form or by any means, electronic or mechanical, including photocopying or recording, or by any information storage or retrieval system, without written permission from Ernst & Young LLP. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, whether electronic, mechanical or otherwise, and including without limitation photocopying, recording, scanning, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions. Published by John Wiley & Sons, Inc.

Next page

Final estimated tax payment for 2016 due if you did not pay your income tax (or enough of your income tax) for that year through withholding. Use Form 1040-ES.

Final estimated tax payment for 2016 due if you did not pay your income tax (or enough of your income tax) for that year through withholding. Use Form 1040-ES.